In this article, we will explain how you can achieve long-term financial growth. Let’s start with bank deposits and savings accounts – and what makes them absolutely useless. Unfortunately, with each year the profitability of bank deposits decreases – yield rates on deposits go down, and in some countries, they even reach the inflation rate. Let’s take a look at an example from Germany – according to a survey conducted by the Bundesbank, 58% of banks have set negative interest rates on deposits for corporate clients, and 23% have done the same for retail clients. The survey was conducted at the end of September, a few weeks after the European Central Bank reduced the interest rate on deposits from -0.4% to -0.5%.

Although the return on investments is still officially above the inflation rate, their real return is effectively the same as the level of inflation. In order to achieve returns that are higher than inflation – real returns – you need to seek out more profitable options that are often riskier. So if you want to maintain or even improve your current financial status, you need to start learning about investment instruments as soon as possible. In this article, we will discuss traditional instruments as well as lesser-known instruments that are no less reliable.

Stocks

When talking about investments, stocks are usually the first thing that comes to mind. That’s why they are a good starting point for this discussion. Stocks are securities that give their holder the right to receive part of the company’s revenue. In other words, they offer an opportunity to purchase a share of a company.

Stocks are a long-term instrument, which means that you should hold them for at least a year, ideally – for several decades. This offers the opportunity to increase your capital by several times. It’s worth noting that in the entire period between 1872 and 2018, there wasn’t a single 20-year interval in which investments in American stocks following the ‘buy and build’ strategy have led to losses – even when adjusting for inflation. On the contrary, one-year investments often resulted in losses.

A study by Business Insider features a list that offers an illustration of this principle. Its authors calculated the amount of money that you could have earned by the end of 2019 by investing $100 in stocks from giants such as Nike, Coca-Cola, McDonalds`s, Microsoft, Apple, Amazon, Starbucks, and Netflix during their IPOs.

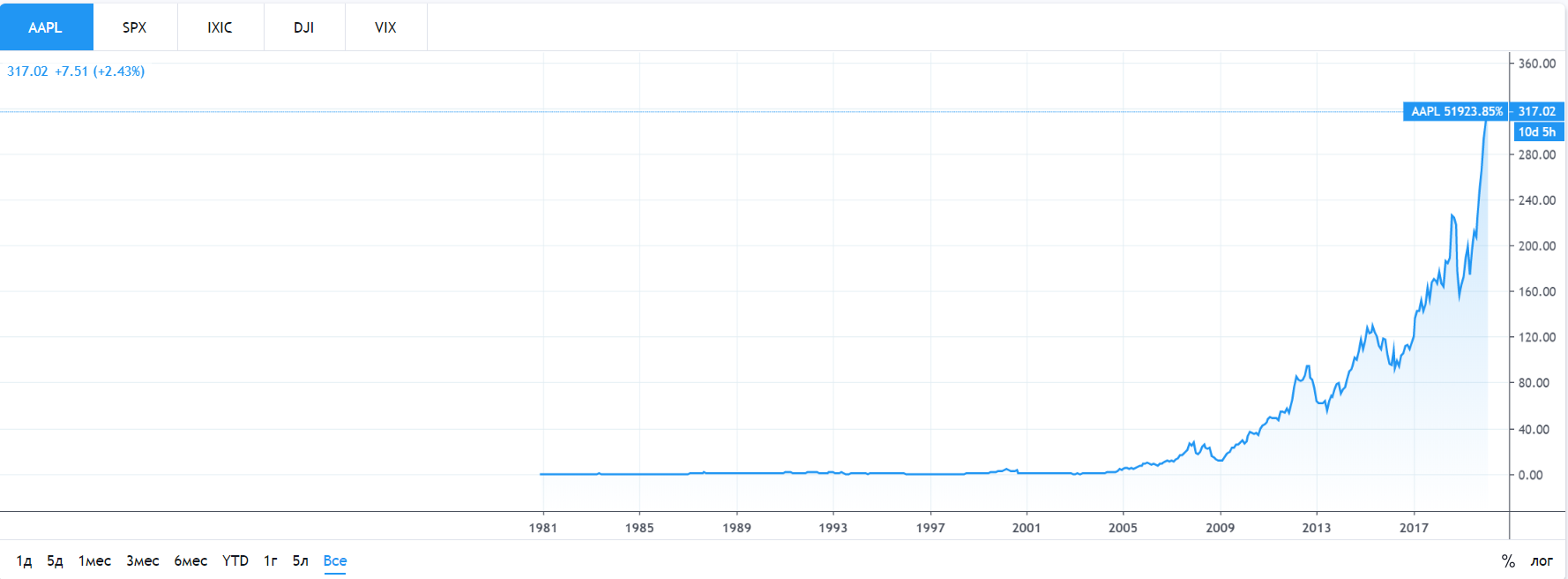

How much would you have earned with Apple?

A graph showing the growth in the price of Apple stocks offers visual confirmation of the long-term potential of this instrument. The company created an IPO on December 12, 1980. The price of stocks in the company started at $22. As of this writing, the price of one stock has gone up to $317.

Can stocks offer earnings above inflation?

Some people believe that it is difficult to earn a lot on stocks, and certain investors forego long-term investments in stocks entirely because of their low profitability. Nevertheless, there are some exceptions in the market, which are usually related to high tech companies. It’s worth noting a recent increase in the stock price of Tesla, which some traders even called a stock bacchanal. In early February, Musk’s company stocks experienced an insane leap: in the evening on Tuesday, February 4, the price increased from $674 to $970, only to drop back to $734 the next day. These sudden changes were not caused by news about Musk’s crazy exploits, sudden revenue growth or launches of autonomous vehicles.

Before moving on to our next instrument, here’s a quote from The Investor’s Manifesto by William Bernstein: ‘…The most that can vanish with any one stock is 100 percent of its purchase value, whereas the winners can easily make 1,000 percent, and exceptionally 10,000 percent, inside of a decade or two.’

Advice: Diversify your stock investments to ensure that your investment portfolio contains stocks with the highest growth potential. Statistics show that a properly diversified portfolio should contain between 10 and 14 stocks. Fewer stocks will expose you to higher risk, while a larger number will reduce profitability and make it more difficult to manage.

Advantages: low risks, the potential for high long-term profitability.

Disadvantages: long term for return on investments, low or negative returns int the short-term perspective, additional expenses on services provided by brokers, hosts, and managers; prices are affected by multiple factors which are difficult to control – from management decisions to political events.

Bonds

In the simplest terms, bonds are like IOUs. They can be released by companies and entire governments in need of additional funds. When purchasing bonds, technically you give out a loan, which is an investment in the development of the bond issuer. Naturally, investors purchase bonds in the hope of making a profit in the future. All conditions, including the purchase price, the payment amount and timing are discussed at the time of purchase. What sets bonds apart from other securities is the opportunity to evaluate future returns in advance.

There are several types of bonds. In most cases, they can be categorized by several parameters: the form of payment (percentage or discount), the repayment period (short-term, medium-term, and long term), the currency of issue, the issuer (government or corporate).

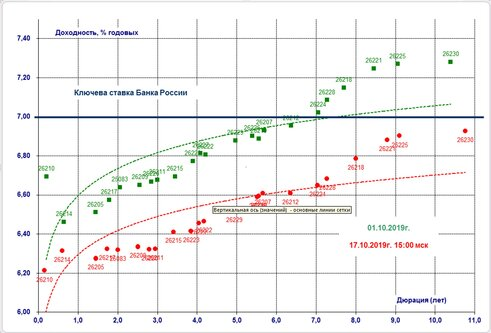

Bonds are traditionally considered to be a secure investment instrument. However, keep in mind that when it comes to investments, low risks are often linked to low returns. This is the case with bonds – for example, the returns on Russian federal bonds (OFZ) are insignificantly higher than inflation, offering the same level of returns as bank deposits:

If you would like to make more money on bonds, you need to prepare for high risks. For example, you can take a risk and invest your funds into a B-rated company. However, in this case, you will face the risk of company default, liquidity, and debt restructuring.

Advice: before purchasing a bond, make sure to research the issuing company. Review the information available on the news, as well as financial and accounting reports available on exchange websites and licensed information agencies.

Advantages: transparency — an opportunity to calculate returns in advance; low risk — compared to investments in stocks or securities; simple sales process, lack of taxation, and in certain cases you can even obtain a tax return.

Disadvantages: lack of insurance — unlike deposits and other investments in the securities market, bonds are not insured; low returns — compared to other securities, bonds offer relatively low returns.

Real estate

According to the old saying that is popular among amateur investors, ‘When in doubt, invest in real estate.’ At first glance, it certainly appears that investing in real estate is a much simpler solution than figuring out the complexities of the securities market, which involves stocks, ETFs, bonds and other confusing terminology. This is also a safe solution for conservative investors – square meters are easy to measure, unlike abstract movements on a graph.

Russian investors’ interest in this instrument is confirmed by the annual study The Wealth Report 2019 — according to the report, 20% of affluent Russians prefer to invest in real estate.

Real estate investments can be divided into two major categories:

1) purchase with the purpose of reselling at a higher price in the future;

2) purchase for leasing.

The idea of investing in real estate certainly looks attractive: real estate has a high liquidity and offers several profitability periods (short-term in case of sales, long-term with leasing), as well as a wide price range. However, the downsides are also worth noting – demand on real estate is highly dependant on external factors (for example, in an industrial city, the closure of a factory can lead to a sharp decrease in the purchasing power of its residents), and real estate requires enormous investments (state fees, utility payments, various improvements). The main advantage of this investment is a significantly lower risk, even compared to stocks.

Let’s take a look at a simple case to avoid unfounded allegations. In our example, we will take a look at one of the largest capitals in Europe, Moscow. By the way, according to a Yandex study, demand for real estate rentals in Russia increased by 18% in 2019. In recent years, the price changes were as follows: as of January 1, 2018, the average rental price of a studio apartment was 30 000 rubles, by September it increased to 33 000 rubles, in early 2019 the average rental price was 35 000 rubles, reaching 38 000 rubles by September 1, 2019.

Based on these figures, it appears that purchasing an apartment for future leasing is an attractive option. According to the Yandex.Realty portal, the average cost of a studio apartment in Moscow is 6.8 million. This is enough to purchase a small studio apartment in an old building close to a terminal metro station, or an apartment in a new building that is currently being built (in this case, it would be outside the Moscow Ring Road). By leasing out the apartment for 38 000 (the average rental price of a studio apartment in 2019), you can earn 420 000 rubles per year.

Now, let’s imagine that we made a bank deposit of this amount, with an annual yield of 6.03% (the average yield in 2019, according to the Bank of Russia), then by the end of the year we will earn 410 000 rubles in interest. If prices on apartments continue to follow current trends, the price of the apartment will increase by 15.9% in a year. This means 420 000 rubles from leasing + 1 081 000 rubles thanks to the appreciation of the asset. As a result, you will earn almost 1.5 million rubles in a year. However, there are several nuances worth considering:

- Even if your tenants don’t break anything inside the apartment and you never need to invest additional money, you will need to pay a tax on your income from leasing the apartment. The best way to do this is to claim ‘self-employment’ and pay 4% from your net income – 16 800 rubles;

- Because the interior of your apartment will become worn out with time, you will need to occasionally invest money into it. If you fail to do this regularly, the rental price will start to go down, and it will lose some of its value for tenants;

- Reduction in liquidity – apartments in older housing units tend to increase their value at a slower rate. Apartments in new buildings are also not immune to price reductions – for instance, if a noisy highway is built close to the building, the apartment will lose some of its value for tenants.

Our findings are clear: investing in real estate is an extremely labour-intensive process, particularly considering the fact the profitability from an apartment in one of the most expensive cities in the world offers the same returns as a deposit with an average yield rate.

Advice: Look into REITs – real estate investment trusts. This instrument makes it possible to invest in real estate with all the advantages of a traditional exchange or investment app. These trusts are protected from inflation – the average rental price increases to match the amount of inflation due to a significant level of diversification: one trust contains a large variety of real estate properties.

Advantages: a well-located property can increase in price, returns on real estate investments are higher than returns on deposits, stability.

Disadvantages: Reduced property liquidity, expenditures on taxes and depreciation.

Cryptocurrency market

The cryptocurrency market is probably the most controversial option for investment. Despite the large number of fake cryptocurrencies created for speculative purposes, falsified trading volumes (some reports claim over 95% of trading volumes are fake(!) ), and the abundance of criminal schemes in the industry, Bitcoin continues to demonstrate a significantly higher level of profitability than traditional assets. According to a recent study, despite major price decreases and an extended bear trend in 2018, Bitcoin remains one of the most profitable assets of the decade. Since its launch in 2009 until 2019, the price of Bitcoin has increased by 236.7 million % (!).

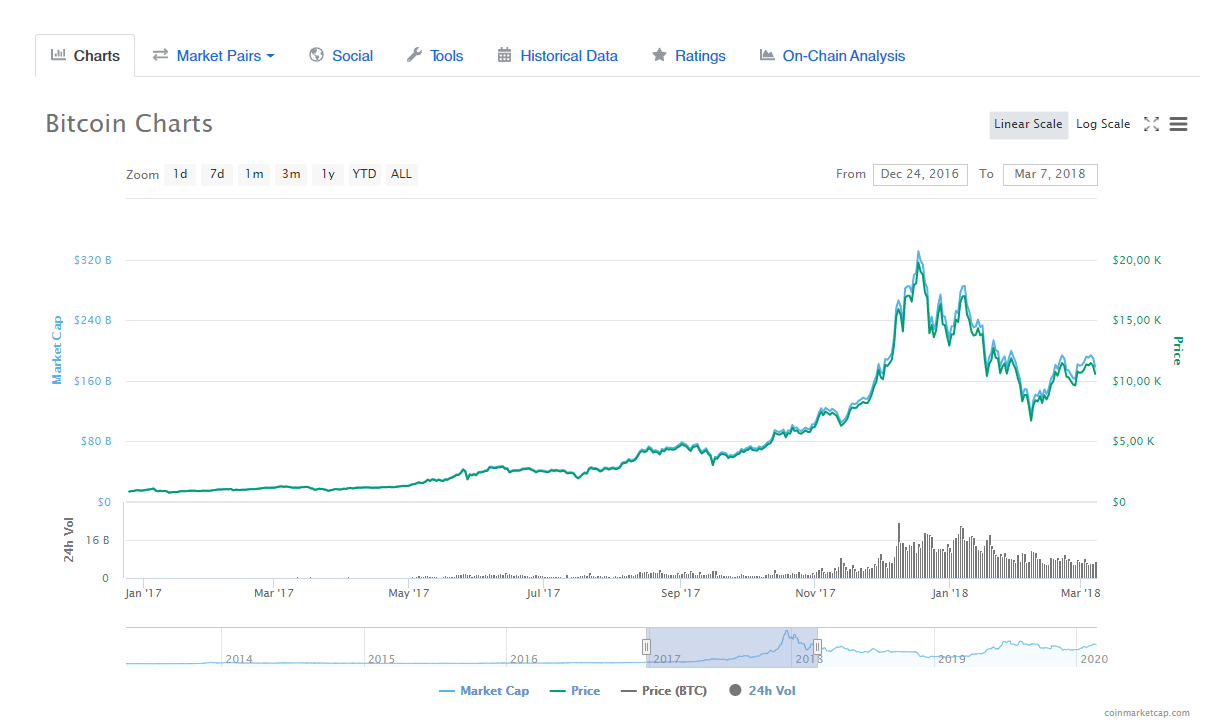

Naturally, no conversation about cryptocurrencies is complete without mentioning the bull run in 2017. The price of the currency started out at $1000 in the beginning of the year and finished at $20 000:

Despite their high potential for profitability, there are many stop factors associated with cryptocurrencies:

- The most significant stop factor is the high volatility in this market. Those who keep track of changes in the market know that the price of Bitcoin can go down by over a thousand dollars overnight. One of the reasons for this is the dependence of the market on the news cycle. After one positive announcement from a regulator, and bear traders suddenly lose all their standing; a security breach at an exchange can instantly put the entire market into the red.For example, on August 19, 2020, LUNA coin suddenly saw a 48.900% increase. This growth was short-lived – a few days later, the coin dropped to its initial level. By the end of the year, the coin restored its value, with an annual growth of 25 000%:

The situation was more dire for the BitTorent coin (BTT), which shocked the market in 2018 with its eight-fold growth. The coin has dropped by 99% since the start of 2019!

Popular cryptocurrencies are not immune to sharp decreases in price. For instance, Ethereum, the silver coin of the cryptocurrency market, with the second-largest market capitalization, lost 12% of its initial price in 2019, despite an abundance of positive news, a strong team of developers, and popularity in the market… How many people invested in Ethereum in 2017 when it cost more than a thousand dollars, considering it to be one of the most promising cryptocurrencies? - Vulnerability to hacking attacks. According to a report by analytical company CipherTrace, in 2019 alone cyber criminals have stolen a whopping $4.26 billion worth of cryptocurrencies. Last year, over the course of a single month, a team of analysts discovered more than 40 vulnerabilities on various blockchain platforms. These platforms included industry giants such as Coinbase, EOS issuer Block.one, Tezos, Brave, and Monero (3 out of 4 of these projects are in the top-10 list on Coinmarketcap, which designates them as blue-chip platforms in the cryptocurrency market).However, these platform vulnerabilities are not as dangerous for users as issues with cryptocurrency exchanges might be. When it comes to crypto exchange breaches, the sad story of Mt. Gox exchange always comes to mind. In September 2011, someone gained access to Mt. Gox hot wallet, which contained Bitcoins and unused keys. Over the course of a few years, this person managed to withdraw a total of 79 957 BTC from the exchange, valued at $70 000.

More recently, a similar situation occurred on the Binance exchange, which is popular among traders and widely considered to be one of the most secure platforms. In May 2019, 7000 BTC were withdrawn from the hot wallet of the exchange. Hackers allegedly gained access to several retail accounts and ‘outsmarted’ the Binance hot wallet system to process a transaction of such a large sum.

- The cryptocurrency market is appealing to fraudsters. The cryptocurrency market makes it easy to conceal your name and the sources of your funds. Furthermore, most countries do not define cryptocurrencies in their legislation, which means that it would be incredibly difficult to prove anything in a court of law. This gives fraudsters a lot of space to organize various criminal schemes. For instance, the Russian Central Bank recently announced that in 2019 more online pyramids were centered around cryptocurrency investments than anything else. This was the case with the notorious AirBitClub, which attracted investments from clients to supposedly release their own cryptocurrency, offering the opportunity to make money from the changing price. In practice, participants could only get their money if they managed to sell this internal currency to others. The scheme managed to attract 60 thousand participants, with the total sum of investments exceeding half a billion rubles.

All of these downsides are part of the hidden costs of potentially high returns in the cryptocurrency market. In order to make effective and secure investments into cryptocurrencies, you need to carefully study the market and review all potential projects. For example, you can take a closer look at stable projects – unlike volatile high-risk coins, where prices can rise and fall by thousands of percent in a minute, these projects offer stable prices and are backed by technologies, teams and communities.

Today, Minting Double Pack is one of the most high-quality cryptocurrency investment products in the market. It is based on minting – a unique technology developed by engineers and programmers at PLATINCOIN. Minting enables users to earn an annual return of 30% from their investment in PLC coins. In the long-term, the Minting Double Pack makes it possible to earn over 100% of your initial investments.

Based on the PLATIN version of this product, let’s see how much an investor can make through minting:

- The initial price of the product is €9 951;

- The Minting Unit inside the product allows users to mint 3 013 PLC;

- Power Minter has a Max load (the maximum amount of coins which can be used to gain interest) of 6700. This means that the user’s account will be credited with up to 2 010 PLC each year!

- In 20 years, the number of coins earned through Power Minter will be 20 100 PLC!

- Now let’s take this sum of 20 100 PLC and add 3 013 PLC earned through minting and 6 700 PLC stored in the PLC Farm – this means that there will be 29 813 PLC on your account in 10 years!

- At the current price of €5 this is almost €150 000;

- If the price of PLC reaches €50, which is part of the company strategy, this will transform the investor into a millionaire, earning €1 490 650.

As it turns out, minting offers an annual earning potential of 100% and more. And unlike other instruments, investors can withdraw their funds at any point – PLATINCOIN is listed on several major exchanges such as Bithumb Global and Coinsbit. Most exchanges list PLATINCOIN as a stablecoin with a price of €5. The company plans to grow the community to 5 million people within a few years, which will increase the price to at least €10. In April 2020, we will witness the launch of the Coinsbit Store marketplace, where users will be able to purchase products from major online stores including Amazon, eBay, AliExpress, Alibaba, Taobao and Shopify using PLATINCOIN and other cryptocurrencies. Coin holders will have access to the entire range of products available in these stores – from concert tickets to domestic appliances.

Advantages: high growth potential, technological component, low threshold for entry.

Disadvantages: due to a lack of regulation, the cryptocurrency is vulnerable to manipulations and hacking attacks and remains attractive to fraudsters.

Conclusion

Hopefully, this article has opened your eyes to a lot of new and useful information. Let’s sum up the article in a few short points:

- With each year, bank deposits become less profitable – in some countries, returns on deposits are on par with the level of inflation;

- Stocks and bonds are secure instruments with low returns;

- Returns on leasing apartments are often similar to returns on deposits, meanwhile, this type of investment is significantly more time-consuming;

- Cryptocurrencies are high-return instruments that also involve higher risks than any other investment instrument described in this article. But even in this volatile market, it is possible to find reliable projects that can guarantee stable and predictable future growth.

Image by Willfried Wende from Pixabay