Gazprombank (Switzerland), an arm of the bank owned by Russian energy giant Gazprom, has carried out the first client transactions as part of its new bitcoin services. Announced Tuesday, the bank’s launch of institutional cryptocurrency services comes after approval was granted by the Swiss Financial Market Supervisory Authority. “Digital assets will become increasingly important for our clients and the global economy,” said the bank’s CEO, Roman Abdulin. The cryptocurrency services, including cryptocurrency accounts, investment management and asset custody, were developed in partnership with fintech firm Avaloq and digital security infrastructure…

Day: November 24, 2020

Binance Issues Stern Quit Notice to US Users, Gives 14 Days Ultimatum

Binance expects its users to transfer their holdings to its US subsidiary which, though regulated, is not yet available in all the 50 states of America. Major cryptocurrency exchange Binance has issued a very stern quit notice to its platform users resident in the United States of America following regulatory concerns. According to the notice contained in a letter sent to the Binance US users fished out through their IP addresses, Binance is giving them a 14-day ultimatum to transfer their current holdings out of the exchange, failure of which…

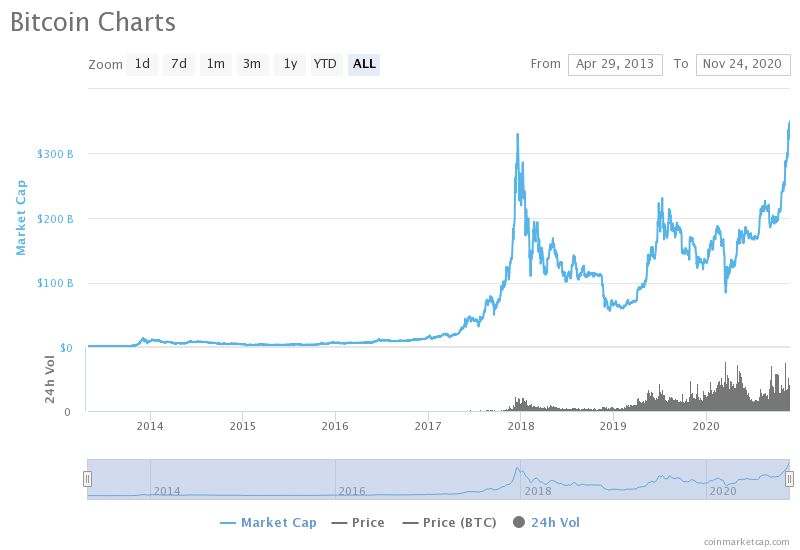

Bitcoin market cap hits new all-time high and surpasses JPMorgan at $352M

Amid an ongoing parabolic bull run, Bitcoin (BTC) is breaking another major milestone in terms of its market capitalization against American banking giant JPMorgan. On Nov. 24, Bitcoin surpassed the $19,000 price mark for the first time since December 2017, breaking another all-time record in its market cap. At publishing time, Bitcoin’s market cap is $352 billion, up from $345 billion 24 hours ago. According to data from Macro Trends, JPMorgan’s market cap closed at $349 billion on Nov. 23. Earlier this year, JPMorgan’s market cap dropped to as low…

What is Bitcoin and How does it work in Hindi || Advantages and Disadvantages of Bitcoin in 2020 ||

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io What is Bitcoin and How does it works in Hindi || Advantages and Disadvantages of Bitcoin in 2020 || Hello Guys, I am Akash Shakya, In this video, I am going to tell you about the Bitcoin, I hope you like this video if you liked it, then please like this video and Subscribe to this channel. Thank you DON’T FORGET TO LIKE, SHARE AND SUBSCRIBE. CHECKOUT THESE PLAYLISTS FOR MORE VIDEOS:- TECHNICAL VIDEOS RELATED TO COMPUTER, MOBILE AND INTERNET:- ETHICAL HACKING…

Bitcoin Hits $19K on Dimming Election Uncertainty and Weaker Dollar

Bitcoin rose above $19,000 on Tuesday after Donald Trump said his administration would assist President-elect Joe Biden’s transition to the White House, easing investors’ concerns about a prolonged period of election uncertainty. The BTC/USD exchange rate rose 3.89 percent to a new year-to-date high of $19,100, pointing to an extended upside move towards its previously established record high near $20,000. Futures tied to BTC/USD also climbed 4.56 percent to $19,445, suggesting a further growth for the pair in the spot market. Bitcoin Futures on CME are 5% away from testing…

Australian Investment Group With Billions in AUM Starts Investing in Bitcoin Futures

Pendal Group, an Australian Securities Exchange-listed investment manager with over A$100 billion (US$73.6 billion) in assets under management, is getting into bitcoin. As reported by the Australian Financial Review on Monday, Vimal Gor, Pendal’s head of bond, income and defensive strategies, said with the cryptocurrency “entering the realm of mainstream,” the company is now investing in bitcoin futures on the Chicago Mercantile Exchange. “All the big hitters in the hedge fund world are coming out to endorse bitcoin,” said Gor, alluding to Paul Tudor Jones II and Stan Druckenmiller, billionaires…

BIS report suggests ‘embedded‘ monitoring tool for stablecoins

Facebook’s proposal for its digital currency, Libra, was a wake-up call for international regulatory agencies, finance ministries and central bankers. All these actors recognized that the company’s reach across its three platforms had the potential to accelerate adoption of a global stablecoin to an unprecedented extent. In a new paper from the Bank of International Settlements, three analysts have proposed that the novelty of Libra and other proposed global stablecoins demand that regulators reimagine the possibilities for monitoring and supervising their issuance and circulation. Libra’s potential for rapid mass adoption…

Bitcoin Interest Soars as Wall Street Journal Discusses Its Adoption in Front Page

According to the report, Grayscale had about $5.9 billion in assets under management. Interestingly, this has recorded a massive surge to over $10 billion. Bitcoin is currently enjoying the rally of its life since the previous market bull run that saw it surge to near $20,000. Just in 2 months, the digital asset has gained about 80% value which saw it fall short of just 4% gain to equal its all-time high of $19,783 after reaching $18,965. Wall Street Journal accessed some of the possible causes for this unexpected Bitcoin…

Here’s Why Analysts Think Ethereum Could Go Parabolic to $800 Soon

Ethereum has enjoyed a massive rally over the past two days despite some weakness on the part of Bitcoin. The leading cryptocurrency has rocketed from the $500 region to highs near $600 as of this article’s writing. ETH currently trades at $590, dropping slightly as Bitcoin shows some weakness after an impressive 70% rally. Ethereum is set to move even higher in the days and weeks ahead, analysts say, as it clears notable resistance levels in the high-$500s and the $600 region. The coin also seems to be benefiting from…

AAPL Stock Up 0.7% in Pre-Market as Apple Extends Enforcement Date for In-App Purchases Fees

Apple (AAPL) stock shows slight rebound in the pre-market after the tech giant extended the date for billing digital class holders making in-app purchases. The shares of Apple Inc (NASDAQ: AAPL) which closed down 2.97% on Monday to $113.85 are up by 0.70% in the pre-market today as the Cupertino-based company announced that it is extending the date to enforce its in-app purchase charges to specified users. As reported by CNBC, Apple announced that firm’s that runs digital classes through the former’s iPhone applications will not have to worry about…