Bitcoin (BTC) dropped $1,000 in minutes on Nov. 26 as a long-awaited pullback hit the market at close to $19,500.

BTC price hits $17,250 lows

Data from Cointelegraph Markets and TradingView showed BTC/USD experiencing major volatility overnight on Wednesday.

After nearly hitting $19,500 during the day’s trading, after-hours saw a period of bearish indecision that ended in a sharp sell-off. Bitcoin then bounced at $17,250, capping daily losses of around 5%.

Many analysts had already warned that the recent gains were due for a pullback, among them CNBC host Brian Kelly and trader Tone Vays, who on Thursday forecast a dip to $14,000.

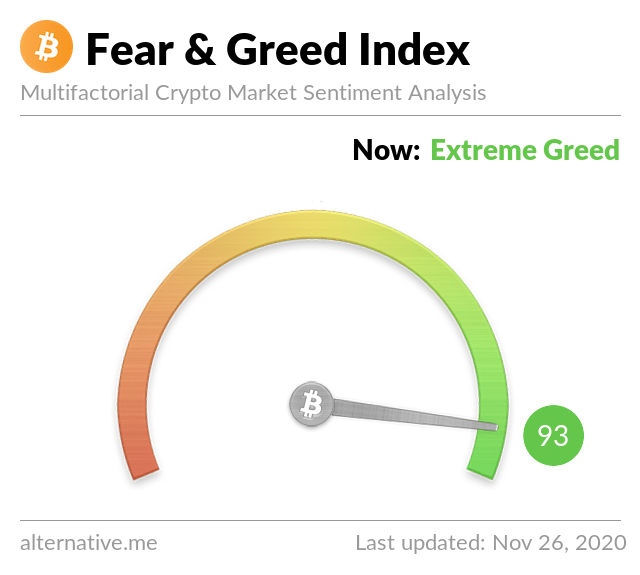

Meanwhile, other metrics have also hinted at a looming correction. Among them is the popular Crypto Fear and Greed Index, which has remained at record high levels throughout November.

Exchange selling pressure mounts

In the event, the downturn was less severe but came in tandem with large-volume investors depositing BTC to exchanges — presumably with the aim of taking profit near Bitcoin’s $20,000 all-time highs.

“All Exchanges Inflow Mean increased a few hours ago. It indicates that whales, relatively speaking, deposited $BTC to exchanges,” Ki Young Ju, creator of on-chain analytics resource CryptoQuant, summarized to Twitter followers.

“But long-term on-chain indicators say the buying pressure prevails. I still think we can break 20k in a few days.”

Bitcoin’s technical indicators support the bullish theory going forward, however, with the mining difficulty set for a 7.3% uptick in three days’ time and hash rate continuing to grow.

At press time, BTC/USD circled $17,900 after a modest recovery from local lows.