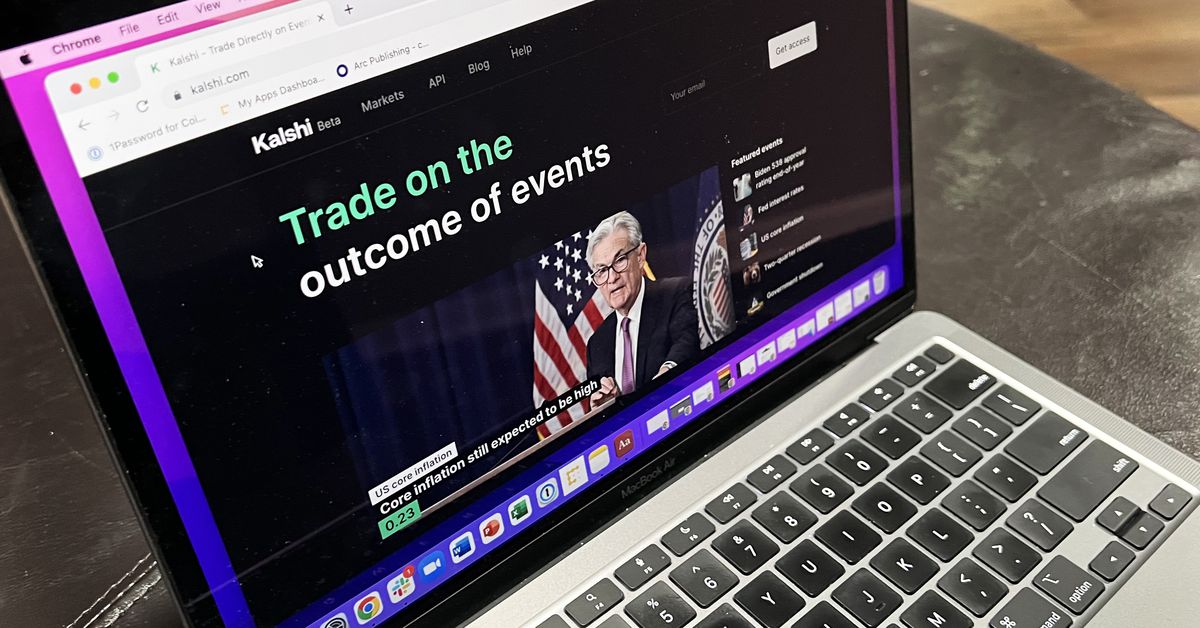

The prediction markets – which allow people “to buy and sell contracts on whether events are going to happen or not,” as Kalshi describes it on its site – have had a tumultuous recent history with the CFTC. Other companies had been ordered to cease doing business in the U.S., such as Polymarket and PredictIt, which has been fighting the CFTC in court since last year. Source

Day: June 16, 2023

Bakkt delists SOL, MATIC, and ADA amid regulatory uncertainty

Bakkt has delisted solana (SOL), polygon (MATIC), and cardano (ADA), citing regulatory uncertainty in the US. The exchange says it’s awaiting further clarity on how to offer more altcoins compliantly. The current regulatory dark clouds in the US continue to impact the crypto industry, as Bakkt has announced the delisting of SOL, MATIC, and ADA. The decision comes as the U.S. Securities and Exchange Commission (SEC) continues its onslaught against web3 market participants in the country, despite failing to formulate clear-cut guidelines for the fledgling industry. SEC’s lawsuits against Binance and…

Crypto Detective ZachXBT Faces Defamation Lawsuit

MachiBigBrother has sued ZachXBT for an investigation the latter published in June 2022 alleging the trader stole tens of millions of dollars worth of crypto. Source

On-chain sleuth ZachXBT sued for libel after claiming plaintiff drained funds from project

Blockchain investigator ZachXBT has been sued for libel by one of the people he accused of fraud, according to a June 16 social media post. According to the post, Jeffrey Huang, known as “MachiBigBrother” on Twitter, has accused ZachXBT of damaging his reputation through false allegations. MachiBigBrother also posted an announcement stating that he is suing the on-chain sleuth. A year ago, @zachxbt published a Medium article about me that damaged my reputation. Today, I have filed a defamation lawsuit against him in the United States District Court for the…

Binance to exit Netherlands after failing to obtain registration

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Crypto exchange giant Binance announced that it would no longer service users in the Netherlands after the company failed to get a license from Dutch regulators. Binance has notified its Dutch customers about the company’s plan to leave the Netherlands. According to an announcement, existing users will be allowed to use only the withdrawal function on the platform from July 17, stating that further trades, deposits, and purchases will be disabled. “While Binance is disappointed that…

BlackRock’s Spot Bitcoin ETF Not The Same As Grayscale’s Product, Experts Say

Exchange Traded Fund (ETF) terminology can sometimes be tricky, and fund management giant BlackRock’s application for a spot Bitcoin ETF has raised some questions. Original

Ethereum network upgrade and uptick in Arbitrum active users could trigger an ARB price reversal

While Arbitrum’s governance token ARB has been in a consistent downturn since the airdrop in late March, its ecosystem shows healthy growth. A recent Nansen report shows that Arbitrum’s activity improved after the airdrop, stabilizing “at a level higher” than before the airdrop. The daily active users, gas fees and transaction count maintained consistent higher levels on the Ethereum rollup since April 2023. The gap between the number of active users on Arbitrum and Optimism widened after the Aribtrum airdrop, closing in on Ethereum. Daily Active Users of Arbitrum, Ethereum…

‘We had to change strategies,’ says SEC enforcement director on recent actions: Report

Gurbir Grewal, director of the United States Securities and Exchange Commission (SEC) division of enforcement, has reportedly said the entire crypto industry was “built around noncompliance,” leading to enforcement actions. According to a June 16 Reuters report, Grewal spoke at an event hosted by law firm Lowenstein Sandler and Rutgers University Law School in New York, which also featured Coinbase chief policy officer Faryar Shirzad. The SEC enforcement director reportedly said the commission had worked “thoughtfully and incrementally” for actions related to the crypto space, but this approach had failed…

BlackRock’s Bitcoin ETF Would Be a Big Deal

First, exchanges should be a bit fearful. If new investors want price exposure to bitcoin and don’t care about the aspect of it that makes it cool (like using it), then those investors will look to pay as little as possible for that bitcoin. Why would an investor pay a 1% fee at an exchange when they could pay a tiny fraction of that through an ETF when they aren’t interested in actually using bitcoin? Original

Curve pool imbalance triggers USDT depeg concerns: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. On June 15, an imbalance in Curve Finance’s 3pool led to a Tether (USDT) depeg scare as the stablecoin’s weightage in the pool rose above 70%, leading to heavy selling. Tether’s chief technology officer claimed these market conditions are stress tests for the stablecoin and played down the depeg “FUD.” In other news, a crypto trading bot programmed to execute arbitrage trades…