The funding from American Express Ventures as well as the other FalconX investors will help position the company to tap into the potential opportunities in the space in 2021. FalconX, an all-in-one American technology company with a platform for institutions trading cryptocurrency, has welcomed American Express Ventures as its latest investor and funding partner. According to the official announcement published on Wednesday, the investment from American Express Ventures comes as an extension of the $17 million funding round launched by FalconX back in May 2020. Following this latest funding from…

Day: December 17, 2020

Economist Calls Bitcoin “Massive Bubble” After Price Hits Record High

Bitcoin’s potential as an emerging safe-haven alternative to gold raised its demand among institutional players in 2020. But a prominent economist is still skeptical about the cryptocurrency’s growth. David Rosenberg, the chief strategist at Toronto-based Rosenberg Research & Associates, said in an interview with Bloomberg that Bitcoin is a “massive bubble.” He criticized the flagship cryptocurrency for having zero evidence about its “future supply curve,” noting that it’s nothing but an “extremely crowded” trade. “The one thing we know about gold, we know the supply curve of gold with certainty,”…

PayPal crypto partner Paxos closes $142M funding round

United States-bases stablecoin operator Paxos has raised $142 million in fresh funding from investors including PayPal and Mithril Capital. The stablecoin issuer announced the news on Thursday. U.S. investment firm Declaration Partners, backed by billionaire David M. Rubenstein, led the funding round with other participants including RIT Capital Partners plc., Ken Moelis, Alua Capital, and Senator Investment Group. Previous Paxos backers like RFE Ventures and Liberty City Ventures also invested in the funding round. With the close of the $142 million Series C round, Paxos has now raised over $240…

Quontic Becomes First FDIC-Insured Bank to Launch Bitcoin Rewards Program

Quontic Bank becomes a pioneer FDIC-insured financial institution to launch a Bitcoin rewards checking program, as announced yesterday in a press release by PR Newswire. Earn Bitcoins While Shopping According to the announcement, users of this reward system would have access to surcharge-free ATMs, ApplePay, GooglePay, SamsungPay, and Zelle peer-to-peer payments at no cost. In addition, customers would also be able to earn at least 1.5% back in Bitcoins on any eligible purchases they make with their Quontic debit cards. The bank is working with NYDIG, a Bitcoin specialist firm…

GoCardless Raises $95 Million as It Nears $1 Billion in Valuation

GoCardless LTD nears $1 billion valuations to earn the Unicorn status. Currently, the new funding takes the company’s valuation to around $970 million. A London-based fintech company GoCardless LTD has been able to raise around $95 million in series F funding which pushed the company’s valuation higher. According to the report, the funding series was led by Bain Capital Ventures. This is a good development by the company considering Its performance in 2020 was 46% better than the previous year due to the global pandemic that caused a spike in…

Stellar expands reach in Latin America with $3M investment in Settle Network

The Stellar Development Foundation has invested Settle Network, the largest digital assets settlement network in the Latin American region. It marks the fourth investment this year from the SDF enterprise fund, bringing the total to more than $9.2 million in 2020. The fund is a venture-style trust for growing the Stellar network and developing partnerships for cross-border payments. It has previously invested in Abra and SatoshiPay. The investment of around $3 million will be paid in lumens (XLM) and help bolster Settle’s current suite of payment tools which include fiat…

Tesla Stock Down 1.65%, Zacks Equity Research Gives TSLA Shares ‘Hold’ Rating

After a critical analysis, Zacks Rank gave Tesla shares a ‘Hold’ rating, citing notable fundamentals that are yet to materialize. Shares of American giant electric vehicle company Tesla Inc (NASDAQ: TSLA) dropped approximately 1.65% on Wednesday to close the day trading at $622.77 and got a new rating from Zacks Equity. The drop had further been magnified during Wednesday’s pre-market as they were down 0.63% to trade around $618. However, the electric vehicle giant has experienced one of its best years in market performance. The market data provided by MarketWatch…

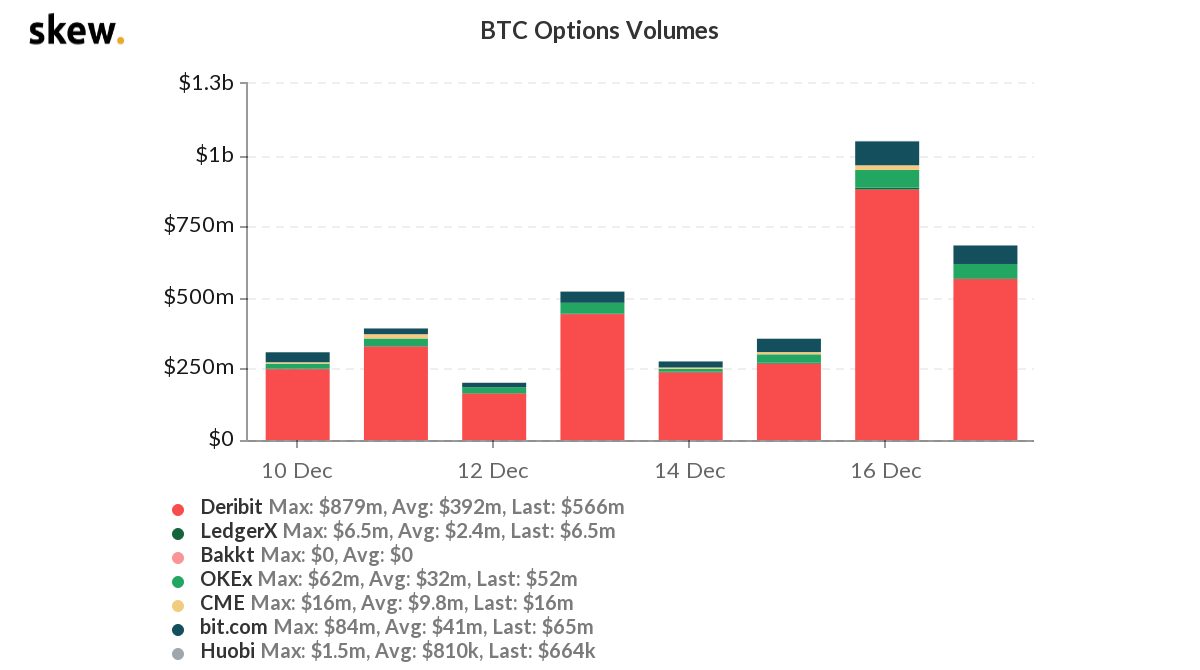

Bitcoin options volume crosses $1B for the first time ever

Amid an ongoing bull run of Bitcoin (BTC), Bitcoin options are hitting a new historical milestone. Bitcoin options are derivative contracts that grant the holder the right, but not the obligation, to buy or sell BTC at a predetermined price. According to data from Skew, Bitcoin options volumes crossed $1 billion on Dec. 16. Skew announced the news Thursday on Twitter, noting that Bitcoin options saw its “first $1 billion day.” Deribit, a major global crypto futures and options exchange, had the largest BTC options volume on the day at…

One River Digital Buying $1B in Crypto with Alan Howard Backing

One River Digital, a new institutional-focused investment firm, under the backing of tycoon and hedge fund manager Alan Howard is eyeing a $1 billion investment in cryptocurrencies by early next year. On Wednesday, hedge fund One River Asset Management CEO Eric Peters explained to Bloomberg that the company’s offshoot One River Digital will surpass $1 billion in terms of crypto holdings sometime in early 2021. The newcomer has already made investments for institutional clients amounting to $600 million in Bitcoin (BTC) and Ether (ETH). Besides supporting the investment fund, Alan…

Fintech Startup EMTECH Launches Platform to Help CBDC Development

The EMTECH Modern Central Bank Sandbox™ will provide its innovative solutions with backing from the cloud services giant Microsoft Corporation in its attempt to deploy the pilots in the coming months. EMTECH, an American Fintech startup, has launched a platform dubbed the Modern Central Bank Sandbox™ to help Central Banks around the world in their pursuit of Central Bank Digital Currencies. Per the official announcement, the EMTECH Modern Central Bank Sandbox platform offers a regulatory compliant system that is ready for its pilot testing. The quest to develop and digitize…