The Financial Services and Markets Authority (FSMA) said Binance is “offering and providing exchange services in Belgium between virtual currencies and legal currencies, as well as custody wallet services, from countries that are not members of the European Economic Area,” which the regulator says is in violation of a prohibition. Source

Day: June 23, 2023

Lowe’s Sells Garden Flag Featuring Mfers NFT

Despite offering no utility and no roadmap, the project has managed to cultivate a strong and passionate collector base. In June 2022, Sartoshi transferred the project’s smart contract and ownership to the community, creating even more fanfare and interest in the collection. Today, these NFTs often sell for over $1,000 each – far higher than their original mint price of 0.069 ETH, or about $320 – and the project has done over 66,510 ETH in sales, or nearly $125 million, according to OpenSea. Source

SEC waives BlockFi’s $30M fine until creditors are paid

The United States Securities and Exchange Commission has agreed to postpone the payment of a $30-million fine from bankrupt crypto lender BlockFi until creditors are paid back. The amount represents the balance of a $50-million settlement with the regulator from February 2022. According to June 22 court filings, the SEC will forgo the amount owed by BlockFi to “maximize” and avoid delays in funds’ distribution to investors “until payment in full of all other Allowed Claims.” The document stated, “The Commission has agreed to forego participating in any distributions under…

Bitcoin Hits One-Year High, Soars Past $31.3K

The largest cryptocurrency by market capitalization has been surging this week after three financial services giants filed applications for spot bitcoin ETFs. Original

Robust crypto fundamentals pull through after May’s monthly red candle: Report

In May, Bitcoin (BTC) posted its first monthly loss since December 2022 with a negative 6.98%. However, this consolidation was not obviously driven by a change in fundamentals or the broader macroeconomic environment. The crypto market was looking for direction and liquidity in this phase before the United States Federal Reserve announced a pause on the rate hiking cycle in June. Many indicators, such as the futures market and VC investment, point to an optimistic underlying sentiment. But while traditional markets and tech stocks were able to continue their rally…

Sam Bankman-Fried Can’t Subpoena Law Firm Fenwick & West, U.S. Judge Rules

New York District Court Judge Lewis A. Kaplan on Friday denied Bankman-Fried’s request saying neither Fenwick & West nor the FTX Debtors are part of the “prosecution team.” The government “has no obligation to produce materials that are not within its possession, custody, or control,” the order added. Source

US Supreme Court halts Coinbase cases in its first crypto ruling

The United States Supreme Court decided in favor of cryptocurrency exchange Coinbase on June 23 in a partisan opinion that will halt court proceedings against the company in two California cases. Plaintiffs in the class-action lawsuits alleged Coinbase failed to provide proper relief after users lost money and that Coinbase allegedly engaged in deceptive advertising. Coinbase asked the district courts overseeing the cases to dismiss them on the grounds that, per the company, users signed an agreement upon creating their accounts stating that such disputes would be handled through arbitration…

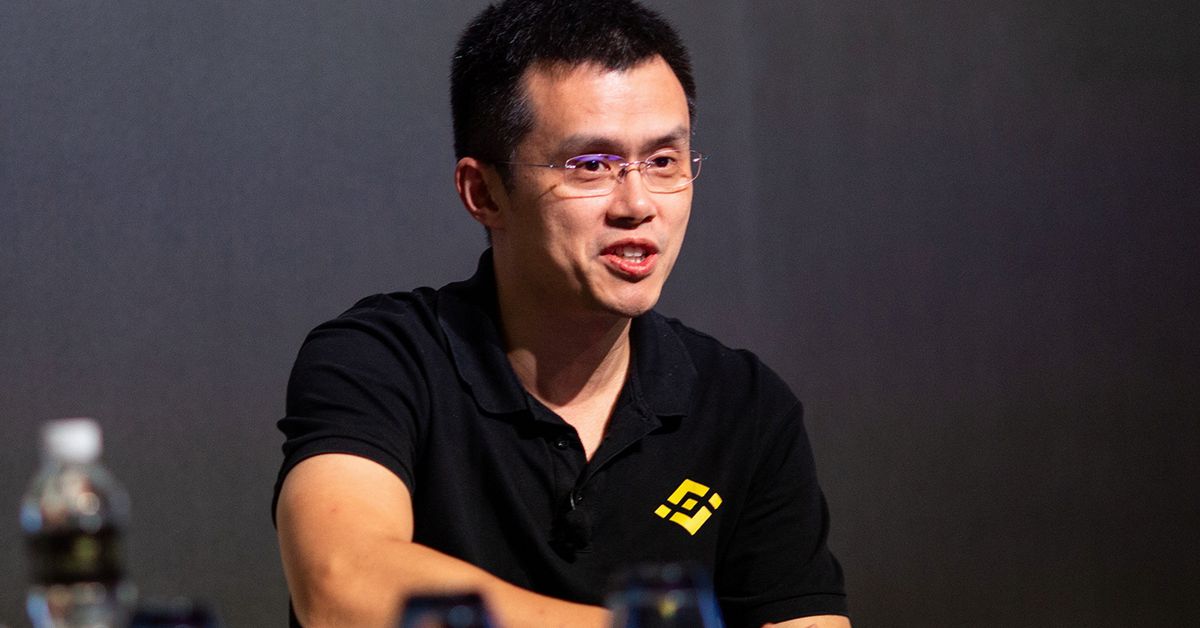

SEC Sought Freeze Order Despite ‘No Evidence’ That Binance Was Moving U.S. Customer Funds

“There are a lot of details about amounts transferred and where they went…” Barrett asked the SEC’s lawyers. “You say these funds consisted in significant part of Binance platforms, plural, customer assets, including those of Binance.US … Can you clarify or walk me through the transfers you allege were made specifically from the U.S. entities, as opposed to the international Binance platform, to offshore accounts held by Zhao, and how you know that those were customer assets?” Source

Circle and Sequoia were among top depositors at Silicon Valley Bank: Report

Stablecoin issuer Circle and venture capital firm Sequoia Capital were reportedly among the top 10 depositors at the collapsed crypto-friendly Silicon Valley Bank (SVB) in March. According to a June 23 report from Bloomberg, the Federal Deposit Insurance Corporation (FDIC) provided documents suggesting that Circle, Sequoia and others were covered for deposits in the billions of dollars. The Federal Reserve announced following the SVB collapse that it would work with the FDIC to make both insured and uninsured depositors whole — in most situations, the FDIC only insures up to…

Leveraged Bitcoin Futures ETF to Start Trading Tuesday, Volatility Shares Says

Volatility Shares’ 2x Bitcoin Strategy ETF (BITX) will become the first leveraged crypto ETF available in the United States after the U.S. Securities and Exchange Commission (SEC) let it go effective on Friday, an executive at the company told CoinDesk. Original