Microstrategy Inc., said Monday that it is planning to sell $400 million in convertible senior notes to private investors so that it could buy more bitcoin. The Nasdaq-listed business intelligence and mobile software company already holds 40,824 bitcoin (BTC) in reserve, valued at $776 million at current prices of around $19,000 per each bitcoin. On Dec. 4, Microstrategy bought another 2,574 BTC for $50 million, adding to its initial $425 million haul from August and September. The firm holds the largest bitcoin reserves of any publicly traded company, according to…

Day: December 8, 2020

BITCOIN CASH (BCH) or BITCOIN TRASH!?!? BCH FORKS AGAIN!! Cryptocurrency Analysis 2020

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin Cash (BCH) is approaching yet another fork as a result of a divided community. With so much tension in the Bitcoin Cash community, it makes us wonder, is it Bitcoin Cash (BCH), or BITCOIN TRASH!?!? On November 15, Bitcoin Cash will ONCE AGAIN fork into yet another Bitcoin forked blockchain, this time with the name of Bitcoin Cash Node. It’s thought that Bitcoin Cash Node (or BCHN on the ticker), will end up being the dominant chain of the fork, leaving…

Chainlink Shows Signs of Weakness Against BTC as Price Slides Lower

Chainlink has been closely tracking the aggregated cryptocurrency market throughout the past few days and weeks This has caused it to see some notable consolidation, as well as some slight downside throughout the past 24-hours The main source of selling pressure on LINK’s price has been the weakness seen across the aggregated market ETH and BTC have both been struggling to maintain their multi-week uptrends, which is leading investors to flee higher-risk assets like altcoins This has put some pressure on LINK’s technical outlook, especially against its Bitcoin trading pair…

Softer stance on Bitcoin but we’ve always been pro-blockchain

Contrary to public perception, JPMorgan Chase has always been pro-blockchain, says the multinational investment bank’s head of wholesale payments, Takis Georgakopoulos. In a live discussion with Nasdaq reporter Jill Malandrino at this year’s Blockshow in Singapore, Georgakopoulos said JPMorgan has always viewed the blockchain and crypto industry through three lenses: Bitcoin (BTC) and other non-fiat-based cryptocurrencies; fiat-based digital assets created by institutions and central banks; and blockchain technology. When questioned about whether JPMorgan is “softening its stance” on digital assets, Georgakopoulos clarified the bank had only softened its stance on…

Ash Cash On Investing In Bitcoin, Differences In Life Insurance, Savings & Investment Accounts

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Ash Cash the financial Guru gives tips on saving and investing money, especially during the pandemic. Subscribe Here! Watch the Best of Sway In The Morning! Check out More From Sway’s Universe #AshCash #FinancialTips #HowtoMakemoney #Bitcoin #Cryptocurrency #SwaysUniverse #SwayInTheMorning #SiriusXM #Shade45 About SWAY’s UNIVERSE Exclusive interviews from Sway Calloway and the Sway In The Morning/ SwaysUniverse.com team with some of today’s biggest celebrities, like Kevin Hart, Kanye West, Eminem, Usher, Jessica Alba, Steve Aoki, Torey Lanez, Julia Stiles and so much more.…

Mike Novogratz has 50% of net worth in crypto, advocates up to 5% for investors

Galaxy Digital founder and CEO Mike Novogratz is encouraging investors to devote a larger percentage of their portfolios to crypto. In an interview with CNN’s Julia Chatterley today, Novogratz said he had “changed his tune” on previous advice that investors should allocate roughly 1% of their net worth to Bitcoin (BTC) and other cryptocurrencies. The CEO has said as recently as November that people should invest up to 3% into BTC and HODL for five years. “I think a new investor could put 5% into Bitcoin,” said Novogratz. “Bitcoin’s not…

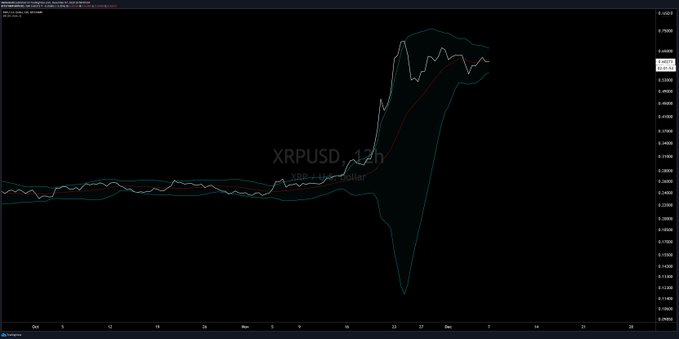

XRP Soon to Undergo Pivotal Breakout After Last Month’s Rally

XRP underwent an extremely strong rally at the end of November. The cryptocurrency, as many remember, surged around 100% in the span of three days amid one of the most rapid bouts of price action in a high-cap crypto-asset since the 2017 rally. At one point, the market became so disjointed and volatile that XRP traded as high as $0.92 on Coinbase. The cryptocurrency, the third-largest by market capitalization, peaked at $0.75 on most other platforms. XRP has managed to consolidate and hold its post-rally prices despite selling pressure from…

Compound (COMP) token outperforms the market as DeFi TVL rises to $14.4B

The price of COMP, the governance token of the decentralized finance (DeFi) giant Compound, has been surging while the wider crypto market has entered a correction. Despite the ongoing cryptocurrency market slump, the token has rallied 56% in the past week. COMP/USDT 4-hour chart. Source: TradingView.com Unusually low funding rate and spot market accumulation There are various potential reasons behind the sudden rally of COMP. Traders have pinpointed the unusual market dynamic on futures exchanges, where the token’s funding rate remained heavily negative. The funding rate of an asset in…

Market Wrap: Bitcoin Steadies at $18.7K; Big Ether Options Position Around $1,120 Isn’t Bullish

Volume doldrums and December sluggishness caused bitcoin to slip steadily below $19,000; ether options above spot are highest at $1,120 strike price. Bitcoin (BTC) trading around $18,705 as of 21:00 UTC (4 p.m. ET). Slipping 1.7% over the previous 24 hours. Bitcoin’s 24-hour range: $18,629-$19,299 (CoinDesk 20) BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians. Bitcoin trading on Bitstamp since Dec. 5. Source: TradingView The price of bitcoin took a tumble again Tuesday, following Monday’s move lower. At around 06:00 UTC (1 a.m. ET),…

Bitcoin’s reputation still a deterrent for institutions, Draper fund analyst says

Although a number of big players have picked up bags of Bitcoin (BTC) in 2020, multiple aspects still avert institutions from investing on a wide scale, according to Robert Li, an analyst for Draper Dragon, a Draper Venture Network fund. “I think there are a few issues that are still holding back the majority of institutional investors from allocating capital freely toward Bitcoin,” Li said during a segment of the Latin America Bitcoin Conference on Tuesday. “Number one would be reputational issues stemming from Bitcoin’s previous association with organized crime…