Amid an ongoing bull run of Bitcoin (BTC), Bitcoin options are hitting a new historical milestone. Bitcoin options are derivative contracts that grant the holder the right, but not the obligation, to buy or sell BTC at a predetermined price.

According to data from Skew, Bitcoin options volumes crossed $1 billion on Dec. 16. Skew announced the news Thursday on Twitter, noting that Bitcoin options saw its “first $1 billion day.”

Deribit, a major global crypto futures and options exchange, had the largest BTC options volume on the day at $879 million. The exchange has emerged as the most popular BTC options exchange, historically dominating the Bitcoin options market.

Bit.com, the cryptocurrency derivative exchange owned by Bitmain-backed financial service platform Matrixport, saw the second largest BTC options volumes on the day. According to Skew, Bit.com’s maximum Bitcoin options volume accounted for about $84 million.

Major global crypto exchange OKEx is the third top BTC options platform in the list, with a maximum options volume standing at $62 million on Dec. 16.

The Bitcoin options market has seen a parabolic growth in 2020 as even weekly volume fell short of the $200 million mark at the start of the year.

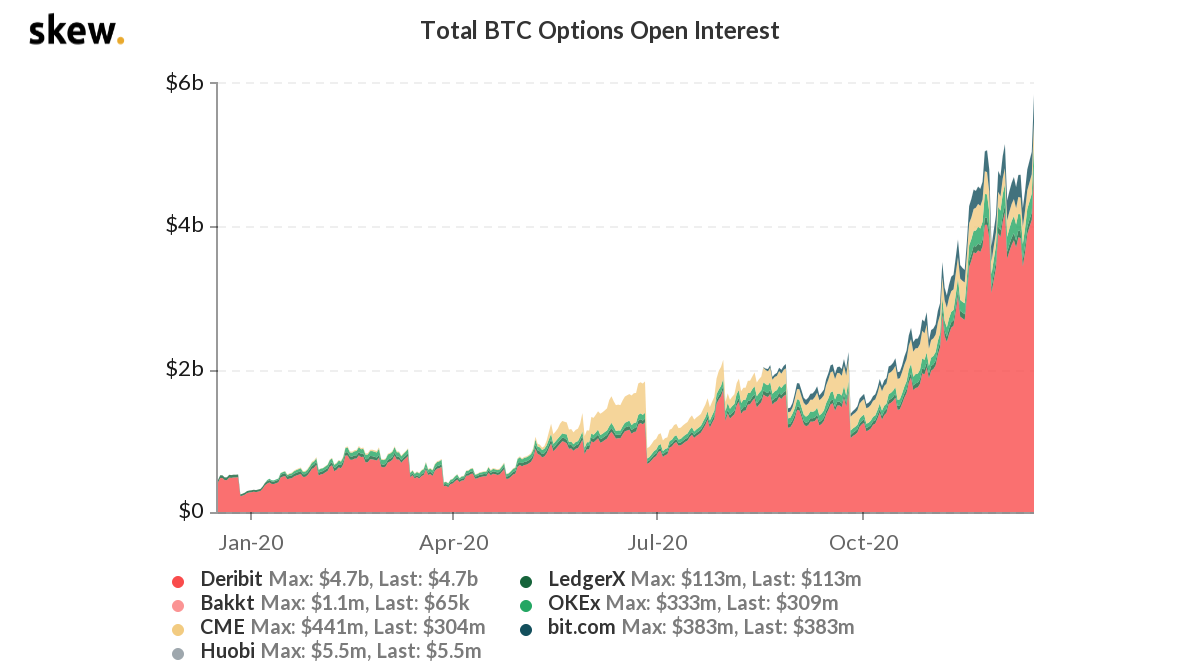

The volume growth comes alongside a massive increase in Bitcoin options open interest, or OI, which stands for the total number of contracts outstanding in the market and not yet settled. According to data from Skew, Bitcoin options’ OI almost touched a $6 billion threshold on Dec. 16, surging from around $600 million in early January.

The OI for Bitcoin options has been steadily increasing over the course of 2020. As previously reported by Cointelegraph, high OI rates are related to the increasing liquidity of options as well as growing number of market participants. Spikes in Bitcoin options’ OI can also be fueled by larger macroeconomic events like the decentralized finance hype and long term effects of the Bitcoin halving on the markets. Options are a derivative tool with several possible uses, including insurance for existing positions against possible drops, or speculating on price with an asymmetric risk-return profile.

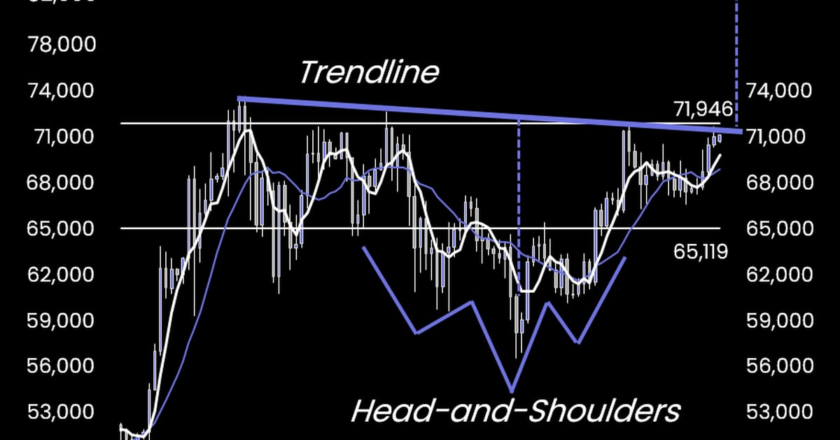

New record-breaking volumes in the Bitcoin options market come amid Bitcoin price hitting its new historical highs. On Dec. 16, Bitcoin posted a new record high by surpassing the $20,000 threshold for the first time since 2017. The largest cryptocurrency continued gaining momentum, briefly rising to $23,500 on Dec. 17.