What can Bitcoin’s history tell us about its post-Black Monday potential? Examining patterns for future predictions.

August 5 turned out to be a chaotic day for investors as global financial markets faced sharp declines. Worries over rising interest rates, upcoming elections, inflation, geopolitical tensions, and the looming threat of a recession all came to a head.

Japan’s benchmark index plummeted over 12% in its worst drop since 1987, the Dow Jones fell by more than 1,000 points (a 2.6% drop), and the Nasdaq slid by 3.5%.

Even the tech giants—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—collectively lost a staggering $650 billion in market cap.

The crypto market wasn’t immune to this turmoil either. Bitcoin (BTC) dropped below $50,000, hitting $49,578, a level not seen since February 2024. However, BTC quickly rebounded, reaching $56,000 before stabilizing around $55,000 by August 6.

The overall crypto market also saw a surge in buying, with the market cap increasing nearly 8% in the last 24 hours to reach $1.96 trillion as of August 6.

Let’s explore how Bitcoin has reacted to similar macroeconomic conditions in the past and what experts foresee for its future amid this market turbulence.

Crypto’s resilience in the face of adversity

In March 2020, the world faced a financial storm unlike any seen before. The COVID-19 pandemic sent shockwaves through global markets, leading to massive sell-offs and stark volatility. The crash started in mid-February and worsened through mid-March, with several severe daily drops.

Even though central banks and reserves worldwide cut interest rates and provided support to investors and markets, US stock markets experienced their largest single-day percentage fall since 1987 on March 12. Additionally, on March 16, known as ‘Black Monday II,’ global markets fell again by 12-13%.

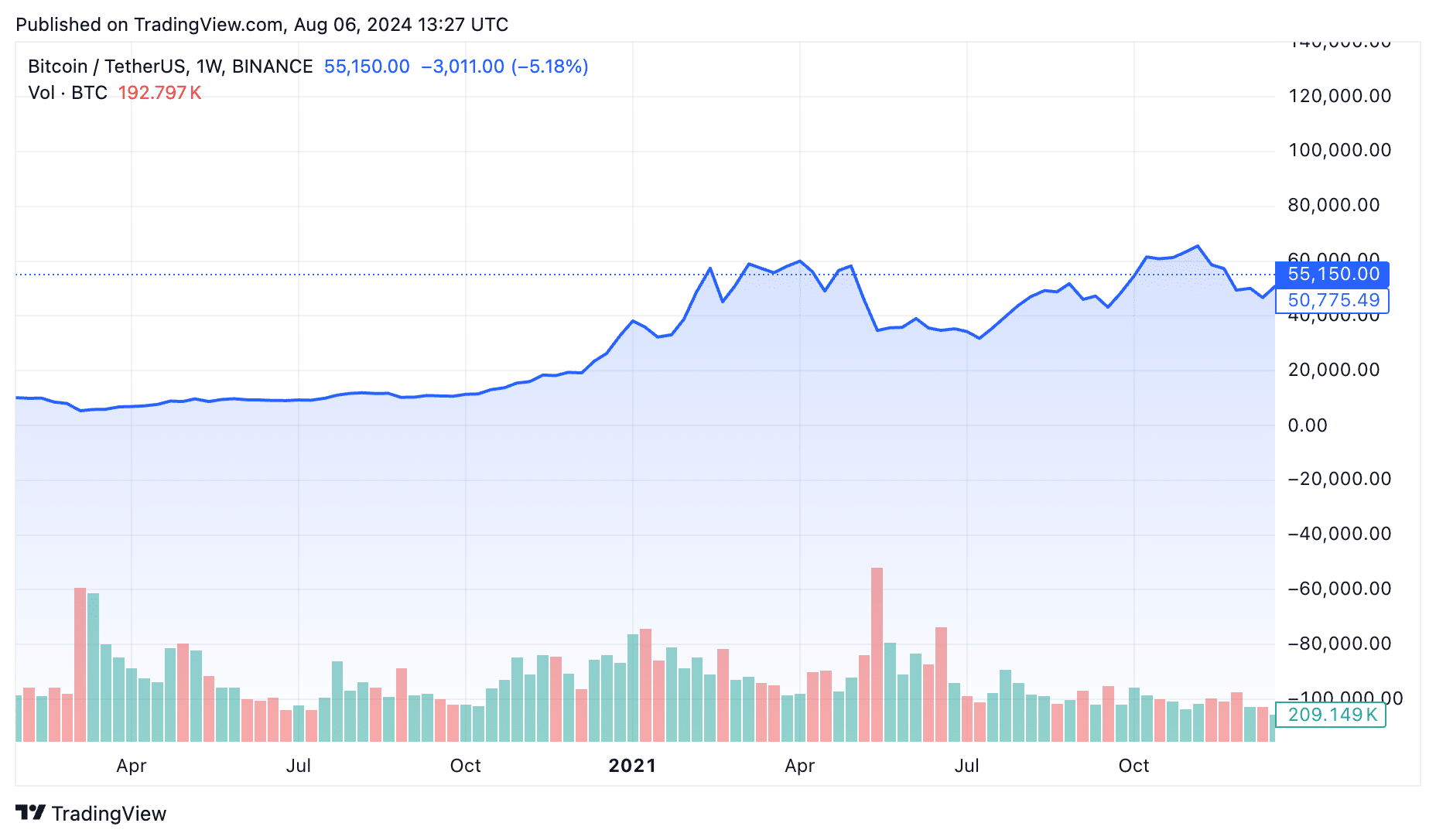

During this period, Bitcoin and the entire crypto market were not immune to the chaos. BTC, which was trading around $10,000 in February 2020, nosedived to $9,000 in early March and further declined to around $5,000 by March 13. The sharp decline mirrored the panic in traditional markets.

However, the recovery story of Bitcoin was remarkable. By June 2020, BTC had regained its $10,000 level and continued to rise, closing the year around $28,000.

The upward trend didn’t stop there. In 2021, amid fluctuations, BTC soared to a new high of $69,000 in November, about 14 times its March 2020 low.

Fast forward to the present, and we see another wave of financial turbulence. After months of worrying about several economic triggers, investors saw their fears come to life as global stock markets plunged.

Yet, if we look at Bitcoin’s historical performance, we can see a pattern of recovery.

During the COVID-19 crisis, many projects continued to develop and launch new features, maintaining interest and investment.

Similarly, the growth of decentralized finance (DeFi) platforms provided new avenues for investment and income generation, contributing to the market’s recovery.

Hence, despite the ongoing challenges, the crypto market’s ability to adapt and recover suggests that it will eventually rise again, continuing its journey of growth and innovation.

What do experts think?

As the dust settles from the latest market crash, experts are weighing in on what might happen next.

Michaël van de Poppe, a popular crypto analyst, believes that although it’s not widely known, quantitative easing (QE) is happening behind the scenes. QE is when central banks buy government securities to pump more money into the economy.

Van de Poppe says about $30 billion will be added each month through Treasury Buyback Operations. More money in the system usually means lower interest rates and more investment in riskier assets like Bitcoin, helping it bounce back from its current state of volatility and uncertainty.

Meanwhile, Raoul Pal, co-founder and CEO of Real Vision, provides another perspective. He attributes the current market volatility to the massive supply changes from past cycles and various entities offloading their holdings. These include the FTX estate, Mt. Gox, Germany, GBTC, and Jump, along with new project unlocks and tokens.

Overall, Pal remains optimistic, suggesting that the market will eventually digest these overhangs, and things will get better once these old issues are sorted out.

Amid this, Vitalik Buterin, the co-founder of Ethereum (ETH), shared positive developments happening in the Ethereum ecosystem.

He believes that the issues with cross-L2 interoperability—essentially, the ability for different layers of the Ethereum network to work together smoothly—are close to being resolved, which could lead to a better user experience across the entire Ethereum network, including Layer 1, rollups, and even sidechains.

Now, here are important things to notice.

First, the subtle implementation of QE could inject much-needed liquidity into the market, potentially spurring investment in cryptocurrencies.

Second, the current volatility driven by the unwinding of past cycle issues might soon stabilize, allowing the market to recover.

Lastly, technical advancements within major crypto networks, like Ethereum, could enhance user experience and drive further adoption.

While the market is experiencing turbulence, there are strong signs of potential recovery and growth. However, nothing in the crypto market is guaranteed, so trade and invest wisely. Always conduct your own research and never invest more than you can afford to lose.