Crypto.com has made the decision to discontinue its institutional exchange service for clients in the United States, with the suspension set to take effect on June 21. The Singapore-based cryptocurrency exchange attributed the move to a combination of limited demand from institutional customers and challenging market conditions. Leaving the U.S. CryptoTea, an anonymous figure known for its involvement in the cryptocurrency community, has raised an important observation regarding the Securities and Exchange Commission’s (SEC) recent actions. Specifically, the SEC has explicitly mentioned multiple tokens traded on the Crypto.com platform as…

Day: June 9, 2023

Binance and Coinbase: Experts Weigh What’s Coming Next

Binance and Coinbase: Experts Weigh What’s Coming Next Source

Binance.US Halts US Dollar Deposits Over Banking Challenges, Says It Will Temporarily Be a Crypto-Only Exchange

Binance.US says that it will be halting US dollar deposits and withdrawals in response to being sued by the U.S. Securities and Exchange Commission (SEC). In a new announcement, Binance.US says it will temporarily become a crypto-only exchange platform due to the SEC’s “ideological campaign” against the US digital asset industry. “The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. Binance.US and our business partners have not been spared in the use of these tactics,…

The Memecoin Grift and How It Threatens Ethereum Culture

This means you have to create an atmosphere, a cultural context, where the message of long-term regen culture overshadows short-term degen culture, relegating it to an immature phase. The regens are those within Ethereum culture dedicated to ensuring the technology does not generate negative externalities, but instead positively impacts society over the long term. How do we, in the words of Gitcoin founder Kevin Owocki, funnel more Ethereans into regen than degen? Source

Bitcoin Payments Firm Strike Moves Custody In-House After Ditching Third-Party Services

The move is a “culmination of over two years of effort,” according to Strike CEO and cofounder Jack Mallers. Original

Price analysis 6/9: BTC, ETH, BNB, XRP, ADA, DOGE, SOL, MATIC, LTC, DOT

Stock markets are showing strength, and selling by crypto traders has taken a pause. Is this a sign that Bitcoin and altcoins are about to reverse course? Bitcoin remains well above the crucial support at $25,250, indicating that market participants have shrugged off the news of the lawsuits by the United States Securities and Exchange Commission (SEC) against Binance and Coinbase. When markets do not stay lower for long after negative news, it is a sign that traders are looking to buy the dips rather than panic and dump their holdings.…

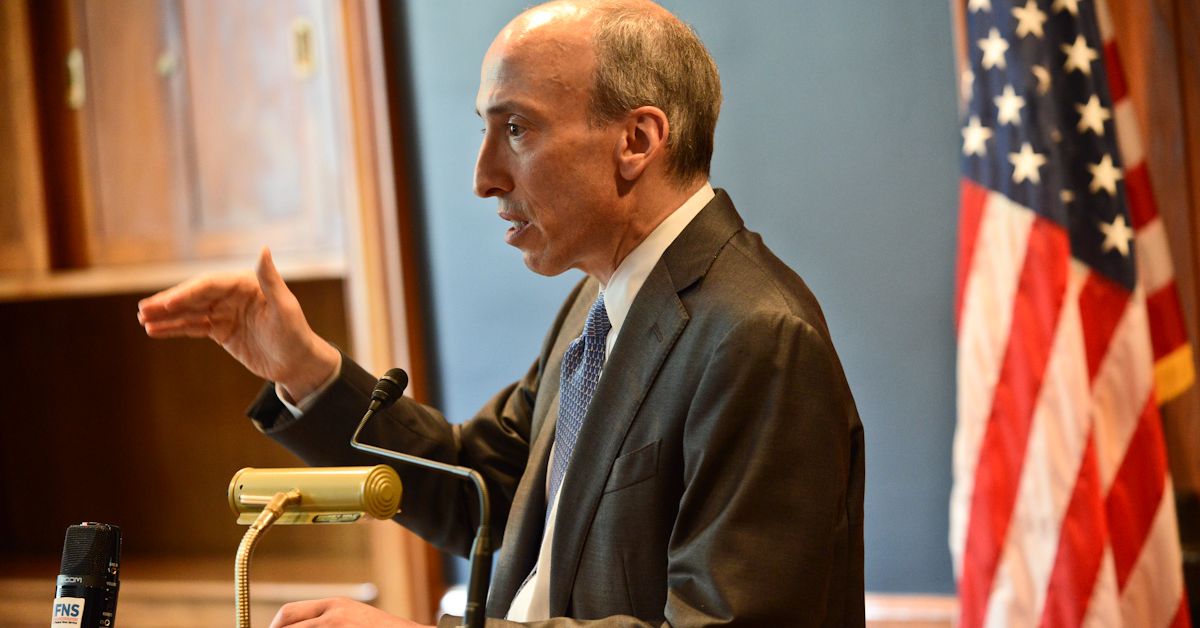

The New Crypto Bill Gary Gensler Doesn’t Want You to Know About

U.S. law doesn’t let appointed regulators trump elected officials. But the SEC head may be doing exactly that. Source

SEC can’t find Binance CEO Changpeng Zhao, asks court for ‘alternative service’

The United States Securities and Exchange Commission (SEC) is seeking ‘alternative service’ from the U.S. District Court in Washington, D.C., to issue a legal summons to Changpeng Zhao, the CEO of cryptocurrency exchange Binance. Zhao and Binance were recently sued by the SEC over alleged unregistered securities operations. Related: SEC sues Coinbase for breaking US securities rules In a case document filed with the District Court on June 7, the SEC requested alternative service. It explains its evident stance that typical service (which requires the presence and signature of the person…

Crypto.com Winding Down U.S. Institutional Business

Singapore-based crypto exchange Crypto.com will no longer be offering its service to institutional clients in the U.S. due to “limited demand,” the company announced Friday. Source

De-dollarization: Is it really happening?

In our latest Cointelegraph Report, we analyze the causes leading to the decline of the U.S. dollar as the world reserve currency and its potential implications. De-dollarization, the decline of the United States dollar as the world’s dominant reserved currency, is underway, and it’s gaining momentum. For over 100 years, the U.S. dollar has been the world reserve currency, which means it has been the dominant foreign currency held by central banks to carry out international transactions and settle international debt. However, in the last 20 years, the dollar’s dominance…