Trustless insurance has arrived on decentralized finance (DeFi). At least on the Compound protocol, the collateralized lending platform that runs on ethereum. The new product, from a company called Opyn, allows people to take out options on stablecoin deposits, allowing users to hedge against the risk of a catastrophic event wiping out Compound’s books. “You can make a claim at any time. You don’t have to prove anything to anyone,” Zubin Koticha, one of the three co-founders behind the new product, told CoinDesk. The decentralized web may have reduced the…

Day: February 12, 2020

Options Protocol Brings ‘Insurance’ to DeFi Deposits on Compound

Trustless insurance has arrived on decentralized finance (DeFi). At least on the Compound protocol, the collateralized lending platform that runs on ethereum. The new product, from a company called Opyn, allows people to take out options on stablecoin deposits, allowing users to hedge against the risk of a catastrophic event wiping out Compound’s books. “You can make a claim at any time. You don’t have to prove anything to anyone,” Zubin Koticha, one of the three co-founders behind the new product, told CoinDesk. The decentralized web may have reduced the…

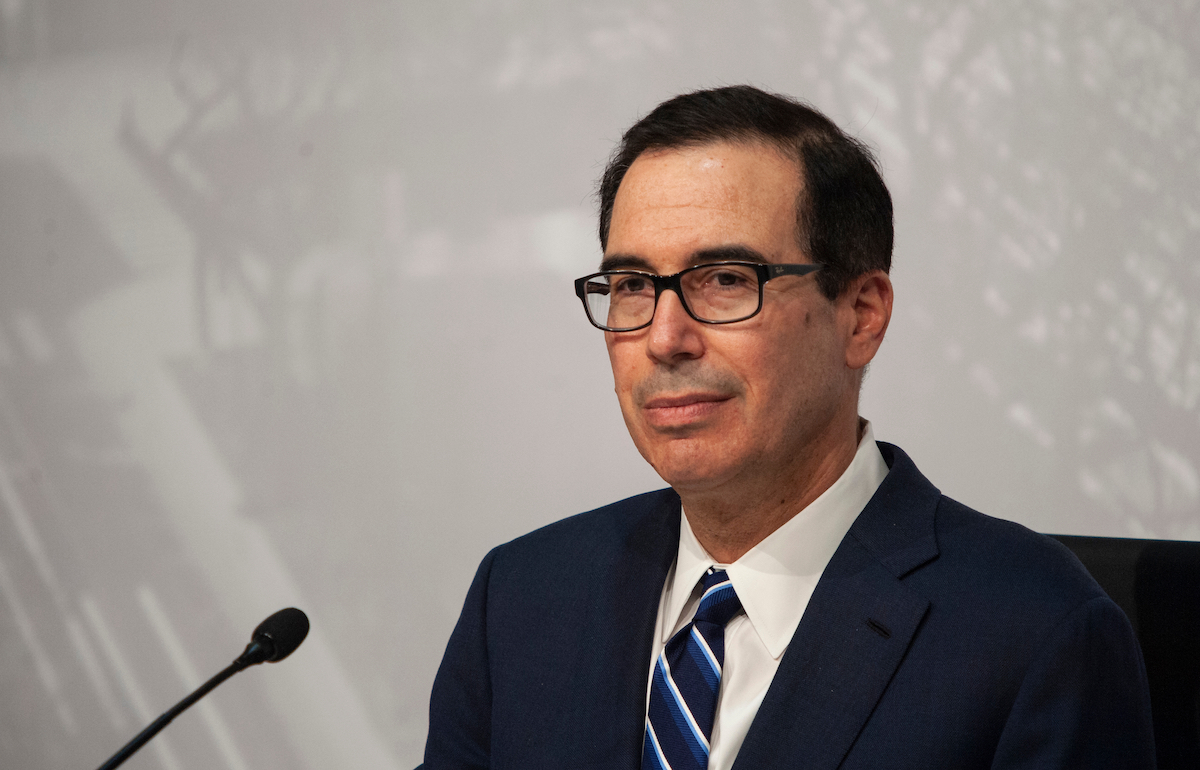

US Financial Crimes Watchdog Preparing ‘Significant’ Crypto Rules, Warns Treasury Secretary Mnuchin

The U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) is preparing to unveil new regulations around cryptocurrencies, Treasury Secretary Steven Mnuchin said Wednesday. Speaking during a hearing before the Senate Finance Committee, Mnuchin said FinCEN, the nation’s financial crimes watchdog, is preparing to roll out some “significant new requirements” around cryptocurrencies, though he did not provide any further detail. Mnuchin’s explanation came in response to Senator Maggie Hassan (D-N.H.), who asked, “How will the Treasury’s proposed budget increase in monitoring suspicious cryptocurrency transactions and prosecuting terrorists and other criminal organizations…

US Financial Crimes Watchdog Preparing ‘Significant’ Crypto Rules, Warns Treasury Secretary Mnuchin

The U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) is preparing to unveil new regulations around cryptocurrencies, Treasury Secretary Steven Mnuchin said Wednesday. Speaking during a hearing before the Senate Finance Committee, Mnuchin said FinCEN, the nation’s financial crimes watchdog, is preparing to roll out some “significant new requirements” around cryptocurrencies, though he did not provide any further detail. Mnuchin’s explanation came in response to Senator Maggie Hassan (D-N.H.), who asked, “How will the Treasury’s proposed budget increase in monitoring suspicious cryptocurrency transactions and prosecuting terrorists and other criminal organizations…

Coinbase Pro Re-Releases 3x Leverage

Coinbase Pro, the cryptocurrency trading platform arm of U.S.-based exchange Coinbase, has unveiled margin trading for select customers. Active Coinbase Pro users in 23 states can now trade with leverage on Coinbase Pro, according to the company’s blog announcement on Feb. 12. Coinbase Pro hosts a modest 3x leverage limit, whereas exchanges such as BitMEX and Binance offer 100x leverage and up. What is margin trading? A product typically seen in professional asset trading circles, margin trading essentially involves borrowing funds with which to trade on a per-trade basis. Coinbase…

Six Out of Forbes Top 50 Fintech Companies for 2020 Are in Blockchain

Forbes released its Fintech 50 list this week, which included six blockchain companies among the media outlet’s compilation of top financial technology companies. Carrying a “Blockchain and Bitcoin” category tag, Forbes listed Axoni, Chainalysis, Coinbase, Everledger, MakerDao and Ripple amongst its top 50 fintech list for 2020, released on Feb. 12. Other contenders on the list included companies such as Plaid, Opendoor and Lemonade, categorized under payments, real estate and insurance respectively. Listed alphabetically Spanning an array of categories within fintech, Forbes composed its 2020 list alphabetically. Among the six…

Dow Blasts to 29,500 Despite CDC’s Scary Coronavirus Warning

A massive rally lifted the Dow Jones to a fresh all-time high around 29,500. Despite stock market enthusiasm, the CDC came out with a shocking prediction that the coronavirus outbreak will gain a foothold in the U.S. Dow bulls also ignored the rise of left-wing presidential candidate Bernie Sanders, who they don’t believe can defeat Donald Trump. The Dow Jones leaped to a record high on Wednesday because Wall Street is refusing to price in virtually any negative headlines. Investors have long plugged their ears to the threat of left-wing…

3 Cents per kWh – Central Asia’s Cheap Electricity Entices Chinese Bitcoin Miners

As tensions escalated between the U.S. and Iran in recent months, reports have detailed that Chinese bitcoin miners are looking to set up shop in Central Asia and more specifically in Kazakhstan and Uzbekistan. Last spring, Chinese bitcoin mining operations flocked to Iran for extremely affordable electric prices ($0.006 per kilowatt-hour) in the oil-rich nation, but now Chinese miners are finding it easier to migrate to Central Asia for $0.03 per kWh in certain countries. Also Read: Iranian Grid Explains Electrical Costs Will Fluctuate for Bitcoin Miners Chinese Miners Consider…

Fed-Induced ‘Deflation Crisis’ Will Cause Bitcoin to Soar: Hedge Fund Manager

The growing U.S. workforce and retirement of the boomers will force the Fed to double its balance sheet. The expansion of the Fed’s balance sheet will lead to low or even negative yields. These conditions will drive investors to seek assets that are scarce and bitcoin is the number one candidate. By now, it’s no longer a secret that the Federal Reserve is responsible for pushing the stock market into all-time highs. The Fed continues to pump billions into the financial system as it grew its balance sheet from $3.7…

Why Crypto Sentiment and Prices Are Soaring

With blockchain puppets (we really mean it) on TV, CNBC pushing the bitcoin-as-gold narrative and The Guardian seeing connections between coronavirus and bitcoin’s recent rally, we’ve got a lot to talk about on today’s episode of The Breakdown. After Monday’s quick retrace, bitcoin and the rest of the market went green again. In this episode, @nlw breaks down the shifting sentiment, looking at: Disclosure Read More The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of…