It has been a year since the start of Cboe’s XBT futures contracts and CME Group’s bitcoin derivatives products launched last December. With super bearish prices these past few months, a lot has changed since the cryptocurrency economy touched all-time highs on spot markets. Meanwhile, bitcoin futures contracts have been growing and some skeptics still believe these derivatives products are disruptive toward cryptocurrency spot prices.

Also Read: Law Professor: Confusing Crypto Regulations Will Hamper Innovation

Have Futures Products ‘Tamed’ Bitcoin’s Spot Price?

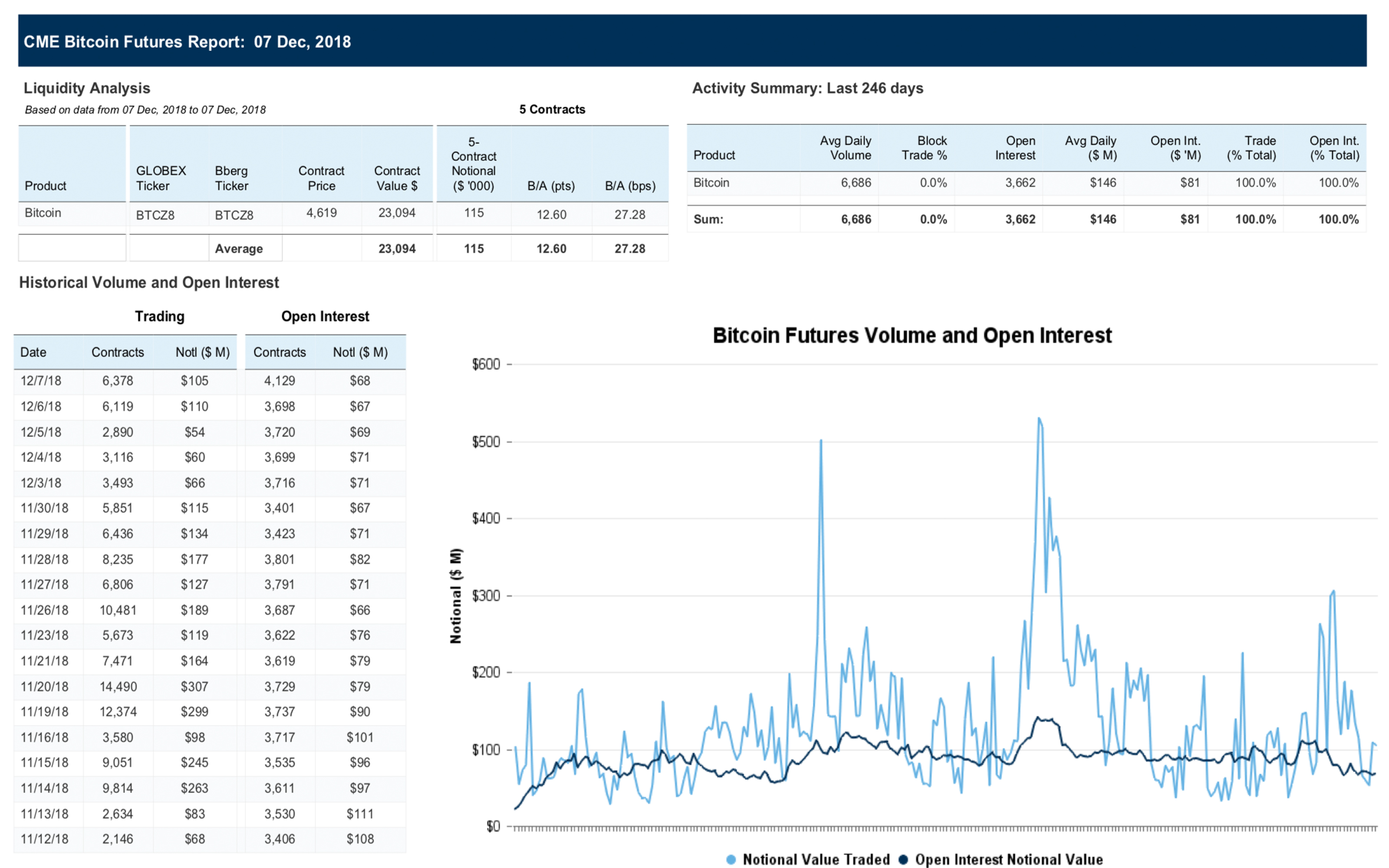

A few weeks before the launch of Cboe and CME Group’s bitcoin-based futures contracts, the price of bitcoin core (BTC) spiked significantly. After Cboe’s launch seven days later, the cryptocurrency touched an all-time high of $19,600 per coin and the value has been depleting ever since. On the opposite side of the spectrum, as the price of BTC went down on many occasions, bitcoin derivatives volumes on both CME and Cboe skyrocketed. A recent CME liquidity report for Dec. 7 shows bitcoin futures volumes rallied in November, just before the price was about to experience some heavy losses. The same can be said for the month of October as CME’s BTC futures contracts saw significant average daily volume (ADV) growth. Cboe’s ADV statistics show the exact same pattern throughout all the false bull traps and subsequent dumps all year long.

Skeptics think and have believed that futures markets have caused the long-term crypto-downturn and think futures actually ‘set the price of BTC.’ Many believe that when precious metals (PM) derivatives products were first introduced they defined and suppressed the price of PMs like gold and silver. Bitcoiners will also remember that CME chairman emeritus Leo Melamed told Reuters last year that futures markets would “tame” BTC.

“We will regulate, make bitcoin not wild, nor wilder. We’ll tame it into a regular type instrument of trade with rules,” said the senior figure at CME Group.

Playing Spot Markets With Leveraged Shorts

The bearish market that followed the launch of bitcoin futures markets has caused people to wonder if derivatives players are manipulating spot prices. Large players like state actors and financial institutions could purchase BTC through the wide range of spot exchanges and follow up with this action by placing leveraged short positions in Cboe and CME contracts.

Just like the Chinese miners who have said they are shorting BTC right now, futures traders who buy from spot exchanges can slowly dump these coins back on the market and they are protected by hedging in futures positions. This same type of manipulation happened years ago with precious metals markets and there’s now an overwhelming amount of paper gold products being swapped compared to physical assets.

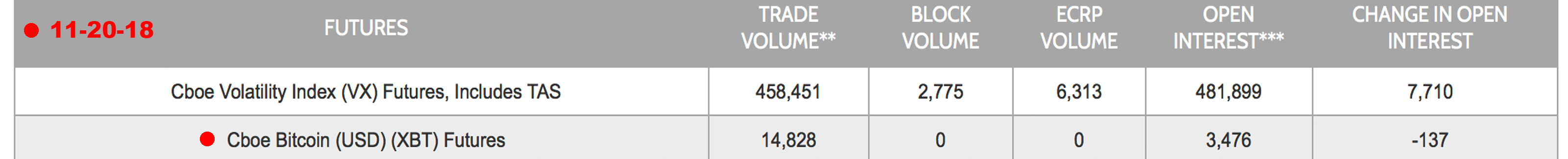

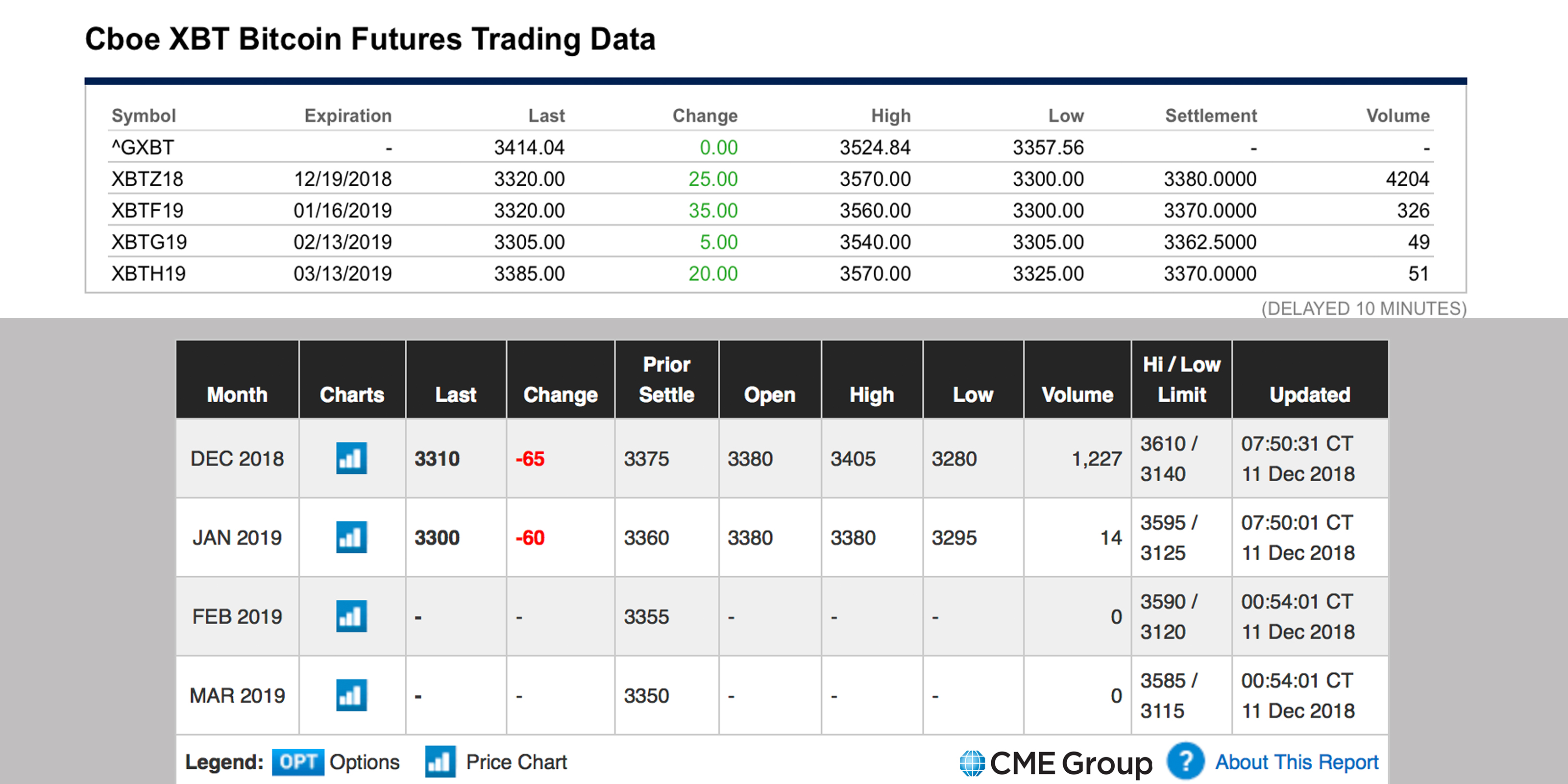

This week, both CME and Cboe markets are processing roughly around 3,500-7,000 ADV contracts and have seen more sizable ADVs on certain days prior to a market shift. For instance, on Nov. 20, CME Group’s bitcoin futures contracts reached a high of 14,490. Coincidentally Cboe’s XBT futures volume that same day matched CME Groups ADV Interestingly enough, the BTC spot price that day dropped from $4,670 per coin to $3,600 over the course of the five days that followed CME Group’s bitcoin derivatives contract spike.

Furthermore, bitcoin futures predictions have changed considerably since December 2017, when people were still betting in the $20,000 to $50,000 range. Instead, contracts today for December, January, and February are between $3,200-3,500, making the Blocktower Capital, and Ari Paul’s BTC wager look passé. In fact, the Ledger X contract that wagered BTC’s price would touch $50K by Dec. 28 was sold for a quick premium that day. Ledger X president Juthica Chou said the options sale made about “25 percent” premium above the spot price at the time.

More Bitcoin Futures Products Coming Soon

It is still too early to tell if bitcoin futures products are affecting spot prices in a negative way but skeptics have claimed markets like these are not beneficial to cryptocurrency since they were announced. In addition to Cboe and CME bitcoin derivatives, other giant financial institutions are joining in on the fun. The vice president of Nasdaq’s media team, Joseph Christinat, told the press that Nasdaq will launch its own bitcoin-based futures in the first half of 2019. Then the Intercontinental Exchange revealed that Bakkt would be launching its derivatives bitcoin products on Dec. 12, but delayed the launch. Now Bakkt is hoping it will start selling products on Jan. 24 and the institution’s contracts will be different than Cboe and CME futures. Bakkt plans to exchange its products in USD but according to reports, each trade “will result in physically delivered bitcoin.”

What do you think about the effect of bitcoin futures markets on cryptocurrency spot prices? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, CME, Cboe, and Trading View.

Need to calculate your bitcoin holdings? Check our tools section.