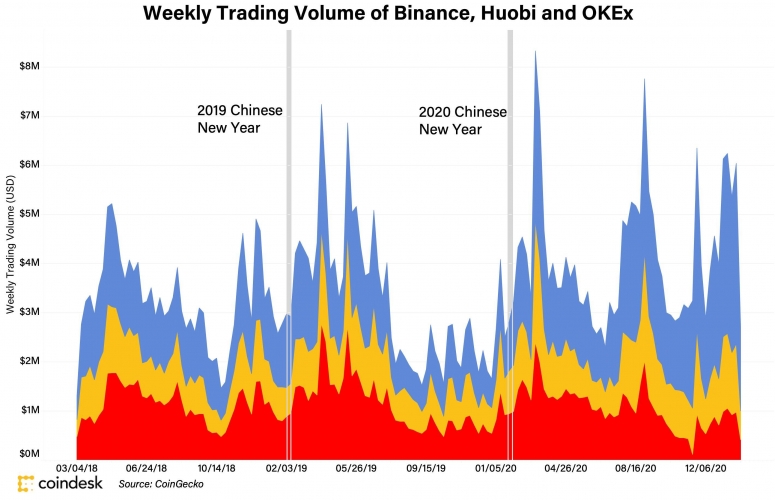

The lunar Chinese New Year this year is on Feb. 12, right around the corner. But unlike in previous years, some analysts and traders say the “Chinese New Year Dump,” a belief bitcoin’s (BTC) price would drop around the holiday period, will not take place this year. Why? The impact of retail traders in China has been reduced. Some argue the “Chinese New Year dump” will not happen this year because institutional investors in the U.S. and Europe have been the main drivers of the current bull run. That is…

Day: February 5, 2021

I Made A Level 999,999 Bitcoin Miner In Roblox

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io I Made A Level 999,999 Bitcoin Miner In Roblox 👔 Merch 👔 ⭐Use Star Code: Gravy ⭐ Game: ► Twitter ► ► Instagram ► ► Discord ► ► My Roblox Group ► Thanks for Watching Gravycatman ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Price analysis 2/5: BTC, ETH, XRP, DOT, ADA, LINK, LTC, BNB, BCH, XLM

Altcoins are reaching multi-year highs while Bitcoin price builds momentum for the next run at the $40,000 level. Bitcoin’s (BTC) correction from its January high has not shaken the confidence of institutional investors. According to Glassnode analysts, the number of whales holding more than 1,000 Bitcoin has increased by 200 this year. Along with the institutions, several high profile investors have also committed money to the crypto sector. Hedge fund manager Paul Tudor Jones, former PepsiCo CEO Indra Nooyi, and American rapper LL Cool J have invested in a new…

Passing The Torch From Hal Finney To Jack Dorsey

Last night, Twitter CEO Jack Dorsey tweeted the phrase “running Bitcoin,” as both a nod to computer scientist Hal Finney and to reveal to the world he is running a full node. Here’s what this means for the first ever cryptocurrency along with a look a how it all started, and where Bitcoin is going next. How It All Started: Hal Finney Tweets He’s “Running Bitcoin” Few realized at the time just how significant a tweet from Hal Finney dated January 10, 2009 would ultimately be. The tweet containing only…

South African Regulator Warns Crypto Investors to ‘Be Prepared to Lose All’ Following Collapse of Bitcoin Trading Company MTI – Regulation Bitcoin News

The Financial Sector Conduct Authority (FSCA) has issued what it terms crypto health warning after receiving many complaints from South African victims of crypto scams. In the warning, the FSCA reminds prospective investors that crypto-related investments are currently not regulated. Therefore, investors have no recourse against anyone should they get duped. Cryptocurrencies Are High-Risk Assets The FSCA’s warning comes a few weeks after an executive with the regulatory body bemoaned the challenges of regulating cryptocurrencies and how scammers are taking advantage of this. The official singled out the now collapsed…

BlockTower Capital CIO estimates another 9–22 months of bull run for crypto

How long will crypto’s current season of prosperity last? Ari Paul, chief information officer at BlockTower Capital, thinks the bull run has at least nine more months. In a tweet on Feb. 4, Paul said the industry is currently in the “7th inning of the crypto bull market.” He added: “This is where we get ongoing, dizzying rotation. BTC up, then when BTC takes a breather, ETH and some largecaps (and in this regime, defi bluechips), then smallcaps, rinse and repeat. Of course, throw in some 30-60% retracements for fun.”…

Corporate Treasuries Are Figuring Out Bitcoin on the Balance Sheet

Digital assets, in one form or another, are making their way into big business. The headline-grabbing version of this is straight-up BTC on the balance sheet, a renegade charge being led by MicroStrategy CEO Michael Saylor, who is known for warning corporates that capital in fiat is being debased. Saylor’s MicroStrategy event this week included a playbook, going into the nuts and bolts of things like qualified custodians, hot and cold wallets and so on. (Square provided a similar guide last October.) It’s worth stepping back and remembering what unlikely…

London Hill Investments – Cryptocurrency market is on fire $$$$ making money

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 12/3/2020 Cryptocurrency and the rising empires ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

The year 2021 will bring DeFi into adolescence

Following the explosive growth of decentralized finance in the second half of 2020, we’re asking ourselves what the next chapter will look like. What would it take for DeFi to expand beyond crypto-native assets and communities and start eating financial services as we know it? The second half of 2020 surpassed many of our expectations, and the market has only accelerated since then. Total value locked in DeFi rose from less than $1 billion at the start of June to $13 billion at the end of the year and over…

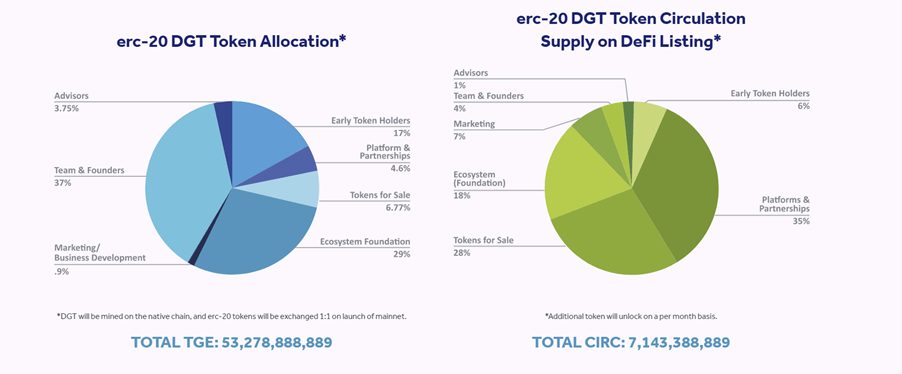

Do it! DGBLabs Token Presale is Live

At this point in time, one can accurately predict that blockchain technology is here to stay. In fact, it’s also safe to say that the market is only just getting started, as massive disruption of the digital ecosystem is bound to occur in the years to come. Reports clearly indicate that blockchain technology is expected to create $176 billion in enterprise value by the year or 2025, with this number surpassing the $3 trillion mark in early 2030. The recent growth of the blockchain market has sparked some debate concerning…