On Bitcoin’s 12th anniversary, a mystery miner from the early days spent 1,000 decade-old bitcoins that were mined in 2010. The strange miner was not the only entity that spent 2010 BTC block rewards during the last nine months, but this miner returned on a few occasions to spend strings of ten-year-old block rewards. As the end of 2021 nears, 152 blocks with 7,600 bitcoin worth $319 million today and minted in 2010 have been spent this year after sitting idle for over a decade.

Old School Whale Transfers From 2010 Outpace 2011 and 2012 Spends, $977 Million Worth of Sleeping Bitcoins Moved This Year

During the last 12 years bitcoins have been lost by a great number of people under different circumstances, and it’s likely these coins will never return to circulation. Then there’s another group of bitcoins the community calls ‘sleeping bitcoins’ or ‘zombie bitcoins’ because they have been sitting idle since the day they were created.

At some point, if the owner decides to spend the bitcoin, the ‘sleeping bitcoins’ wake from slumber after a number of years. Last year and this year, Bitcoin.com News has been monitoring old school block rewards that get spent years later, after discovering an extraordinary 2010 whale.

Following the spend on the 12th anniversary of Bitcoin (January 3, 2021), the mystery miner appeared a few times during the year to spend strings of 20 block rewards from 2010. Block spends from 2010 are not common, and each block reward contains 50 BTC as the first block reward halving did not happen until November 28, 2012.

The last time this specific miner from 2010 appeared was on June 9, 2021. This year they spent 20 block reward strings on January 3, 2021 (Bitcoin’s 12th anniversary), January 10, 2021, January 25, 2021, February 28, 2021, March 23, 2021, and June 9, 2021.

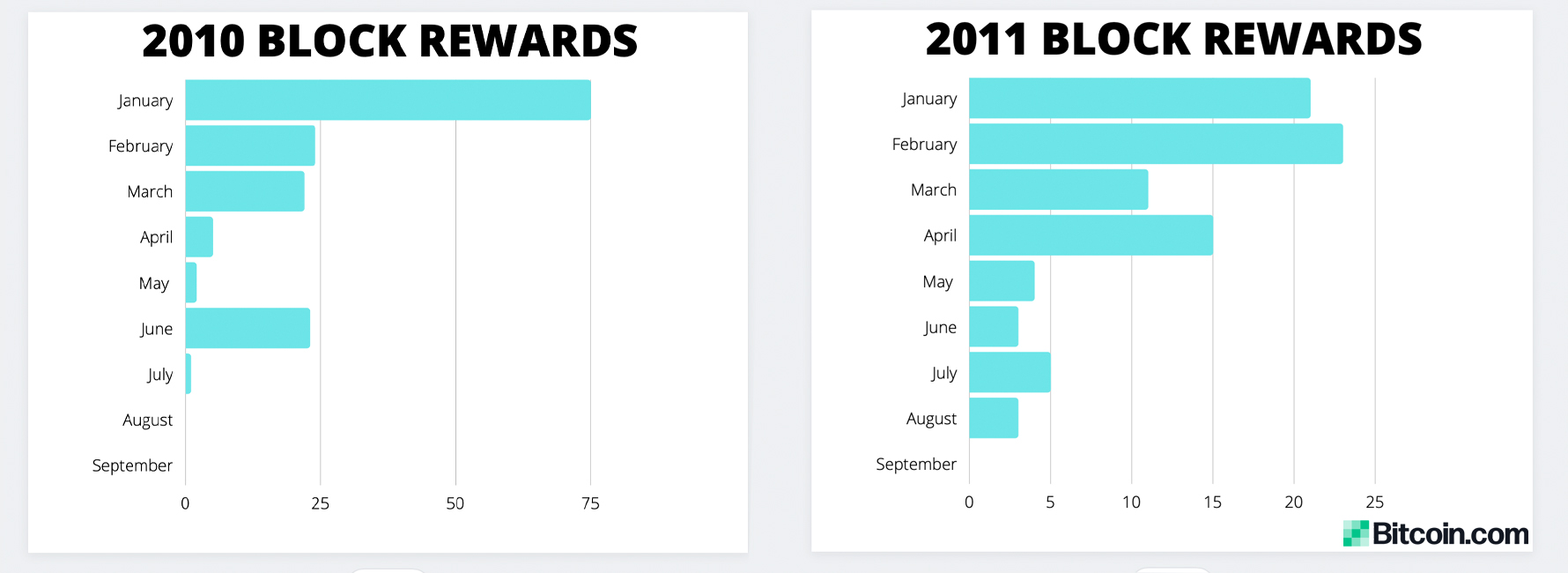

That’s a total of 120 blocks, or 6,000 bitcoin, worth $252 million spent by what we assume is a single mining entity from 2010. In fact, we can say that the entity spent 78.94% of all the 2010 blocks spent this year (152 total). Because of this whale’s spends, the 2010 block reward spends in 2021 outpaced 2011 and 2012 block reward spends.

In 2021, there were approximately 85 block rewards from 2011 transferred from the original address. That’s 4,250 bitcoins total worth $178 million using today’s exchange rates. January and February 2021 saw the most 2011 blocks transferred this year.

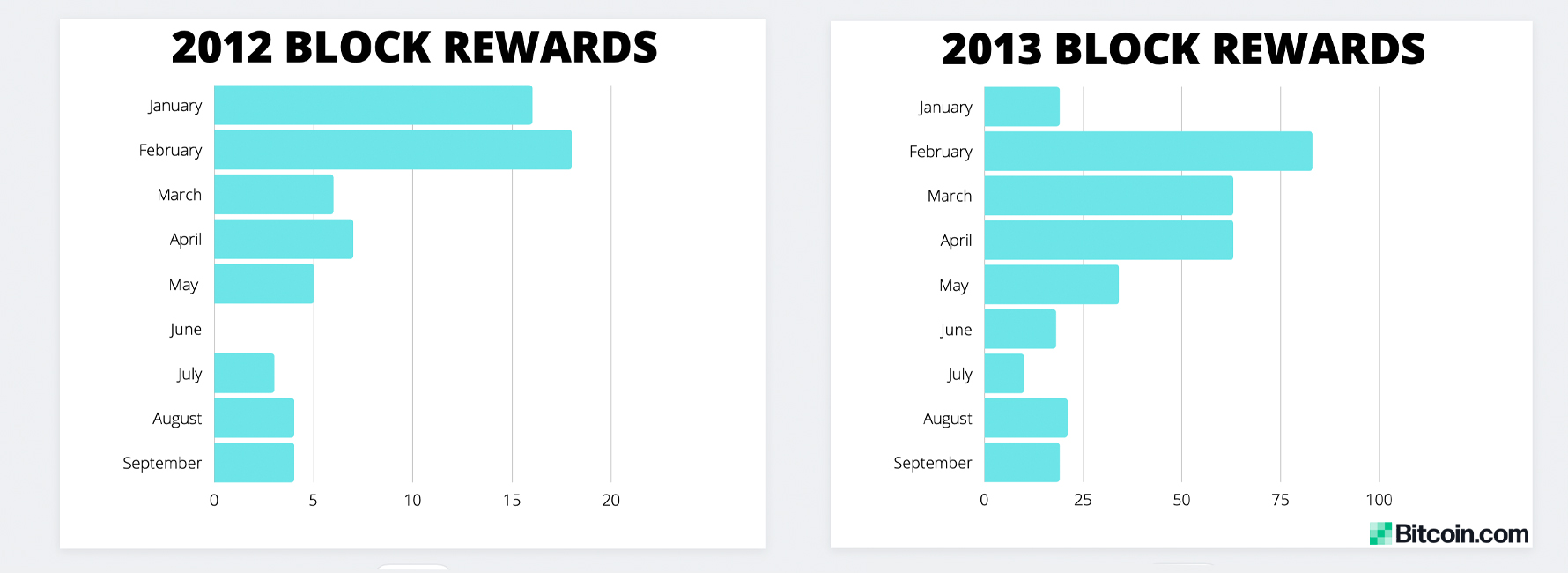

Statistics from btcparser.com show that there were more 2011 blocks spent this year than the quantity of 2012 blocks. The aggregate total of 2012 block rewards moved in 2021 is currently 63 block rewards. Of the block rewards in the list of 2012 blocks, all of them were pre-halving minted which means they were issued before November 28, 2012.

63 block rewards with 50 BTC each is approximately 3,150 BTC or $132 million dollars’ worth at the time of writing. The number of 2013 blocks transferred in 2021 exceeded all of the 2010, 2011, and 2012 block reward spends this year.

2013 Block Spends Surpass Previous Three Years but the Transfers Moved Fewer Bitcoin

So far there have been 330 block rewards from 2013 spent during the course of 2021. That’s 30 more blocks than the 2010, 2011, and 2012 spends combined. However, because the 2013 blocks were spent after the first halving in November 2012, the transfers only moved 8,250 BTC this year ($347M).

That’s because miners in 2013 got 25 BTC instead of the 50 BTC reward that was given prior to the halving. All of the 2010, 2011, and 2012 spends combined (300 blocks) adds up to 15,000 BTC ($630M). Between block rewards moved from 2010, 2011, 2012, and 2013, an aggregate total of 630 block rewards was spent with 23,259 BTC worth $977 million today.

Crypto proponents have no idea who these miners are but they certainly mined a great quantity of bitcoin in the early days. It’s worth noting that the terms “spent” or “spend” in this article, do not necessarily mean that the bitcoins were “sold” to a third party for fiat or another crypto asset.

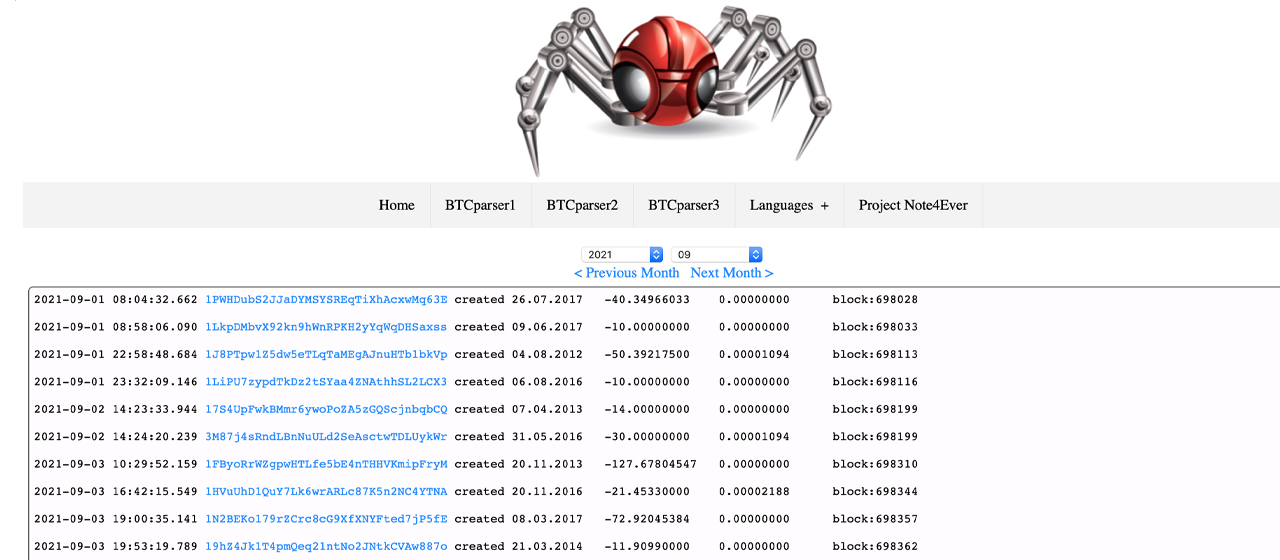

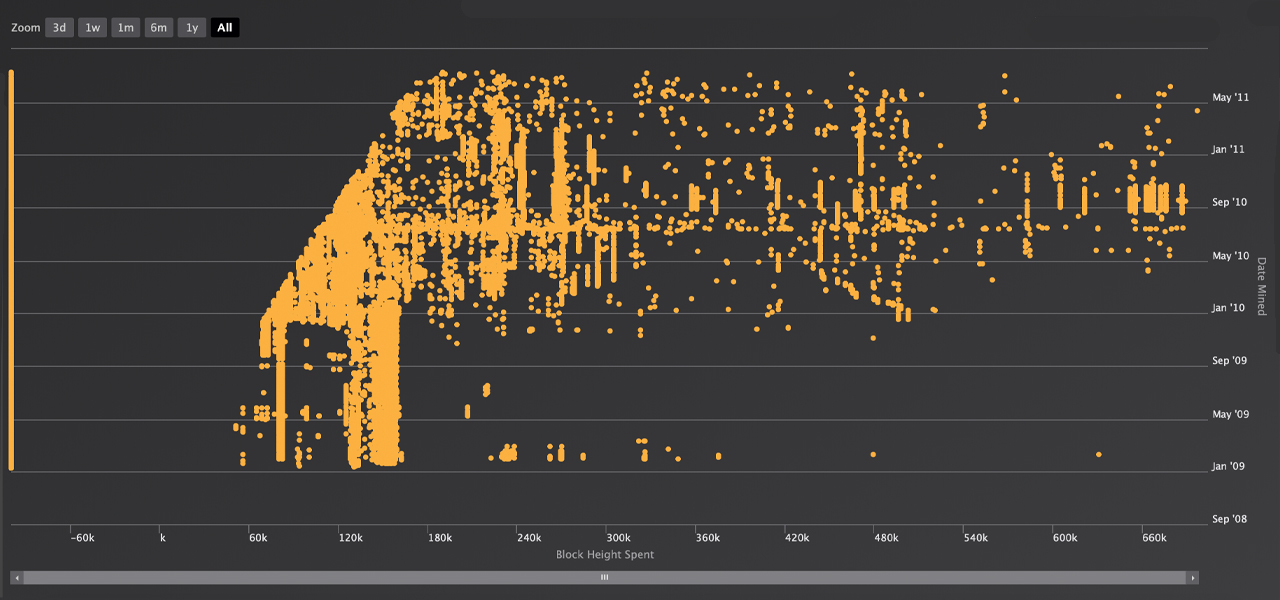

For this article, using Btcparser.com we parsed 21,519 addresses from 2009, 12,396 addresses from 2010, 3,598 addresses from 2011, 2,193 addresses from 2012, and 5,214 addresses from 2013. From a visual perspective, in this report we leveraged “The (Not) ‘Satoshi’s Bags’ Tracker” located on theholyroger.com. No block rewards from 2009 were spent in 2021 and the last time a 2009 block was moved was on May 20, 2020, when an entity spent a coinbase reward that was minted on February 9, 2009.

What do you think about the $977 million in bitcoin moved from 2010-2013 block rewards in 2021? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, theholyroger.com, Btcparser.com, Bitcoin.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.