The four major media outlets advocating for the release of FTX customer names have opposed the decision to seal them. Meanwhile, a crypto lawyer told Cointelegraph that “there is clear evidence” of potential harm if the names were to be disclosed. According to a June 23 Reuters report, Bloomberg, Dow Jones & Company, The New York Times, and the Financial Times have appealed Judge Dorsey’s decision to seal the names of FTX customers from the public. The decision to allow FTX to “permanently redact” the names of individual customers from all…

Day: June 24, 2023

FTX files $700m lawsuit against investment firm tied to Hillary Clinton aide

Bankrupt crypto exchange FTX has taken legal action by filing a lawsuit against a former aide to Hillary Clinton and the aide’s investment firm. The exchange seeks to reclaim $700 million in investments that it alleges were made using misappropriated FTX funds. According to court documents, FTX’s founder, Sam Bankman-Fried, authorized the transfer of $700 million to entities affiliated with K5 Global, an investment firm led by former Clinton aide Michael Kives and co-founder Bryan Baum. FTX claims that Bankman-Fried allowed this transfer as part of a scheme to misuse…

JP Morgan expands blockchain payment system to include euros

JP Morgan, the U.S.-based investment bank, has widened the scope of its blockchain-oriented payment platform, JPM Coin, to include euro-based transactions for corporate customers. JPMorgan, a prominent investment bank headquartered in the United States, is broadening the use of one of its key blockchain ventures into conventional banking operations. The bank has initiated the usage of its blockchain-oriented payment system, termed JPM Coin, to incorporate euro-based payments for its corporate clientele, as reported by Bloomberg on June 23. The extension of the JPM Coin blockchain platform to accommodate euros, alongside…

CFTC Kicks Off Review of Prediction Market Kalshi’s Congressional Control Betting Contracts

“The Commission should treat Kalshi’s certification in the same manner it treats all DCM certifications of new products, and then do what Congress provided: Undertake a public rulemaking process to establish a legal framework for exercising its discretion to determine whether event contracts, including those relating to political control, may be prohibited from trading because they are contrary to the public interest,” she said. Source

CACEIS Bank gains PSAN registration, becomes first digital asset custodian in France

CACEIS Bank, the French banking entity of the CACEIS group, has achieved a significant milestone by obtaining PSAN (digital assets service provider) status from the AMF (France’s financial markets authority), following the recommendation of the ACPR (France’s prudential control and resolution authority). With the newly acquired PSAN status, CACEIS Bank is now authorized to offer digital asset custody services to external parties, catering to the increasing demand from investment management firms and institutional investors. The sole recipient PSAN status for CACEIS signifies that the French financial markets regulator (AMF) and…

Celsius creditors allege Wintermute facilitated ‘wash trading’: Report

Creditors of bankrupt cryptocurrency lending platform Celsius have alleged that crypto market maker, Wintermute, assisted Celsius executives in manipulating the price of CEL (CEL) through the use of “wash trading.” According to a June 23 Bloomberg report, which cited a recent court filing, Celsius creditors have recently amended their lawsuit in the United States District Court of New Jersey to allege that Wintermute was engaged by Celsius executives to conduct improper market trading. June 24 court filing in the United States District Court of New Jersey. Source: assets.bwbx.io Wintermute, described…

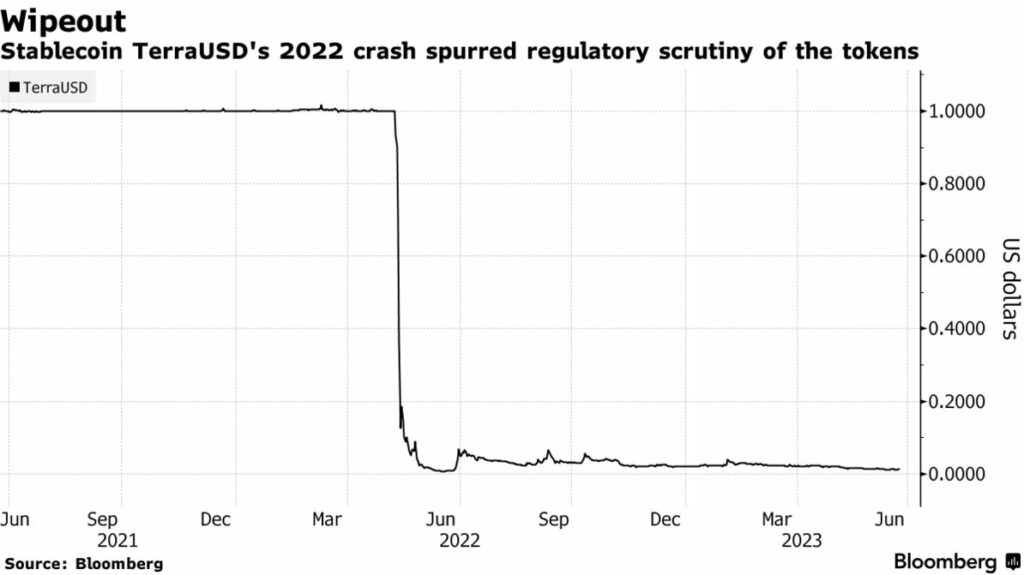

MUFG may issue stablecoin via Progmat blockchain platform

Mitsubishi UFJ Financial Group Inc., a prominent Japanese banking corporation, is currently in negotiations with several businesses about issuing stablecoins, a form of digital asset, through its blockchain platform Progmat. Japan’s banking giant, Mitsubishi UFJ Financial Group Inc. (MUFG), is believed to be in discussions with several companies, including those linked to major international stablecoins, about the prospective deployment of these digital assets via its blockchain platform, Progmat. The new Japanese legislation on stablecoins, one of the first among the world’s leading economies, mandates that only the country’s licensed banks,…