“Bitcoin jumped back as high as $26,800 Wednesday as key whale & shark addresses are now collectively adding to their stacks once again,” on-chain analytics firm Santiment said in a tweet. “There are currently 156,660 wallets holding 10 to 10,000 $BTC, and they have accumulated $308.6M since August 17th.” Original

Day: August 24, 2023

Optimism Reverses From Range Low, Gains 10%

Optimism (OP) is proving to be a beacon of stability amidst the tumultuous fluctuations of the cryptocurrency market, particularly Bitcoin (BTC). While Bitcoin’s price swings have left investors on edge, Optimism’s weekly rally seems poised to extend its resilience. The cryptocurrency’s price trajectory has demonstrated a notable rebound, bouncing back from its range-low of $1.41. This steadfast performance has entrenched Optimism within a trading range bordered by $1.80 at the upper limit and $1.41 at the lower threshold. As bulls and bears lock horns in a battle for supremacy, the…

Binance to halt crypto debit card in Latin America, Middle East

Cryptocurrency exchange Binance will suspend its crypto debit card services in Latin America and the Middle East from Aug. 25. The crypto debit card worked like other debit cards, allowing users to pay for day-to-day goods and services. The only difference is that these cards were funded by cryptocurrency assets. The crypto debit card services in Latin America and the Middle East will be terminated by Sept. 21, but the exchange claimed refunds and disputes can still be processed until Dec. 20, 2023. Binance crypto debit card interface. Source: X…

Bitcoin halving can take BTC price to $148K by July 2025 — Pantera Capital

Bitcoin (BTC) is due to hit nearly $150,000 during its next four-year halving cycle, Pantera Capital believes. In its latest “Blockchain Letter” released on Aug. 22, executives at the crypto asset manager doubled down on their bullish BTC price forecasts for 2024 and beyond. Halving data reinforces November 2022 BTC price bottom Bitcoin price performance depends heavily on its halving cycles, Pantera Capital argues, and with the next due within the coming twelve months, the firm is betting that historical trends will continue. BTC/USD, it notes, tends to put in…

DeFi Yield Platform Pendle Finance Now Offers Real-World Asset Product

“Yes, RWA is already in DeFi, and now Pendle is able to offer a suite of tools that lets you properly hedge or manage these yields. Interest rate derivatives, swaps, fixed income…all these products that TradFi institutions love, they’re already here,” Lee added. Source

FTX to Hire Galaxy Digital Capital Management to Help Sell Off $3B in Crypto

FTX is hoping interest on its crypto pile will add to the stock it can distribute to customers who are still waiting for their money back. The company, now run by restructuring expert John J. Ray III, worries that selling all in one go would cause the price to plummet, to the benefit of short sellers and other market participants. It’s turning to market experts to figure out how best to avoid that, for example via weekly sales limits. Source

Crypto Exchange Bitstamp Will Shut Down Ether Staking in U.S.

Meanwhile, a report from HashKey Capital shows that the ether Liquid Staking Derivatives market – which is decentralized and non-custodial, unlike services offered by exchanges – is projected to grow by $24 billion in the next two years, and Ether.Fi, a decentralized staking platform, closed a $5.3 million round in May. Source

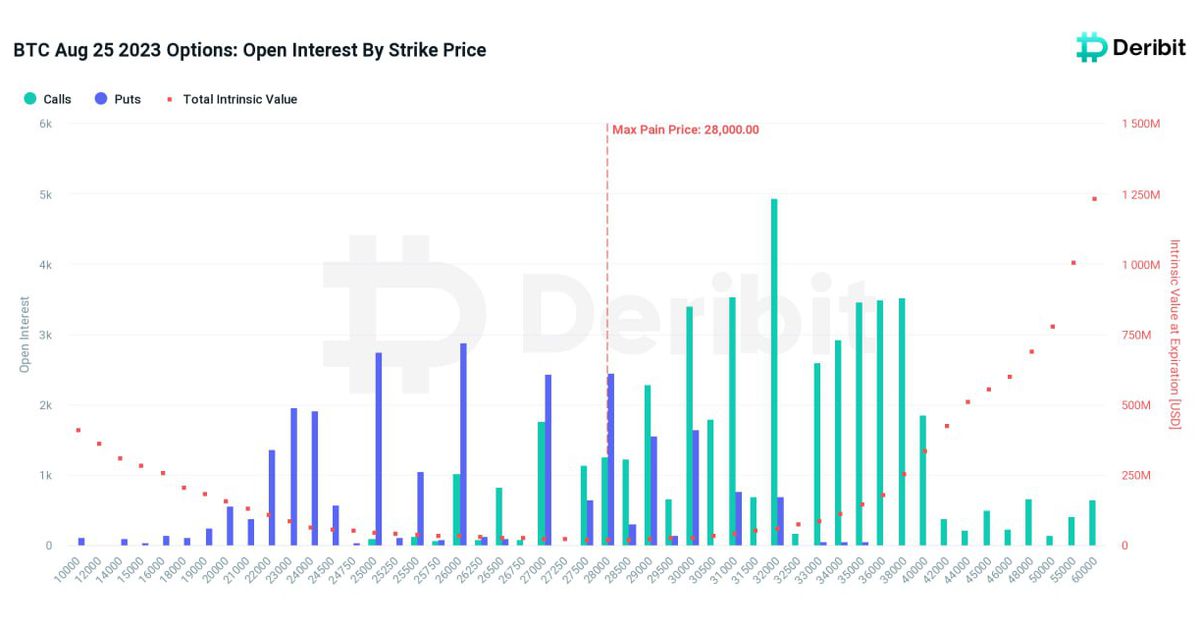

Bitcoin, Ether Trade Below 'Maximum Pain' Levels Ahead of $2.7B Options Settlement

A lot of put options are in-the-money, crypto options exchange Deribit’s Lin Chen said. Source

Hedera, THORChain, and InQubeta demand spikes despite shaky market conditions

The crypto scene is inherently volatile. Albeit the general shaky conditions, a few projects continue to shine, drawing investors’ attention and enthusiasm globally. Hedera (HBAR), THORChain (RUNE), and, notably, InQubeta’s QUBE are popular as more investors explore their core propositions. InQubeta is connecting AI with crypto In an era where artificial intelligence (AI) is being adopted, many investors often find it challenging to tap into the potential of AI ventures. InQubeta acts as a bridge connecting ordinary investors with vetted AI startups. By developing a platform that supports fractional investments in AI startups via…

Liquidity Provider B2C2 Buys Rival Trading Firm Woorton, Eyes European Growth

“Like us, the [Woorton] team has a TradFi background but with the same crypto and digital assets laser focus. Together we are a combination of highly complementary businesses that deliver multi asset breadth and depth to clients in the EU market,” Thomas Restout, Head of EMEA at B2C2 said. Source