One change, AIP-21 would enhance the network’s capabilities when it comes to tokenized securities, real estate, in-game currencies and other fungible assets. Although Aptos already supported on-chain token issuance, its existing standards could not keep up with “creative innovations” like restrictions on who can own an asset, according to a proposal description. Source

Day: July 11, 2023

Multichain Executor has been ‘draining’ AnySwap tokens: Report

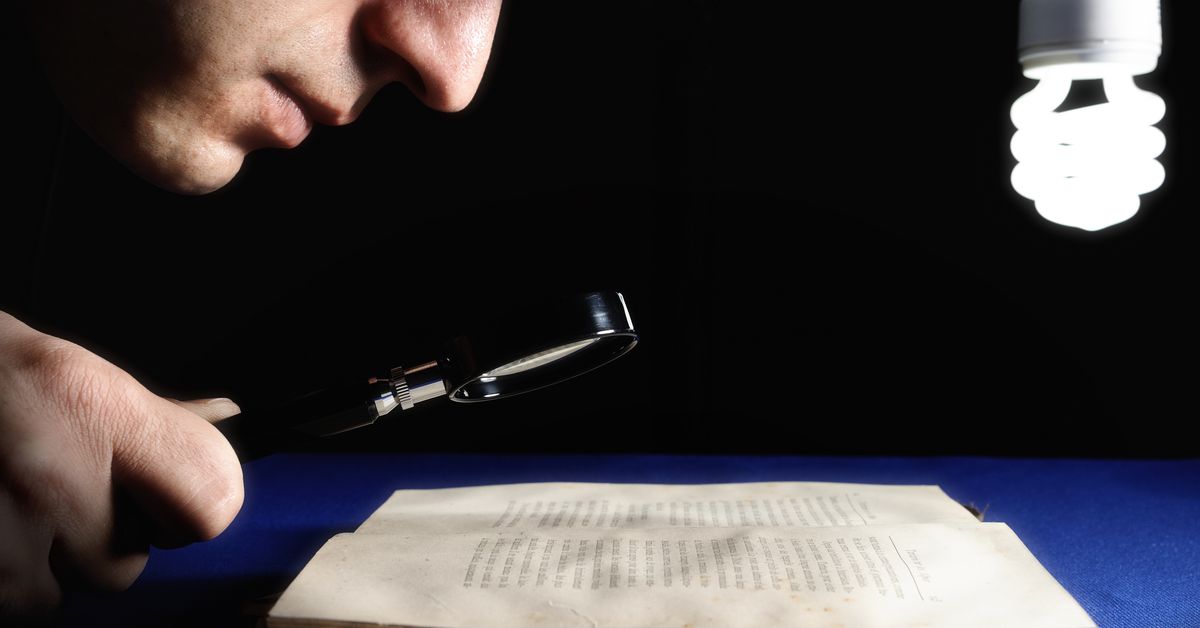

A person is using the Multichain Executor to drain tokens associated with the AnySwap bridging protocol, according to a July 10 report from on-chain sleuth and Twitter user Spreek. The report follows outflows of over $100 million from Multichain bridges that occurred on July 7, which were reported by the Multichain team as “abnormal.” The Multichain Executor address has been draining anyToken addresses across many chains today and moving them all to a new EOA pic.twitter.com/gqDaXMBl96 — Spreek (@spreekaway) July 10, 2023 According to Spreek’s July 10 report, “The Multichain…

FTX claims portal becomes unavailable shortly after going live

Bankrupt cryptocurrency exchange FTX launched a customer claims portal which stayed live for roughly an hour before going offline for unknown reasons. Many social media users reported the FTX claims portal went live on July 11, offering customers of the failed crypto exchange who had accounts with FTX, FTX.US, Blockfolio, FTX EU, FTX Japan, and Liquid the opportunity to access their account information and submit claims for consideration in the firm’s restructuring proceedings. According to FTX’s Kroll page, users had until Sept. 29 to submit claims. Customer Claims portal is…

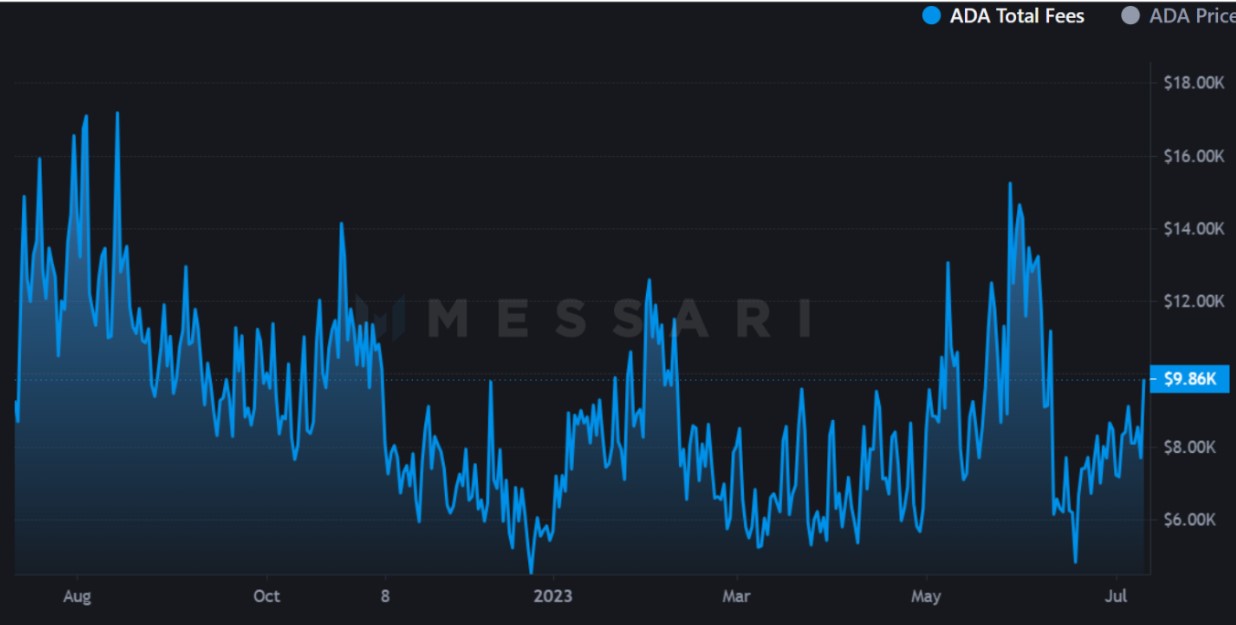

Cardano network activity and ADA’s oversold price action hint at a powerful breakout

Caradano’s native gas-paying token ADA received a big blow at the start of June when the SEC regarded it as a security in its lawsuit against Binance and Coinbase. The lawsuit triggered a 42.5% drop in ADA’s price from $0.37 to a two-year low at $0.21 within a few days after SEC’s lawsuit. Additionally, the token faced further downside selling pressure due to delisting on U.S.-based trading apps Robinhood and eToro. However, under the hood, the network has been making progress with an uptick in DeFi activity after a scalability…

This is why miners are selling their bitcoin at levels not seen since 2019

Recent data shows a major increase in the amount of bitcoin moved by miners from the mining pool to crypto exchanges, but the price of the flagship cryptocurrency continues to show resilience. Selling volume by miners hit its highest level on Friday since March 2019, according to blockchain data firm Glassnode. The day BlackRock filed for a spot bitcoin ETF , selling volume jumped to its highest level since September 2017. This selling behavior, implied by miners’ moving mined bitcoin to exchanges, began at the end of May. Miners are…

Bitcoin continues dominance as 3rd week of fund inflows correct previous months’ outflows

A third straight week of positive digital asset inflows has fully corrected nine previous weeks of outflows for the market, according to a report from CoinShares published on July 10. This week’s inflows registered $136 million. Bitcoin (BTC) funds continued their trend of holding the anchor position, with 98% of the inflows coming from BTC. The other 2% mostly came from Ether (ETH), multi-asset holdings, and a handful of altcoins. Source: Screenshot, CoinShares After nine weeks where digital asset outflows outpaced inflows, this third consecutive week of positive movement brings the…

Arkham CEO Defends ‘DOX-to-Earn’ Program, Says Public Blockchains ‘Worst’ for Privacy

“Publicly available blockchains are probably the worst possible way of keeping one’s private information private,” said Arkham CEO Miguel Morel. Source

UK Treasury plans to exclude derivatives and ‘unbacked’ tokens from regulatory sandbox

The Treasury Department of the United Kingdom has proposed excluding unbacked crypto assets and derivatives from its plans for a digital securities sandbox. In a consultation paper released on July 11, HM Treasury said the regulatory sandboxes that will be established under the country’s Financial Services and Markets Act will provide the U.K. government the time to modify existing legislation, if needed, for crypto products. The proposed framework was aimed at giving firms the opportunity to operate as Parliament considers where its products or services may fall under existing regulations.…

Bitcoin ETF hopium fades as on-chain and futures data reflect traders’ muted activity

The price of Bitcoin (BTC) has been trading between $29,900 and $31,160 for the past 18 days, causing concern among investors who are looking for explanations for the lack of a clear trend. After a 25.5% rally between June 15 and June 23 leading to Bitcoin’s highest level in 13 months one would expect investors to become more active and optimistic, but the lack of BTC’s ability to sustain prices above $31,000 and neutral on-chain and derivatives data do not corroborate this thesis. Bitcoin ETF expectations faced a harsh regulatory…

EthCC and Crypto's Latent Biases

A major Ethereum conference set for Paris is not drawing the same criticisms and concerns around last year’s DevCon in Bogota, Colombia. If the industry wants to grow, it must take a truly global perspective. Source