Japan’s SBI Holdings plans to create a new investment management company in collaboration with major U.S. asset manager Franklin Templeton by the end of the year. This joint venture will focus on managing digital assets. The new entity will be 51% owned by SBI Holdings and 49% by Franklin Templeton. This move aligns with the […] Source CryptoX Portal

Tag: Firm

Solana Sees Arrival of Nomura, Brevan Howard-Affiliated Tokenization Firm Libre

“Solana’s importance to financial services is quite significant around secondary trading,” Sehra said in an interview. “They have developed the chain for capabilities of increasing throughput, so the number of transactions per second, and also the reduction of the latency between transactions. Since we’re planning to launch secondary trading services later this year, we decided to provide access to all of our funds on Solana now.” Source

Bitcoin firm Swan pauses IPO plans, suspends mining arm

Bitcoin-focused firm Swan is suspending its crypto mining business, pulling plans to IPO “in the near future.” Californian Bitcoin-focused investment firm Swan is halting its plans to go public in the near future and has decided to suspend its mining branch just five months after its launch. In an announcement on X, Swan chief executive Cory Klippsten said the firm is also pulling back from its “accelerated spending plan,” including staff cuts “across many functions.” The Swan CEO explained that the decision was made because the firm doesn’t anticipate “significant…

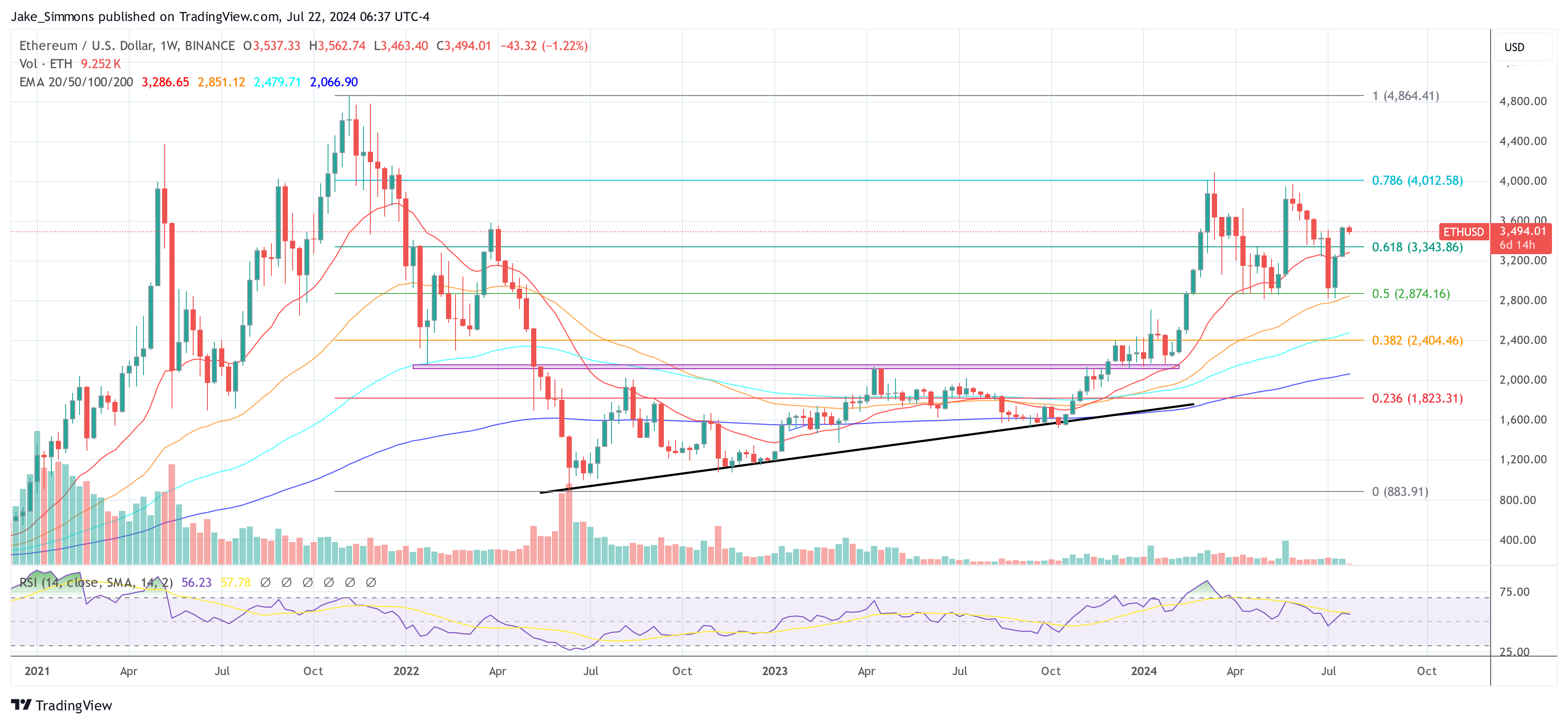

Spot Ethereum ETFs Will Draw $1.2 Billion Monthly: Research Firm

The US spot Ethereum ETFs are set to launch on Tuesday, July 23rd, with projections indicating potential monthly inflows of $1.2 billion. This forecast comes from ASXN, a research firm specializing in crypto finance analytics. US Spot Ethereum ETFs Could Surprise To The Upside At the core of ASXN’s analysis is the comparison between the newly introduced Ethereum ETFs and the previously launched Bitcoin ETFs. One of the critical differentiators highlighted in the report is the fee structure. The Ethereum ETFs, while mirroring the fee approach of Bitcoin ETFs, introduce…

Former Finance VP Pleads Guilty to Embezzling $4 Million From Crypto Firm

Dylan Meissner, 31, of Westport, has pleaded guilty to fraud in Hartford federal court, the U.S. Department of Justice (DOJ) announced. Meissner, a former Vice President of Finance at a cryptocurrency research firm, admitted to stealing over $4 million from his employer. Starting in January 2022, Meissner secured a $170,000 loan in ethereum from his […] Source CryptoX Portal

Solana Price To $200? This Blockchain Firm Thinks So

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies. Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking”…

XRP Price Faces a Dip, Yet Uptrend Support Holds Firm

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis. From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked…

Crypto Custody Firm Copper Receives Key License in Hong Kong as it Expands in Asia Pacific

The license permits the holder to provide trust and corporate services in the region. Source

Crypto Trading Firm XBTO Establishes Tokenization Team to Focus on Real World Assets

Arguably closer to real world scenarios, the Bermuda-based XBTO has been working on mid-tier corporate debt issuances, including two instances of tokenized debt, or “senior e-notes,” by boutique airline BermudAir. In the coming weeks, hemp and CBD producer AgroRef is also launching an e-note on XBTO. Source

Standard Chartered-Backed Blockchain Firm Partior Closes $60 Million Series B Round

Blockchain firm Partior announced on July 12 that it had closed a $60 million Series B funding round led by Peak XV Partners. The investment will be used to enhance Partior’s capabilities, including intraday foreign exchange swaps, cross-currency repos, and just-in-time multi-bank payments. Partior Aims to Integrate Ten More Currencies JPMorgan and Standard Chartered-backed blockchain […] Source BitcoincryptoexchangeExchanges CryptoX Portal