Bitcoin is roughly 35% below its all-time high of almost $69,000, which was set in November. The drawdown, or percentage decline from peak to trough, is the largest since July. Previous drawdowns have reached levels of nearly 80% and took several months to recover. Source

Day: January 6, 2022

Here’s why Bitcoin traders say a drop to $38K is the worst case scenario

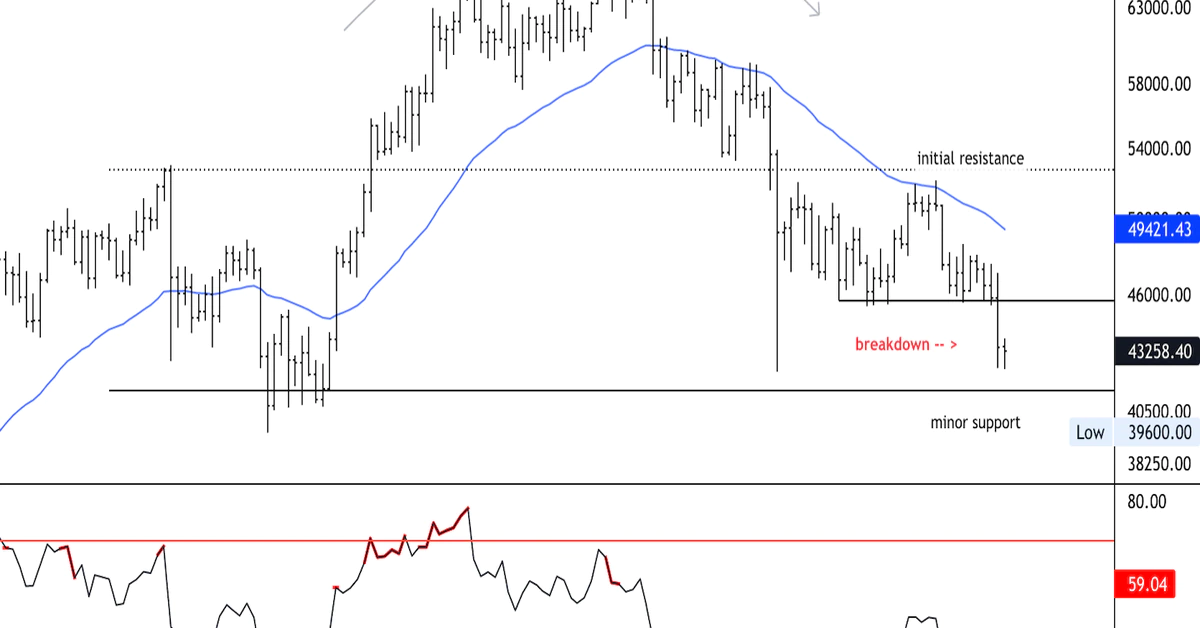

The fallout from the Federal Reserve’s recent hawkish comments about raising interest rates as soon as March continued to weigh heavily on the cryptocurrency market on Jan. 6. The Crypto Fear & Greed index has been dialed down to 15 and some traders are lamenting the possible start of an extended bear market. Crypto Fear & Greed Index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that bears attempted to challenge the lows set on Jan.5, bringing BTC price down to $42,439 during early trading on Jan. 6. BTC/USDT…

Después de la caída, bitcoin se estabiliza en una resistencia cercana a $45K-$50K

Bitcoin (BTC) cayó por debajo del soporte inicial de $45.000 el miércoles, aunque más tarde se estabilizó en torno a $42.000, cerca del mínimo del 5 de diciembre. Las señales de sobreventa permanecen intactas, lo que sugiere que la presión de venta podría disminuir. Source

Human Rights Foundation to grant 425M satoshis as part of its Bitcoin Development Fund

The Human Rights Foundation announced on Tuesday that it intends to distribute 425 million satoshis — the smallest divisible unit of a Bitcoin — to various contributors as a part of its ongoing Bitcoin Development Fund. Launched in May 2020, the Bitcoin Development Fund is primarily focused on improving the Bitcoin network’s privacy, usability and security. The Foundation said that it will focus this particular round of grants on expanding Bitcoin education and translation as well as Bitcoin core, lightning and wallet development. According to the organization’s press release, it…

Why Bitcoin and Crypto Are Crashing

This episode is sponsored by Nexo, Abra and FTX US. Download this episode Today on “The Breakdown,” NLW looks at one of the most important relationships in economics: the relationship between Fed statements and market actions. With bitcoin cratering under $43,000 NLW explores: The Fed’s relationship with markets in general Bitcoin’s relationship with equities FinTwit and Crypto Twitter’s reaction to the dip “The Breakdown ‘’ is written, produced by and features Nathaniel Whittemore aka NLW, with editing by Rob Mitchell and Michele Musso, research by Scott Hill and additional production…

Bitstamp – What is Bitstamp Exchange

Bitstamp, a U.K.-based cryptocurrency exchange that was founded in 2011, is Europe’s largest crypto exchange. It offers crypto-to-fiat and crypto-to-crypto exchange services, and supports euros, U.S. dollars, bitcoin, ether, litecoin, bitcoin cash, XRP and other assets. It is led by CEO Julian Sawyer, a co-founder and former CEO of Starling Bank, a U.K. digital bank. Source

NYDFS Hires New Deputy Superintendent of Virtual Currency

The NYDFS had been looking to fill this role for some time. The position is in its Research and Innovation Division and has a special focus on virtual and digital currencies, blockchain, distributed ledger technology and other related innovative and derivative products and technologies, according to the initial job posting. Original Source CurrencydeputyHiresNYDFSsuperintendentVirtual CryptoX Portal

Blast From The Past Bitcoin Fractal Suggests A Record Reversal Is Near

Mark Twain said that history doesn’t repeat, but it often rhymes. Such a scenario could be about to play out in Bitcoin, according to a potential fractal that mimics the setup before a previous record-breaking rally. While the conditions aren’t quite the same for an exact repeat, there could be enough for the price action now and then to rhyme just enough. Let’s take a closer look. Record-Breaking Bitcoin Price Fractal Found, But Is It Valid? Markets are cyclical and patterns repeat in those markets so often, they can be…

Arab Bank Switzerland Is Quietly Getting Into DeFi

“The idea for now is just for our clients to buy, sell and hold some of the most prominent DeFi tokens,” said Braud in an interview. “But we do believe traditional financial institutions will be replaced in the near future by these protocols and we want to be part of this change. So, naturally in the future, we want to go deeper into these kinds of decentralized services.” Source

Fed’s Minutes Report ‘Bludgeons’ Global Markets — Stocks, Crypto, Precious Metals Slip in Value – Economics Bitcoin News

Minutes from the U.S. Federal Reserve’s policy meeting on December 14-15 show that the central bank is being persistent about unwinding quantitive easing (QE) tactics and that it views ultra-low interest rates as no longer necessary. Global markets immediately dropped after the news was published as stock markets roiled, crypto markets shed billions, and precious metals like gold slipped a hair in value as well. US Central Bank Policy Meeting Suggests the QE and Low-Interest Rate Fiesta Is Coming to an End, Global Markets Lose Billions Recently published notes from…