The German Federal Financial Supervisory Authority (BaFin) — the country’s financial regulator — has reportedly rejected Binance’s crypto custody license application. The news was first reported by Forward Finance, citing people familiar with the matter. Cointelegraph reached out to Binance to confirm the news, and a spokesperson from the firm said that it is “unable to share details of conversations with regulators,” adding: “We continue to work to comply with BaFin‘s requirements. As expected, this is a detailed and ongoing process. We are confident that we have the right team and…

Day: June 29, 2023

COMP Token Rises by 50% in 4 Days Amid Flurry of Whale Activity on Binance

According to historical CoinMarketCap data, 24-hour volume for COMP trading pairs averaged between $10 million and $15 million between June 11 and June 24. On June 25, it experienced $170 million in daily volume with a further $119 million being printed on June 27. Source ActivityBinanceCOMPDaysFlurryRisesTokenWhale CryptoX Portal

MicroStrategy Buys More Bitcoins Taking Total Treasury Value Above $4.5B

MicroStrategy is currently the largest corporate holder of Bitcoins with its total BTC holdings at 152,333. On Wednesday, June 28, business intelligence firm MicroStrategy announced the purchase of over 12,000 Bitcoins worth $350 million. As we know, MicroStrategy is the largest corporate holder of Bitcoins and the recent purchase takes its Treasury value to more than $4.5 billion while holding a total of 152,333 Bitcoins. As per the filing with the US Securities and Exchange Commission MicroStrategy said that they bought 12,333 bitcoins for approximately $347 million in the period…

Michael Moro, Genesis’ Former CEO, to Head Ankex Startup Crypto Derivatives Exchange

“In terms of leverage, we don’t want this to turn into a full blown leverage casino. So for Bitcoin, the max leverage we are offering is 20x, and then for ETH and BNB, just 10x,” said Moro. “But of course, if we only traded bitcoin, ETH and BNB, then, frankly, that is a boring exchange. We will also have to offer derivatives on tokens that are less common and lower in the market cap table.” Source

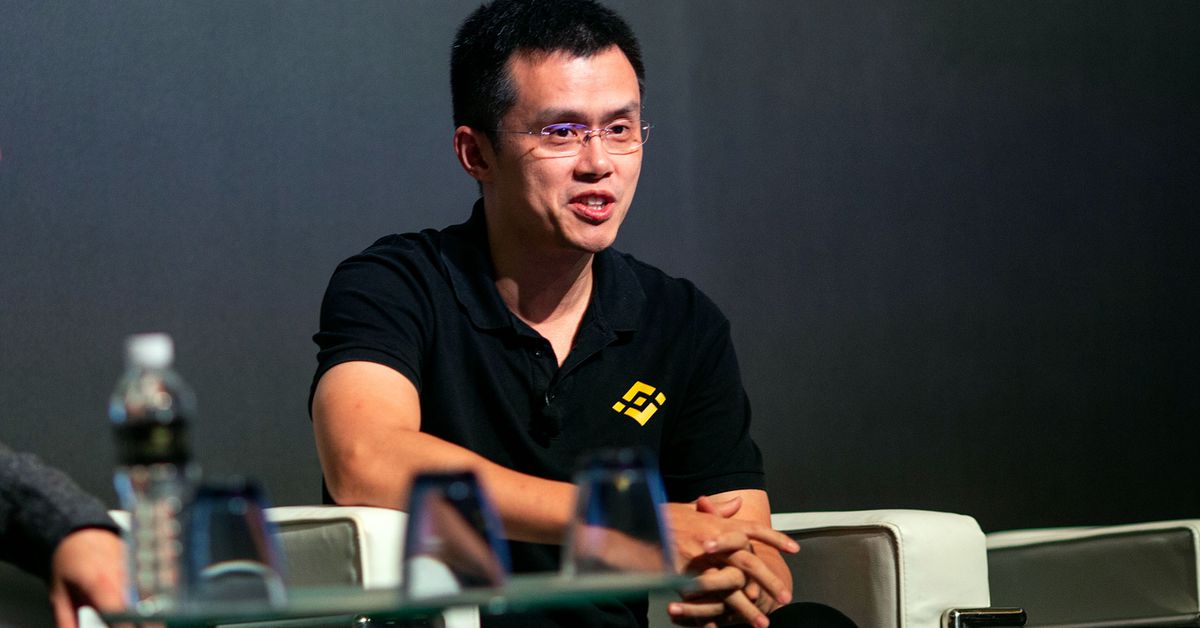

Binance Market Share Drops in June after SEC Lawsuits

SEC lawsuits on crypto exchange Binance and founder Changpeng Zhao has dented the company’s business operations with trading volumes taking a hit. The world’s largest cryptocurrency exchange by trading volume – Binance – saw a drop in its market share this month in June following the regulatory action by the US Securities and Exchange Commission (SEC) on the exchange and its chief Changpeng Zhao. The lawsuit has particularly affected the US affiliate of the crypto exchange i.e. Binance.US. Blockchain data and research firm Kaiko reported that Binance’s share in the…

Exchange Responds to SEC’s Lawsuit in Court, Says Regulator Is Overreaching

The Thursday filing shares a detailed explanation of the company’s stance on the subject matter. The ongoing legal battle between the Coinbase exchange and the US Securities and Exchange Commission (SEC) has taken a new dimension. This follows after Coinbase issued its first legal response to SEC’s lawsuit early Thursday. Coinbase vs SEC In the response, the firm argues that the SEC has gone beyond its jurisdiction by coming at the crypto exchange in the first place. It further claimed that none of the digital assets listed on its platform…

Binance Application for Crypto Custody License Denied by German Regulator: Report

“While we are unable to share details of conversations with regulators, we continue to work to comply with BaFin‘s requirements. As expected, this is a detailed and ongoing process. We are confident that we have the right team and measures in place to continue our discussions with regulators in Germany,” a Binance spokesperson said in an emailed statement to CoinDesk. Source

OpenAI Faces Class Action Lawsuit for Unauthorized Data Harvesting

The class-action lawsuit against OpenAI adds to the increasing number of legal challenges faced by companies involved in developing and profiting from AI technologies. OpenAI, the prominent technology company pioneering unique innovations in Artificial Intelligence (AI) has been hit with a lawsuit filed by sixteen pseudonymous individuals. The plaintiffs claim that the company’s AI products, specifically those based on ChatGPT, collected their personal information without proper notice. The complaint, filed in a Federal Court in San Francisco, alleges that OpenAI bypassed legal means of data acquisition and instead gathered personal…

Crypto debanking could drive industry underground: Australia Treasury

The growing trend of cutting services to cryptocurrency companies in Australia could lead to undesired consequences like making the industry less transparent, according to the state. Australia’s Treasury on 28 June published an official statement addressing potential policy responses on debanking in Australia. Debanking occurs when a bank declines to provide services to a customer citing issues like Anti-Money Laundering (AML), sanctions compliance, reputational risk considerations and others, the authority noted. According to the Treasury, there is a clear lack of data on debanking practices in Australia, which makes it challenging…

ECB to Start Exploring DLT for Wholesale CBDC Settlement in 2024

CryptoX – Cryptocurrency Analysis and News Portal The central bank is looking at how it can innovate in settling transactions between financial institutions for securities or foreign exchange, while also developing plans for a retail central bank digital currency (CBDC), the digital euro, that could be used by EU citizens. Source The post ECB to Start Exploring DLT for Wholesale CBDC Settlement in 2024 appeared first on CryptoX. CryptoX Portal