“Yet again, the Chinese government has cracked down on Bitcoin. Since 2013, it has done so at least seven times now – and twice this year already. While each time this happens, the markets react with a price drop, each time the effect is smaller and more short-lived. The ‘China bans Bitcoin’ story has gained almost a meme-like status in the Bitcoin community because of this.” Source

Day: September 24, 2021

Yemen national uses crypto donations to fight starvation amid civil war

A Redditor living in Yemen’s capital city of Sana’a claims to be using cryptocurrencies to buy food packages for families unable to access supplies during an ongoing civil war. According to a Sept. 23 Reddit post from user yemenvoice, the Yemen national has raised roughly $12,000 in crypto donations to be used towards fighting starvation in the Middle Eastern nation. They claim to have provided 15 families with flour, rice, oil, and beans and hope to reach 30 more in the near future. “I have tried very hard to help…

Bitcoin Is the Most Illiquid It’s Ever Been: 12 Numbers That Tell the Current Story of Markets

This episode is sponsored by NYDIG. Download this episode NLW looks at the current state of crypto markets through numbers, including: Bitcoin illiquid supply Lightning Network capacity Evergrande’s debt The total value of CryptoPunks And more See also: Twitter Adding Bitcoin Tipping Feature, Pushes Further Into NFTs “The Breakdown” is written, produced by and features NLW, with editing by Rob Mitchell and additional production support by Eleanor Pahl. Adam B. Levine is our executive producer and our theme music is “Countdown” by Neon Beach. The music you heard today behind…

crypto currency kyauta cikin minti biyar 5 mint. free mining

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io yadda ake bude faucet pay wallet:- ga link din nan(mining crypto):- mubarakeey#free#mining#Abdul tech#Sam u#kyauta# ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Whales Shut Down the BTC Network in the Year 2100 – Featured Bitcoin News

On September 21, former Bitcoin developer Gavin Andresen published an interesting blog post about “a possible [Bitcoin] future.” The blog post details a theoretical situation for the Bitcoin network in 2061, where most [bitcoin] transactions don’t happen on the [Bitcoin] network. A Theoretical Look at $6 Million Dollars per Bitcoin and the Year 2061 Following Satoshi Nakamoto’s departure from Bitcoin in 2010, for a few years, Gavin Andresen was considered the software’s lead maintainer after Nakamoto left him the keys. In 2011, Bitcoin developer Mike Hearn also claims he received…

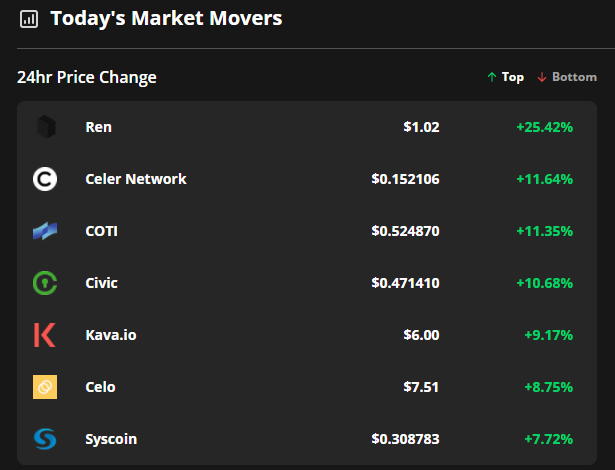

Cross-chain bridge equipped altcoins rally higher despite China’s crypto ban

The bullish momentum that had been growing across the cryptocurrency ecosystem over the past few days came to a screeching halt on Sept. 24 as news that China had banned cryptocurrency transactions made the rounds on social media and initiated an abrupt fall in the price of Bitcoin (BTC) from $45,000 to $42,000. After the initial knee-jerk reaction and a brief period of time for the market to digest the news, traders jumped back in to buy the dips on several altcoins which helped some of the losses seen earlier…

China’s Latest Crypto Ban Is Its Most Severe, Insiders Say — CoinDesk

“Do not be too pessimistic about it,” he told CoinDesk via WeChat audio messages. “…I think the biggest possibility in the future is that once major countries in Europe, North America as well as Japan, South Korea have come out with clearer regulatory policies on crypto, China will slowly introduce laws and regulations on crypto, too.” Source

VR Mining – From the mine to the future

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Move Mining Season 5 See all Season 5 video entries and VOTE for your favorite at ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Why El Salvador Is Botching Its Bitcoin Experiment — CoinDesk

There’s a reason El Salvador uses the dollar, and why Ecuador and Venezuela do, and why Argentina, where I lived for six years, had de facto dollarization throughout the 1990s. In all these cases, reverting to the world’s reserve currency as the national medium of exchange is a last resort move, a mark of profound institutional failure brought on by hyperinflation and a history of exchange rate instability. It’s an acknowledgement that the people of the country in question cannot trust the stewardship of their money with their leaders, whatever…

Billionaire Mike Novogratz Says He’s “Not Nervous” About Crypto Sell-Off

The crypto market has been subjected to major sell-offs since assets began to crash across the board. September which has been a historically bloody month for the market has stayed true to nature as various cryptocurrencies suffered crashes that dragged the market down. Due to this, over $1 billion longs have been liquidated in the market since Monday. Billionaire Mike Novogratz was on CNBC to talk about the current market trends. But unlike most investors in the market, Novogratz does not seem at all worried about the numerous price dips…