Centralized cryptocurrency exchanges (CEX) operators say they are unfazed by the increasing trading volumes on decentralized exchanges (DEX) because the latter’s liquidity is still too insignificant to cause user mass migration. The majority of CEX operators also insist that it is very unlikely the DEXs’ liquidity would surpass their own liquidity in 2 years’ time.

The comments by operators of CEX platforms come at the time when traded volumes on DEX applications are increasing courtesy of the rapidly growing Defi ecosystem. Underlining this growth is Uniswap’s monthly trade volume which exceeded that of Coinbase in September.

CEXs Rule Liquidity and Fiat Compatibility

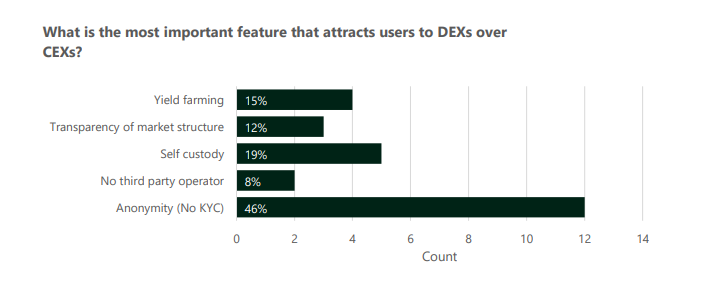

As data from the survey conducted by cryptocompare.com shows, CEX operators are conceding that volumes on DEXs are growing, but they suggest different reasons why this is happening. To begin with, the survey data shows that about 46.2% or 12 out of 26 of the responding operators “believe that the anonymity afforded by DEXs was the primary reason users traded on DEXs.” About 19.2% (5) believe the self-custody feature is the secondary driver of volumes on DEXs.

However, on the flip side, the respondents thought that “liquidity and fiat compatibility were the two main reasons why users preferred CEXs over DEXs.”

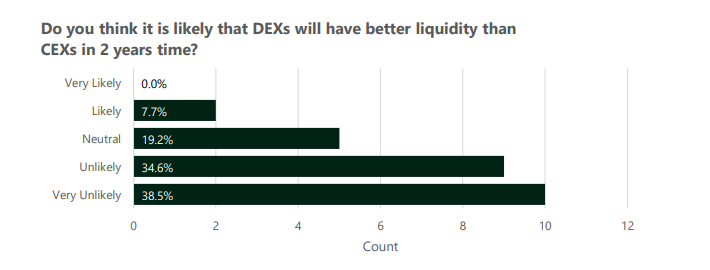

When asked about the possibility of DEXs usurping CEXs in the liquidity stakes, over 70% thought this will not happen anytime soon. The survey says:

Exchange operators felt their deeper liquidity would be an unassailable competitive advantage in the next 2 years. Over 70% of respondents thought it was unlikely or very unlikely DEX liquidity would surpass CEX liquidity in 2 years’ time.

Interestingly, the survey data shows that 40% of the respondents say “they are actively building or may build a DEX in the near future.”

With respect to the issue of user experience (UX), the respondents were less emphatic about the prospects of CEXs on this. According to the findings, just “57% of respondents believe it was unlikely or very unlikely that DEXs will have better UX in 2 years.” Only 11% of respondents thought that DEXs will have better UX than CEXs in 2 years’ time.

Operators Expect Fees to Fall

Meanwhile, the survey notes that as more digital asset exchanges are launched, “questions are being raised around the legitimacy of the volumes garnered by these upstarts.” Some analysts predict that there will be a decline of exchanges either through mergers and acquisitions or competition driving out weaker exchanges.

On this subject, cryptocompare.com shows that opinion is almost evenly divided as 42.3% of respondents expect to see an increase in this number next 2 years while 46.2% are expecting to see the number decline. On the question of fees, “there was more alignment with 65% of exchanges expecting to see trading fees decrease and only 11.5% expecting fees to increase.”

On the question of institutional investors entering the sector in the next two years, there was near unanimity as 92% of exchanges were optimistic that there will be a rise in

institutional investors entering the sector in that period.

What do you think will be the outcome of the rivalry between DEXs and CEXs in a year’s time? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, cryptocompare.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.