Bitcoin has undergone a 25% rally over the past two weeks as buying pressure in the digital asset market has heated up. The leading cryptocurrency currently trades for $13,800, far above the $9,800 lows seen in September. Analysts think that Bitcoin has room to extend to the upside in the months ahead. One crypto-asset chartist shared a chart on November 1st indicating that a pivotal macro technical indicator shows Bitcoin may soon go parabolic. Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom Bitcoin Could Soon Go…

Tag: Parabolic

Chainlink’s Parabolic Trendline is Intact, But Analysts Fear a Breakdown

Chainlink has been struggling to gain momentum over the past couple of days, with the ongoing bout of capitulation within the altcoin market, creating far-reaching shockwaves that have impacted LINK. The crypto is now struggling to hold above its $11.00 support level, and some analysts believe that it could be at risk of seeing further losses if this level is broken. That said, while looking towards LINK’s BTC trading pair, the cryptocurrency’s parabolic trendline formed throughout the past few years remains fully intact. A break below this, however, could mark…

Analyst Who Called Ethereum’s Parabolic Breakout Says XRP is Next

XRP’s price action has been rather lackluster as of late, with buyers and sellers remaining deadlocked as they struggle to gain control of the cryptocurrency’s near-term trend. This lack of momentum isn’t new for XRP, as the token has been stuck within a macro consolidation phase throughout the past few years against both its USD and BTC trading pairs. This has caused its community to dry up, with the so-called “XRP Army” largely evaporating as they move on to other projects. It is important to note that XRP still has…

Chainlink Could Follow Bitcoin and Go Parabolic if It Breaks One Key Level

Chainlink and other altcoins have been severely underperforming Bitcoin throughout the past few days, as BTC has pushed to fresh yearly highs while most altcoins remain down 50% or more from their highs that were set just a few days ago. The immense selling pressure that has been placed on altcoins as a result of Bitcoin’s upswing is starting to subside, as bulls are beginning to propel some altcoins like Chainlink off of their recent lows. LINK is in the process of erasing all of the losses that came about…

Market Wrap: Bitcoin Rebounds to $10.5K; Stablecoin Market Cap ‘Goes Parabolic’

Bitcoin has performed well in the face of a bleak news cycle while stablecoin assets in the crypto ecosystem continue to grow. Bitcoin (BTC) trading around $10,515 as of 20:00 UTC (4 p.m. ET). Slipping 0.44% over the previous 24 hours. Bitcoin’s 24-hour range: $10,362-$10,667 BTC above its 10-day moving average but below the 50-day, a sideways signal for market technicians. Bitcoin trading on Coinbase since September 30.Source: TradingView Bitcoin’s price stumbled in the early hours of Friday, falling to as low as $10,362 on spot exchanges such as Coinbase…

This Chart Suggests Chainlink’s Parabolic Rise Isn’t Finished

Chainlink volatility is increasing after the asset fell from its all-time high of $20. A 60% collapse sent the cryptocurrency plummeting, only to see a record-breaking bounce that beat any intraday throughout the rest of the altcoin’s amazing 2020 so far. And although there was a 60% crash, LINKBTC weekly price charts suggest that the asset’s parabolic advance is still intact, potentially pointing to more new 2020 highs ahead. But if the cryptocurrency can’t maintain its upside momentum, the fall down could be substantial. Chainlink’s Parabola Hasn’t Broken On Bitcoin…

Bitcoin Reclaims Crucial Technical Level; Is a Parabolic Move Imminent?

Bitcoin has seen a strong move higher throughout the past 12 hours, which has come about as a direct result of the cryptocurrency’s strong weekly candle close. Analysts are now noting that it may be positioned to see further near-term upside, as this latest bout of heightened buying activity led it above a crucial technical level that was previously lost as a result of the recent downtrend. One trader, however, is noting that it may see a short-term throwback that leads it into its key near-term support level. He contends…

Yearn.finance (YFI) Posts Bullish 3-Day Close as Analysts Eye Parabolic Upside

Yearn.finance’s price has seen some turbulence in the weeks following its intense rally to all-time highs of over $40,000. The governance token for the Yearn ecosystem – YFI – has been largely consolidating in the time since, with both buyers and sellers being unable to spark any sustained trend. This may be due to YFI being viewed – and traded – as an index bet for the entire DeFi sector, which has seen stagnating growth in recent weeks. As such, the token’s bout of sideways trading may persist until the…

Chainlink Weekly MACD Bearish For First Time Since Parabolic Rally Began

Chainlink may have rebounded with a record-breaking single-day rally, it did so after a 60% fall from its all-time high set just over a month ago. A key indicator measuring momentum has flipped bearish on weekly timeframes for the first time since the parabola began. Is this a sign that momentum is about to slide further to the downside? Chainlink Flips Bearish For First Time Since Parabolic Rally Started Chainlink cryptocurrency tops the list of the industry’s best-performing tokens in 2020 and the years before it. Chainlink was launched during…

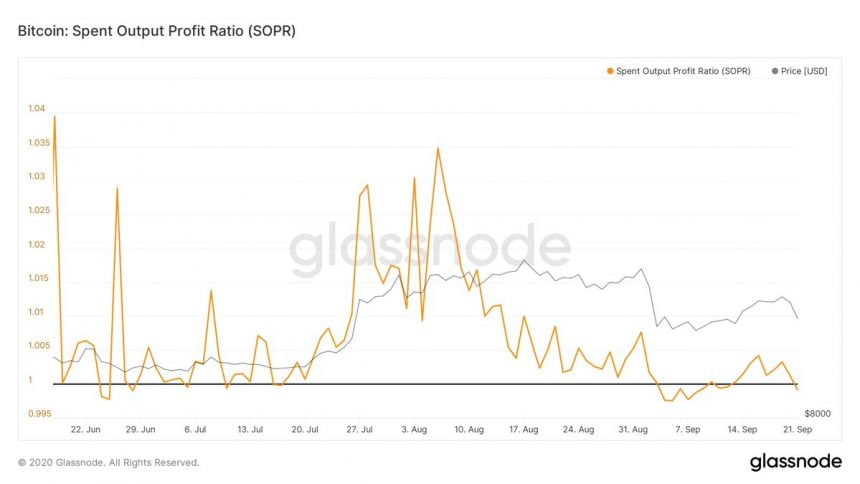

This On-Chain Indicator Signals Bitcoin May Soon Go Parabolic

Bitcoin’s price action has been largely favoring sellers throughout the past several days and weeks, with bulls unable to catalyze any strong momentum while the cryptocurrency continues facing intense selling pressure each time it attempts to push higher. The lack of sustainable momentum seen throughout the past few days and weeks has struck a serious blow to the benchmark digital asset’s technical outlook. Part of this weakness has come about due to the turbulence seen within the stock market, coupled with mounting strength seen by the US Dollar. Despite not…