Bitcoin surged above $103,000, causing a wave of forced exits that resulted in the liquidation of over $900 million in the last 24 hours. This represents a 200% increase in liquidations over the previous day, according to Coinglass data. Bitcoin (BTC) shorts accounted for $321 million in liquidations. At the same time, open interest increased by 5% to $133 billion, indicating that new leveraged bets are entering the market.The average crypto relative strength index has also risen to 70, signaling overbought conditions. The spike in liquidations followed a rapid market…

Tag: 900M

Circle plans to bring $900M money market fund under DABA license

Circle, the creator of stablecoin USDC (USDC), announced on March 13 plans to bring its Hashnote Tokenized Money Market Fund (TMMF) under Bermuda regulatory oversight through the company’s existing Digital Assets Business Act (DABA) license. Hashnote, which Circle acquired in January 2025, is the issuer of USDY, the largest tokenized treasury and money market fund with a total value locked (TVL) of $900 million, according to DefiLlama. The fund’s TVL has fallen from $1.9 billion as of Jan. 7. Hashnote USYC TVL over time. Source: DefiLlama Related: Wall Street is betting…

Mt. Gox makes second $900M+ move in a week as Bitcoin taps $76K

Defunct crypto exchange Mt. Gox moved almost a billion worth of Bitcoin, the second large BTC transfer in a week, as Bitcoin’s price fell to a four-month low on March 11. Of the 11,833 Bitcoin (BTC) moved, 11,501 ($905.1 million) were sent into a new wallet, while the remaining 332 Bitcoin ($26.1 million) were transferred to a warm wallet, according to blockchain analytics firm Lookonchain, citing Arkham Intelligence data. The transfer cost Mt. Gox just $2.13. Transaction details of Mt. Gox’s $931 million transfer. Source: Arkham Intelligence It comes less…

Blockchain Celestia Braces for Price Volatility for TIA Amid $900M Token Unlock

“There could be some pronounced effects,” David Shuttleworth, partner at Anagram, told CoinDesk, noting that the amount of tokens being unlocked is multiple times larger than the average daily trading volume between $50 million and $200 million over the past month. “The broader timing, however, is favorable,” he added, with bitcoin (BTC) trading near all-time highs and other majors including ether (ETH) and solana (SOL) also performing well. Source

GOAT Outpaces PEPE Growing To $900M Market Cap In 2 Weeks – Details

Este artículo también está disponible en español. Goatseus Maximus (GOAT), a new meme coin on the block, has taken the crypto community by storm with its aggressive surge since launching earlier this month. In just two weeks, GOAT skyrocketed from virtually zero to over $900 million in market capitalization, drawing comparisons with last year’s memecoin sensation, PEPE. This rapid ascent has captivated both analysts and investors, who are beginning to see GOAT as a potential contender for memecoin dominance in the current market cycle. Related Reading Much like PEPE’s explosive…

Bitcoin Falls Below $64K Following $900M of ETF Outflows

Bitcoin fell to its lowest in over a month during the European morning, slumping to $63,500. This is the first time BTC has dropped below $64,000 since mid-May. At the time of writing, the bitcoin price is around $63,900, a fall of 3.5% in the last 24 hours. The CoinDesk 20 Index (CD20), a measurement of the broader digital asset market, has dropped just under 2.3%, while ETH is down 2.25% at $3,500 and SOL has fallen almost 3.8% to $132.24. Original

Bitcoin ETFs Post $900M in Net Outflows This Week

Such outflow activity is the worst since late April, which saw $1.2 billion in total net outflows in trading sessions from April 24 to May 2. Inflows since picked up and saw the products add more than $4 billion in the next 19 days of trading – before the ongoing outflow deluge started on June 10. Original

ZKsync Airdrop of ‘ZK’ Token Puts Initial Market Cap Near $900M

The ZK token opened at $0.31 and is down about 21% since then, trading at $0.24 at the time of writing, according to CoinGecko. The market capitalization stands at about $908 million, based on the circulating supply, with about 3.7 billion tokens eligible to be distributed. On a fully diluted basis, the market cap would be $5.1 billion. Source

Bitcoin drops to $65k, crypto market nears to $900m in liquidations

Bitcoin has decreased by nearly 5%, reaching $65,000 for the first time in a week, as the overall crypto market capitalization dropped 7%. Ethereum’s price has also experienced liquidation, as the largest altcoin dropped 8.5% in 24 hours. According to Coinglass, more than 277,000 traders liquidated assets worth $877.79 million in 24 hours. The BTC decline is likely being driven by a pre-halving pullback and miner capitulation. There is a familiar anticipation that the halving will lead to a larger bull cycle for Bitcoin. A pullback generally occurs when traders start taking…

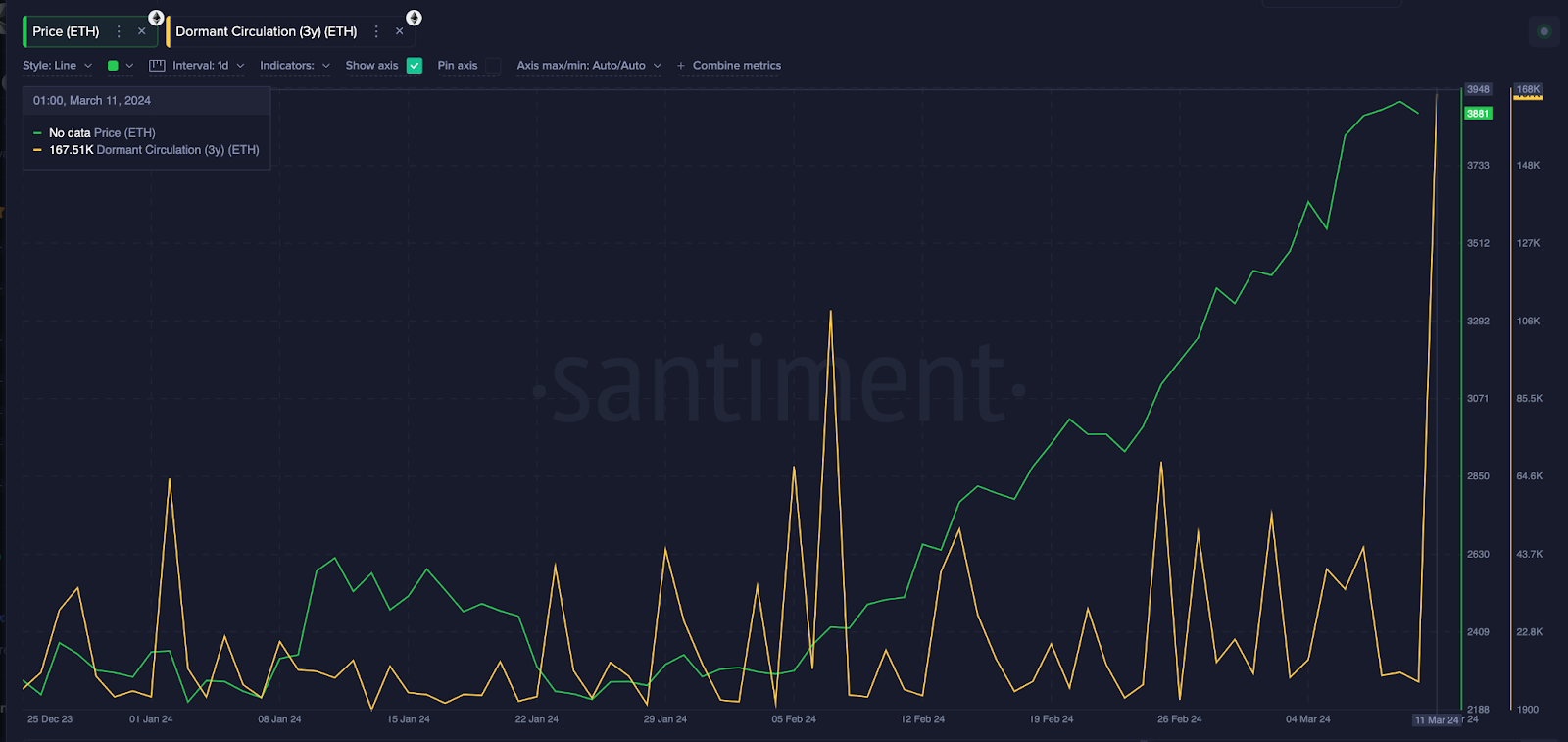

Ethereum price rally at risk amid $900M Profit-taking spree

Ethereum price grazed $4,100 territory in the early hours of March 12, but a profit-taking wave observed among long-term holders threatens to scuttle the rally. After a blistering 73% rally over the last 30-days, Ethereum price rally has hit a brick wall at $4,100 mark. Can the bulls regroup for another brazen attempt at the $4,500 milestone or will ETH price surrender the $4,000 support. Long-term investors traded 167,500 ETH within the last 24 hours Unlike Bitcoin (BTC), which has entered the price discovery phase, Ethereum is still about 22%…