- Nikola’s stock has taken a hit from the fraud allegations put out by a short-seller.

- The stock is now trading significantly below the value at which GM was to get a stake in the new energy carmaker.

- Securities regulators and federal authorities are investigating Nikola over claims of misleading investors.

The stake that General Motors received in Nikola under the strategic manufacturing partnership is already in the red.

In the deal with Nikola announced earlier this month, General Motors will receive 47.7 million shares of the new energy carmaker at $41.93 a share. At that price, the shares are worth slightly more than $2 billion.

But Nikola’s stock has fallen sharply since then. It closed Wednesday at $33.28. For GM, that represents paper losses of over $400 million.

Why Nikola Stock Is in Free-Fall

Nikola’s plunging share price follows damaging allegations by short-seller Hindenburg Research, which accused the company of “intricate fraud.”

Citing investigations it had conducted, Hindenburg alleged that Nikola founder and chairman Trevor Milton had deceived his way into creating a $20 billion company.

Most recently, Hindenburg claimed that the new energy carmaker had parlayed an “ocean of lies into a partnership with the largest auto OEM [original equipment manufacturer] in America.” This includes making exaggerated claims about its technology.

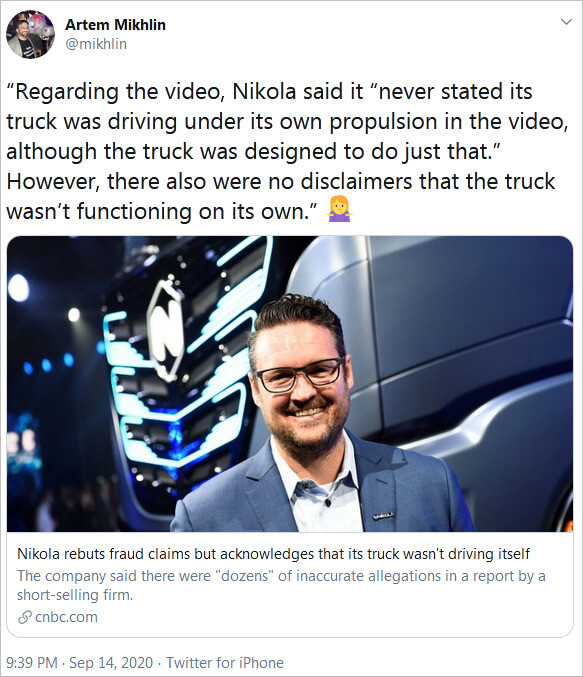

Nikola was, for instance, accused of faking a demonstration of one of its semi-trucks by making it appear like it was self-propelling when it was just rolling downhill unpowered.

The new energy carmaker admitted this, but it said the only problem was failing to say that the semi-truck was not self-propelling.

The evidence which Hindenburg cited includes a video that was released in early 2018. In the description, Nikola states that it is a 1,000 HP, zero-emission Nikola One semi-truck in motion. Watch the video below:

Are Nikola Short-Sellers Getting Their Wish?

Since the allegations about Nikola misleading investors surfaces, federal authorities have become involved. Both the U.S. Department of Justice and the U.S. Securities and Exchange Commission have initiated investigations into Nikola.

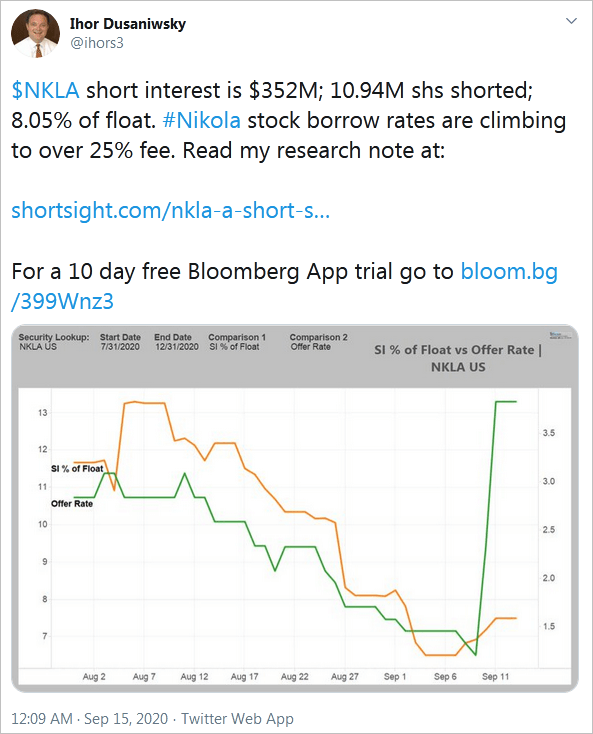

Hindenburg Research has already initiated a short position in the stock.

As of September 15, short interest in Nikola was 8.05% of the share float, even higher than Tesla’s–another favorite of short-sellers.

Did General Motors Make a Mistake?

According to some analysts, the biggest risk GM faces from its Nikola deal is reputational–that is, if the new energy carmaker is charged with criminal fraud following the investigations.

Morningstar’s David Whiston says:

Even though there isn’t much financial risk right now because the deal is initially cashless for GM, it still looks really bad optics-wise should Nikola be charged with criminal fraud or go bankrupt.

Fortunately for GM, there is still time to reconsider and pull out of the deal with Nikola if it is deemed necessary. The strategic manufacturing partnership deal between the two firms doesn’t close until September 30.

GM CEO Mary Barra insists the Detroit auto giant conducted the “appropriate diligence” before entering into a deal with Nikola, though.

Disclaimer: This article reflects the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.