Most major cryptocurrencies are facing selling at higher levels. Is the current dip a buying opportunity or will the price break below recent lows? Let’s analyze the charts. Asset managers VanEck and SolidX plan to offer a limited version of their Bitcoin (BTC) exchange-traded funds (ETFs) to qualified institutional buyers. While the wait for retail investors continues, institutional players might get an opportunity to buy the shares starting on Sept. 5. This is a positive development because a strong demand from institutional players might help in expediting approval for a…

Day: September 4, 2019

Crypto Banking Regulation Around the World, First Signs of Growth

Banking is often seen as the antithesis of Bitcoin (BTC), the very industry the nascent protocol looks to defuse and disrupt. Ironically, many banks are desperately in need of the attributes and facilities afforded by cryptocurrencies — specifically blockchain, their underlying technology. Perhaps then, it’s not too surprising that more and more cryptocurrency banks are springing up, offering an alternative to tired legacy systems and allowing room for an emerging asset class. However, some significant hurdles remain for these emerging institutions. Regulatory uncertainties are rife within the world of cryptocurrency…

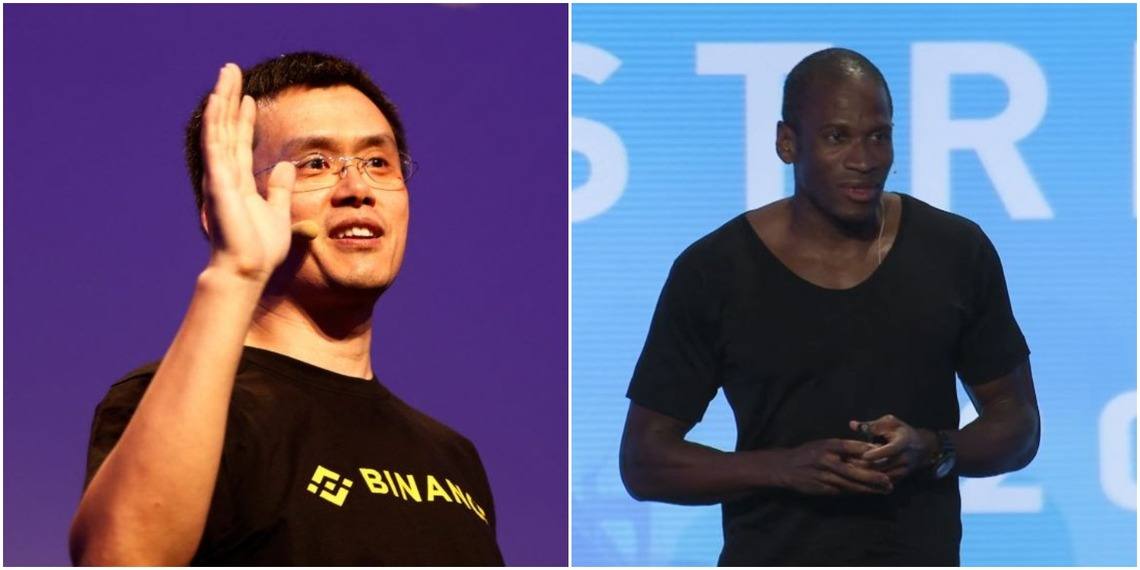

Binance & BitMEX Kiss and Make Up After Plagiarism Accusation – CCN Markets

BitMEX accuses Binance of plagiarism, but it’s not long before the two bitcoin exchange giants kiss and make up on Crypto Twitter. | Source: Reuters (i), Distributed/YouTube (ii). Image Edited by CCN. Binance and BitMEX shared a social media bro hug after the latter publicly accused its fellow cryptocurrency exchange of plagiarizing documentation featured in its recently-launched crypto derivatives testnet. On Wednesday, the BitMEX Twitter account ribbed Binance over its testnet launch, highlighting apparent plagiarism in the two platforms’ documentation. Congrats on the Testnet Futures launches @binance. Glad to see…

Burundi Bans Cryptocurrency Trading Due to Lack of User Protection

The Republic of Burundi in central Africa has banned the trading digital currencies in the country due to associated risks. As Bloomberg reported on Sept. 4, some Burundian citizens urged the government to take action regarding cryptocurrency trading after they lost money while dealing with virtual currencies. The government subsequently banned crypto trading explaining that it cannot provide appropriate user protection. Commenting on the issue, Alfred Nyobewumusi, a director at the central bank’s micro-finance department, said, “Strong measures could be taken against all those who will not respect this decision.”…

Gemini Hires Former Morgan Stanley Exec as New Chief Compliance Officer

The Winklevoss brothers’ cryptocurrency exchange Gemini has hired Noah Perlman, a former executive at financial services giant Morgan Stanley, as its new chief compliance officer. Per an official announcement published by Tyler Winklevoss on Sept. 4, Perlman joined Gemini after 13 years at Morgan Stanley, where he worked as global head of financial crimes and global head of special investigations. Legal and compliance background The announcement said Perlman had “firm-wide, legal and compliance responsibility for the governance, oversight, and execution of the firm’s anti-money laundering, sanctions, anti-boycott, anti-corruption, and government…

TruTrace Partners With Deloitte to Track Cannabis Using Blockchain

Blockchain tracking startup TruTrace Technologies Inc. partnered with Big Four auditing firm Deloitte to track cannabis using blockchain technology. Investing news outlet ProactiveInvestors reported on Sept. 4 that TruTrace is launching its StrainSecure product in partnership with Deloitte. The system in question reportedly employs blockchain technology to track cannabis from seed to sale, in order to guarantee that customers and retailers know the history of the product. TruTrace CEO Robert Galarza said that the new system will bring more transparency to the cannabis industry. The partnership with Deloitte will purportedly…

Fantasy Sports Giant Fanduel Now Accepts Bitcoin Cash

The second-largest fantasy sports provider Fanduel has revealed customers can make deposits on the platform using cryptocurrency. Fanduel members can now top up their accounts with BCH or BTC via the digital currency payment provider Bitpay. Also Read: More Than 70 Projects and Applications Built Around Bitcoin Cash Fanduel Adds Bitcoin Payments via Bitpay Fantasy sports is a hugely popular phenomenon worldwide that experiences more than 10% annual growth and is currently an $8 billion dollar industry. The Fantasy Sports Trade Association (FSTA) has recorded more than 59 million fantasy…

Luxembourg Branch of Accounting Giant PwC to Accept Bitcoin Payments

One of many “Large 4” accounting corporations PwC, the Luxembourg department, will settle for Bitcoin(BTC)trade funds from shoppers starting October 1st. PwC Luxemburg, a subsidiary of the world’s second-largest skilled companies agency, has announced on September 2nd that the agency will begin accepting Bitcoin as a way of cost from its shoppers as from October 1st, 2019. Luxembourg is likely one of the first nations which has adopted and embraced cryptocurrencies and blockchain expertise for the sake of improvement and help of the rising nationwide crypto ecosystem. The announcement reveals…

Bitcoin Futures Continues Making Bitcoin Price Ridiculously Predictable – CCN Markets

The correlation with bitcoin price is becoming obvious. | Source: Shuttertock Bitcoin (BTC) started this week off in good spirits, citing an impressive rise of around 8%. Interestingly, analysts are attributing some of this action to the close of the Chicago Mercantile Exchange (CME). Bitcoin’s 8% rise this week which left a gap in the CME futures chart | Source: TradingView On Labor Day, September 2, the CME closed up shop. Far from the typical bloody Monday the cryptocurrency markets typically exhibit, many crypto assets shot up seemingly following BTC’s…

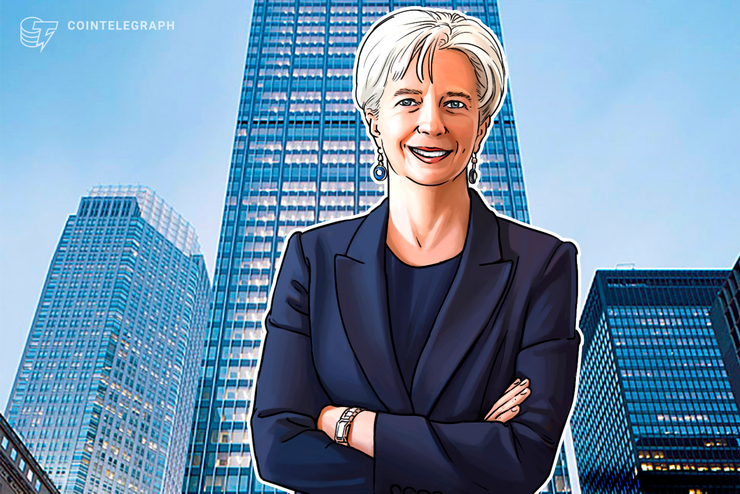

IMF Chief Christine Lagarde Encourages Open Cryptocurrency Regulation

European Central Bank (ECB) president candidate and International Monetary Fund (IMF) chief Christine Lagarde stated on Sept. 4 that central banks and financial supervisors should protect consumers but also be open to innovation such as cryptocurrencies. Changes are opportunities During her opening statement, shared with Cointelegraph in an IMF press release, Lagarde told the Economic and Monetary Affairs Committee of the European Parliament that central banks and financial regulators should be open to the opportunities offered by change. She noted: ”In the case of new technologies – including digital currencies…