Cryptocurrency firm Pantera Capital has raised $134 million for its bitcoin fund, according to a form D filing with the U.S. Securities and Exchange Commission. Formed in 2013, the Pantera Bitcoin Fund Ltd. was the first U.S.-based bitcoin fund. In an investor letter at the end of 2017, Pantera boasted a 25,004% return on the fund, mainly due to the bitcoin bull run of that year. Recently, CoinDesk discovered that Pantera’s venture funds hadn’t fared well in comparison to the S&P 500. The venture funds Pantera Capital raised in August…

Day: November 21, 2020

THIS IS THE BEST WINK.ORG SLOT GAME EVER! *SLOT GLITCH?* [CRYPTOAUDIKING]

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io START MAKING PASSIVE INCOME ON BITCOIN EVERYDAY NOW!! CHECK OUT THESE OTHER DAPPS NOW BEFORE ITS TOO LATE! JOIN THE WINK COMMUNITY! START MAKING PASSIVE INCOME!!! JOIN ME ON ROOBET!! CRYPTO EXCHANGES TO BUY BITCOIN & ALTCOINS: CRYPTO.COM and we both get $25 USD 🙂 COINBASE ► EARN A FREE $10!: BINANCE ► GET A FREE STOCK WITH ROBINHOOD! ► I’m on GuildChat, the best app for the crypto community. Join my community for some FREE AIRDROPS! 👇👇👇👇👇👇👇 WANT TO GIVE ME…

Prominent DeFi Coin Pickle Finance Plunges 50% in Wake of Attack

Holders of Pickle Finance’s native coin PICKLE are currently suffering from a 50% drawdown after the protocol was attacked by an unknown user. Details are still unclear about the attack but the loss of funds has resulted in users pulling their liquidity and selling the cryptocurrency en-masse. PICKLE is down to $11.50 as of this article’s writing, just under 50% below where it was 24 hours ago. This makes it one of the worst-performing cryptocurrencies of the past 24 hours. Only bad performers include yAxis and Yield Wars, which both…

Here’s Where a “Bitcoin Bear Whale” Has Put Up a Massive Sell Wall

Bitcoin’s price action as of late has greatly favored buyers, with the cryptocurrency being caught within the throes of an intense bout of sideways trading just below $19,000 as buyers try to garner enough buy-side pressure to break through this level. The selling pressure here has been intense, but it has yet to catalyze any type of intense selloff throughout the past few days. This seems to point to immense underlying strength amongst buyers and may indicate that near-term upside is imminent. If bulls can break above this level, they…

Bitland Cloud Mining Website full Review | Free TRX Mining New Payment Proof | Crypto Currency

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitland Cloud Mining Website full Review | Free TRX Mining New Payment Proof | Crypto Currency Join link Best for you Join faucetpay wallet for fast withdrawal 1sec me paisa bank me and buy and sell btc eth Thank #bitlandreview #trxmining #Tron #faucet #Bitcoin #ETH #Ethereum #Litecoin #bitcoinmining #withoutinvestment Keyword – trx coin, trx coin price prediction, trx coin hindi, trx coin news, trx coin malayalam, trx coin mining, trx coin, TRX Decentralized, tamil, trx coin future, trx coin 2020, trx coin…

Parabolic rally ‘a real possibility’ after Ethereum price surges to $547

The price of Ether (ETH), the native cryptocurrency of Ethereum, has surpassed $547. Following the breakout, traders are pinpointing several key resistance levels in the near term. In the short term, traders generally foresee $600 as the major resistance area for Ether as it marked the beginning of a bearish trend starting in May 2018. As such, $600 could act as an area of interest for sellers. But, traders also believe that if Ether surpasses $600, it would likely enter the $700 to $900 range. Above it, there is little…

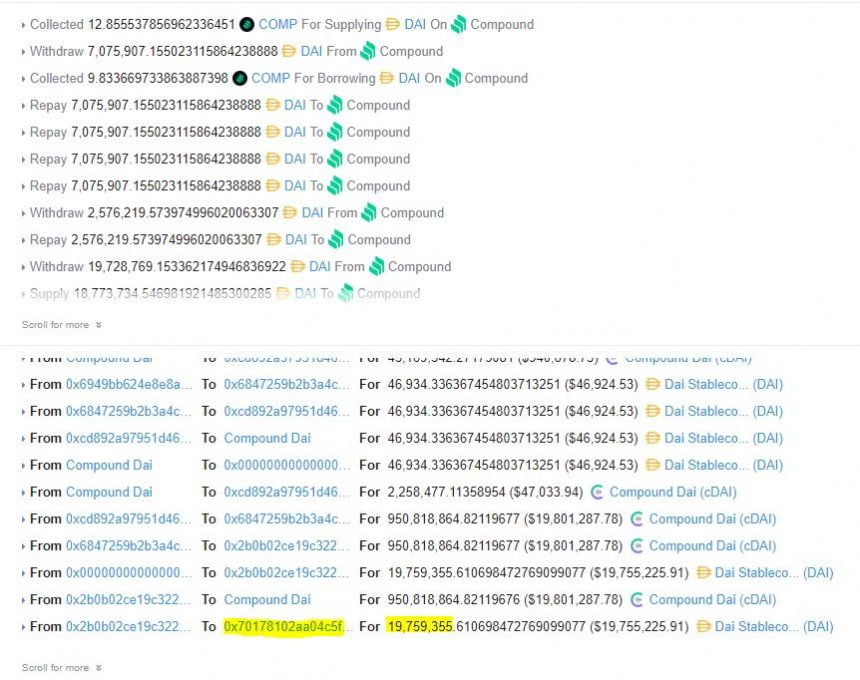

$pickle in a pickle as attacker swipes $20 million in “evil jar” exploit

In yet another attack on a major decentralized finance (DeFi) protocol, farming project Pickle Finance has been exploited today to the tune of $20 million. The attack transpired roughly two hours ago, and ETH-savvy Twitter users were quick to notice that pickle’s cDAI jar — Pickle’s term for a yield-bearing vault — had been emptied: I think @picklefinance‘s cDAI jar just got attacked and drained. https://t.co/Lxwi2dWSSZ pic.twitter.com/nUBE1KjEPh — mattyb (@mattybchats) November 21, 2020 Unlike other recent attacks however, this particular exploit did not feature flashloans — an increasingly maligned DeFi…

Paypal Bought 70% of All Newly Mined Bitcoin Last Month as Demand Rockets

Paypal bought up to 70% of all the newly mined bitcoin since the payments giant started offering cryptocurrency services four weeks ago. Now that’s according to estimates by hedge fund manager Pantera Capital, as revealed in its latest monthly blockchain letter. Together with Square’s Cash App, the two companies are buying more than 100% of all newly issued virgin bitcoin (BTC), it says. The letter said demand for Paypal’s crypto service, which runs on Paxos fiat-to-crypto exchange, Itbit, had hit the roof. The exchange “was doing a fairly constant amount…

Osmose technology new update (Notice) – Don't Miss | Osmose technology | Osmose business task | Task

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io In this video I am talking about Osmose Technology Pvt Ltd Latest Official Circular Which is released by Osmose Management On 9th Nov 2020. From 11th November Those who are not completed their task they will not be able to get their 20/- Daily benefits. 🔴 IMPORTANT 🔴 Watch this video till the end, I have shown you Notice which is received from Osmose Management. Next to watch -) Osmose technology Pvt Ltd in hindi || Osmose Technology Business Plan 🛑 IMPORTANT…

Crypto hedge fund Pantera Capital files for massive $134 million raise

In a filing with the SEC yesterday, Bitcoin hedge fund giant Pantera Capital announced an equity offering of up to $134 million — among the largest capital fundraising efforts in the seven year history of the firm. Formed in 2013 as the first-ever Bitcoin fund in the United States, Pantera initially raised a comparatively measly $13 million, and later $25 million, according to reporting from Cointelegraph. But in 2018, the fund directed its efforts towards a larger raise that would result in the formation of a third investment fund, dubbed…