Bitcoin is surging higher despite uncertainty relating to the election. The leading cryptocurrency currently trades for $14,030, around $700 about the daily lows and around $800 above the week-to-date lows. The coin is up 3.5% in the past 24 hours, outperforming many top altcoins. It seems that Bitcoin’s rapid price action to the upside is forcing capital and attention into the leading cryptocurrency and away from altcoins. Chart of BTC’s price action over the past few hours from TradingView.com Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A…

Day: November 3, 2020

Uniswap’s UNI is Likely to Plunge Further as “Farmer Exodus” Nears

Uniswap’s governance token UNI has seen a relentless selloff over the past few days, with buyers unable to reverse its downtrend as the cryptocurrency continues sliding lower daily. The cryptocurrency’s inability to gain any strong momentum as of late has caused it to see consistent losses. Each rally has been met with massive selling pressure, making it impossible for buyers to gain any ground against bears. There are a few factors behind this trend, including the downturn seen across the aggregated DeFi sector, the heavy UNI distributions seen on a…

Hashgraph CTO expects blockchain interest to grow even bigger in 2021

In an interview with Cointelegraph, Hedera Hashgraph CTO Leemon Baird said that while interest in blockchain greatly increased in 2020, he expects much bigger things to come in 2021. Baird, who holds a doctorate in computer science from Carnegie Mellon University, explained that “the world as a whole looks at this industry as blockchain or DLT and says, ‘wow, there’s really something there.’” He continued, “This year I saw a rapid increase in interest throughout the world. And I think next year we will see an even bigger increase.” Elaborating on his…

Why Is Deutsche Bank More Worried About Trump Than Jeffrey Epstein?

Donald Trump owes Deutsche Bank roughly $340 million. The German bank will reportedly look to sever ties with Donald Trump after the election. This is the same bank that sought Jeffrey Epstein as a client after he was a convicted sex offender. What does that say about Donald Trump? Deutsche Bank is getting its affairs in order. After working with child-trafficker Jeffrey Epstein, the German bank is taking no risks on Donald Trump. Curiously, on election day, it decided to announce that it will look to sever ties with the…

Layer1 co-founder takes former business partner to court

Jakov Dolic, co-founder of the U.S.-based Bitcoin (BTC) mining company Layer1, has filed a lawsuit against his former business partner, Alexander Liegl. According to court documents filed on October 30, Dolic claimed that Liegl had ultimately failed to raise funds for the company. As a result, Dolic said that he had to pay $16.24 million out of pocket to purchase a power plant for the mining firm. He also claimed to have spent an additional $3.5 million expanding the plant. Dolic felt short changed for his investment, noting that Layer1…

Investors fight to keep Bancor securities case out of Israeli court

Lawyers representing investors in a class action against BProtocol Foundation, parent company of decentralized liquidity network Bancor, have asked for the case to be tried in the United States rather than Israel. According to court records filed Nov. 2 in the U.S. Southern District of New York (SDNY), lawyers for Timothy C. Holsworth, the lead plaintiff in the class-action lawsuit against defendants BProtocol and four of its executives, argued that the firm’s “repeated and extensive contacts with the United States” for marketing its Bancor Network Token (BNT) made the SDNY…

South Korean financial watchdog will ban privacy coins from exchanges

According to a Nov. 3 announcement from South Korea’s Financial Services Commission, or FSC, virtual asset service providers within the country will no longer be able to handle any digital assets that present a high money laundering risk. These updates were made as part of the guidelines under the Special Payment Act — regulation which specifically covers the legality of cryptocurrencies in South Korea. The FIU specifically called out “dark coins”, which are privacy-oriented cryptocurrencies, for having transaction records that are reportedly difficult for the group to trace. This could…

COVID-19 has spurred more nonprofit organizations to accept crypto

Over the past three years, an increasing number of nonprofit organizations have begun to accept crypto-based donations. According to Alex Wilson, co-founder of crypto donation gateway The Giving Block, the COVID-19 pandemic has pushed this trend further than ever before. Pandemic prevention measures began to accelerate in March 2020, resulting in business closures and economic turmoil for many. Businesses and nonprofits alike faced notable losses in revenue once the virus took hold. “Interestingly, the last six months or so, COVID has actually been a pretty major catalyst for nonprofits accepting crypto…

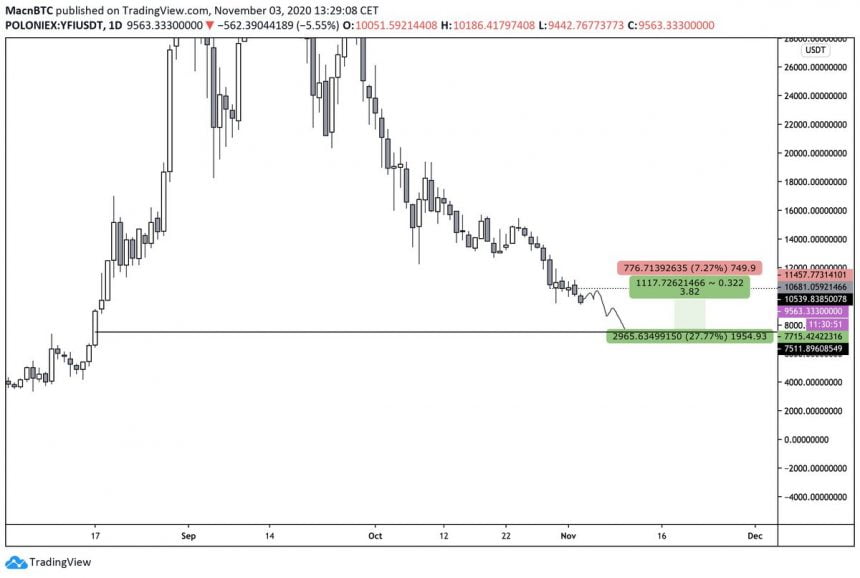

Yearn.finance (YFI) Faces a Meltdown as Analysts Eye Decline to $7,500

Yearn.finance’s embattled YFI governance token has been caught within a relentless downturn as of late that has been induced by immense sell-side pressure, a fragmented community and declining protocol value. The culmination of these various bearish factors has led analysts to expect significantly further downside in the near-term. One trader is now noting that a decline towards $7,500 is likely imminent due to its inability to find any strong momentum as it slides beneath $10,000. One recently passed governance proposal could bolster its outlook, as it redistributes the protocol’s income…

Can Bitcoin hit $17K next? Watch these 3 key BTC price levels

Bitcoin (BTC) has been on a tear and there’s no escaping it. But the majority of high-cap altcoins are seemingly suffering at the hands of this bull run, leading to the question: have we had our altseason already? Is it over or is there more to come? Multi-year resistance levels BTC/USD 12-hour chart. Source: TradingView Bitcoin has been eating up multi-year resistance levels like Pacman on an amphetamine-induced rampage lately, smashing through $11,300, then $12,400 then $13,100 before being rejected around the $14,000 level. After $14,400 there isn’t much in…