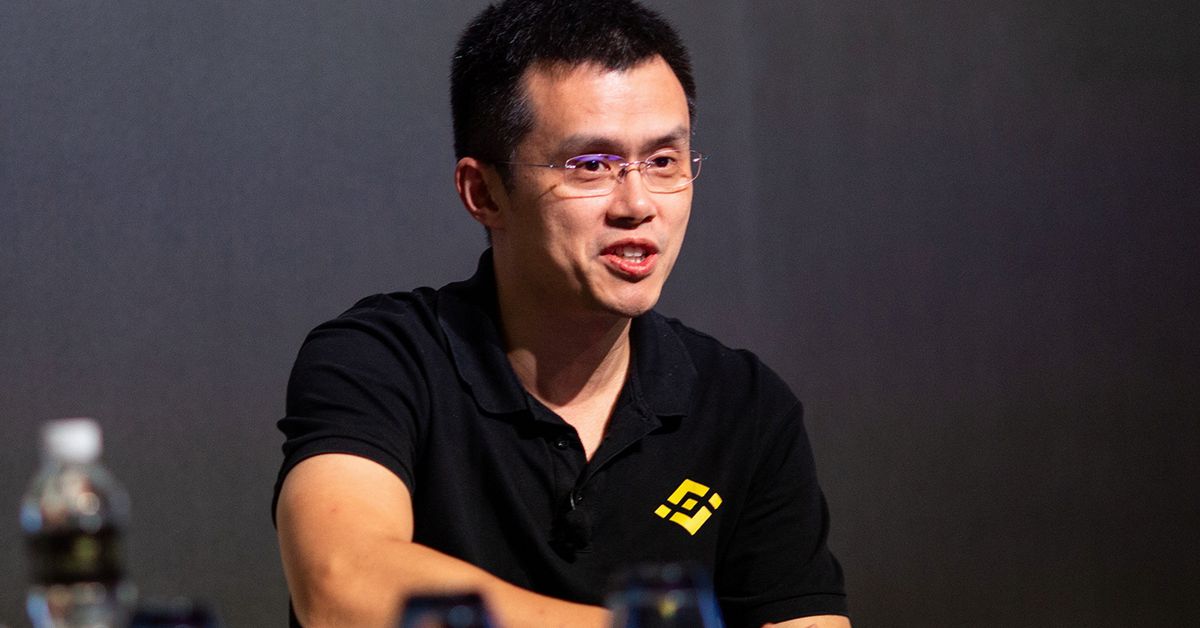

Binance started to promote TUSD on its platform after New York state regulator’s forced issuer Paxos to mint Binance-branded stablecoin BUSD in February. Now, the exchange’s crypto wallets hold at least 90% of the stablecoin’s $3.1 billion total market capitalization, according to Arkham data. Source

Tag: Exchange

ADA Token Options Roll Out on Crypto Derivatives Exchange BIT

The offering, launched in collaboration with strategic partner Darley Technologies and market maker DWF Labs, expands BIT’s existing suite of options, which include those tied to the decentralized layer 1 blockchain, The Open Network’s TON coin and bitcoin and ether futures and options. Source

Robinhood’s crypto trading volume falls in May, this hybrid exchange can take over

Robinhood, a popular trading platform, has announced that its crypto trading volumes plunged in May amidst a regulatory crackdown on centralized entities. Cryptocurrency traders are migrating from centralized exchanges (CEXs) to hybrid exchanges as they offer less restriction. Amidst the exodus of traders, Tradecurve has stood out, but can it take over from centralized trading platforms? >>Buy TCRV tokens now<< Robinhood trading volumes plunge 68% Robinhood, a trading platform, has reported a decrease in cryptocurrency trading volume in its May report. The report shows a 43% drop in crypto trading…

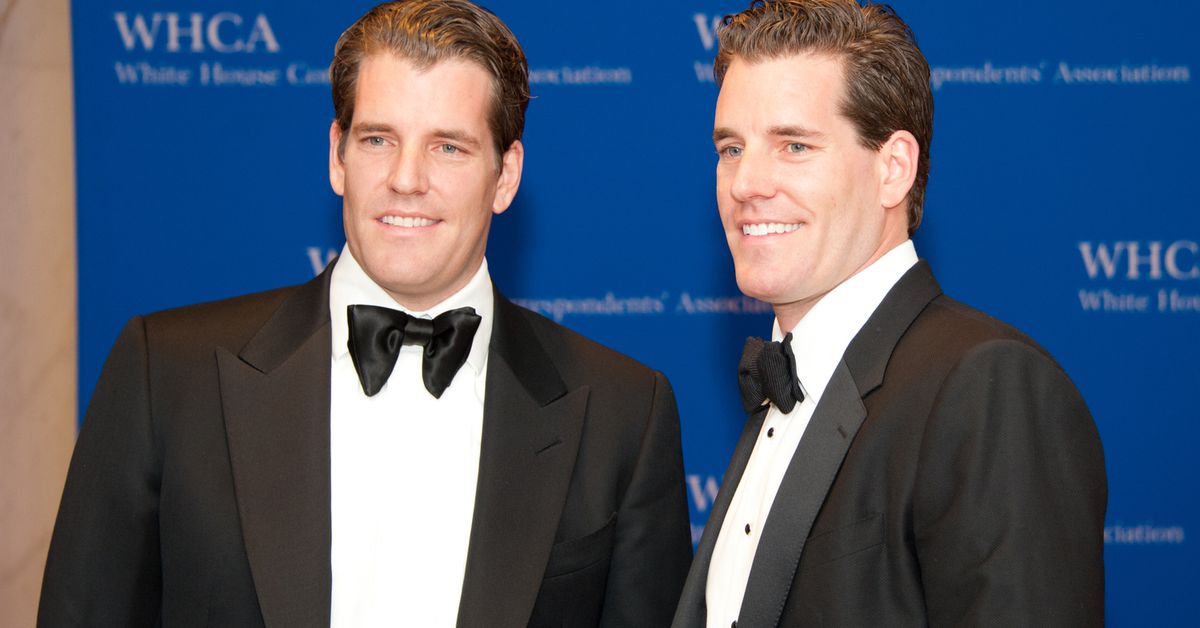

Crypto Exchange Gemini Announces New Expansion Into Asian Region To Capture ‘Next Wave of Growth’

A major American crypto exchange is announcing a new expansion into one of the world’s biggest market regions. In an announcement, crypto exchange Gemini says it is expanding into the Asia Pacific (APAC) region in addition to growing their engineering base in India. “We’re expanding in the Asia Pacific region! Our Singapore office will serve as a hub for our larger APAC operations and we plan to increase our headcount to 100+ in Singapore. In addition to our expansion plans in APAC, we are rapidly growing our engineering base in…

New Crypto Exchange Backed by Fidelity, Schwab and Citadel Launches With Additional Investors

One thing that separates EDX Markets from other crypto exchanges is that it doesn’t custody customers’ digital assets. Instead, users will have to go through financial intermediaries to buy and sell crypto assets, similar to how trades are executed on the New York Stock Exchange (NYSE) or the Nasdaq (NASDAQ). Regulators like the different approach, Nazarali said, because they think it’s important that there’s separation between the exchange function and the broker dealer function. Source

Fidelity, Charles Schwab, Citadel and More Back Newly Launched Crypto Exchange

A group of the biggest financial institutions in the world are backing the newly launched digital asset marketplace EDX Markets (EDX). According to a new press release, the company received a round of funding from financial heavyweights including Charles Schwab, Citadel Securities, Fidelity Digital Assets, Paradigm, Sequoia Capital, and Virtu Financial. The funding will “support EDX as it continues to develop its trading platform and solidifies its market leadership position.” EDX currently only offers trading for four crypto assets: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH) –…

Wall Street Giants Bet on EDX Markets Crypto Exchange

EDX Markets, a new digital asset marketplace, has announced the successful initiation of its trading operations, backed by a consortium of major financial institutions. Among the mentioned companies are several Wall Street giants, including Charles Schwab, Fidelity Investments, and Citadel Securities. Explore limitless, instant crypto swaps. Choose from 1000+ coins and tokens and exchange with no registration or sign-up. Experience a platform that prioritizes your data privacy and fund security. The company has also completed a new funding round Funding Round Startups look to raise capital can participate in a…

Exegy’s Metro Adds Deribit Crypto Options Exchange

Exegy, Inc., a trading solutions provider for the capital markets, has broadened its crypto derivatives coverage for the Metro professional trading platform by integrating with Deribit. Adding Deribit, known as the world’s largest crypto options exchange Exchange An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading…

Wall Street giants back EDX Markets, a new cryptocurrency exchange

EDX Markets, a newcomer to the cryptocurrency exchange landscape, has made a notable entry with backing from prominent financial institutions such as Citadel Securities, Fidelity Investments, and Charles Schwab. The company recently unveiled the launch of its digital asset market on June 20, marking its official entry into the industry. According to the announcement, the exchange hopes to attract “industry leaders” by incorporating best practices from traditional finance and offering unique advantages, including liquidity, competitive quotes, and a non-custodial model designed to minimize conflicts of interest. Currently, EDX supports the…

Crypto Exchange Gemini to Expand Asia-Pacific Operations to Capture 'Next Wave' of Growth

The company plans to expand in Asia-Pacific (APAC), a region it sees as driving the “next wave of growth for crypto.” Source