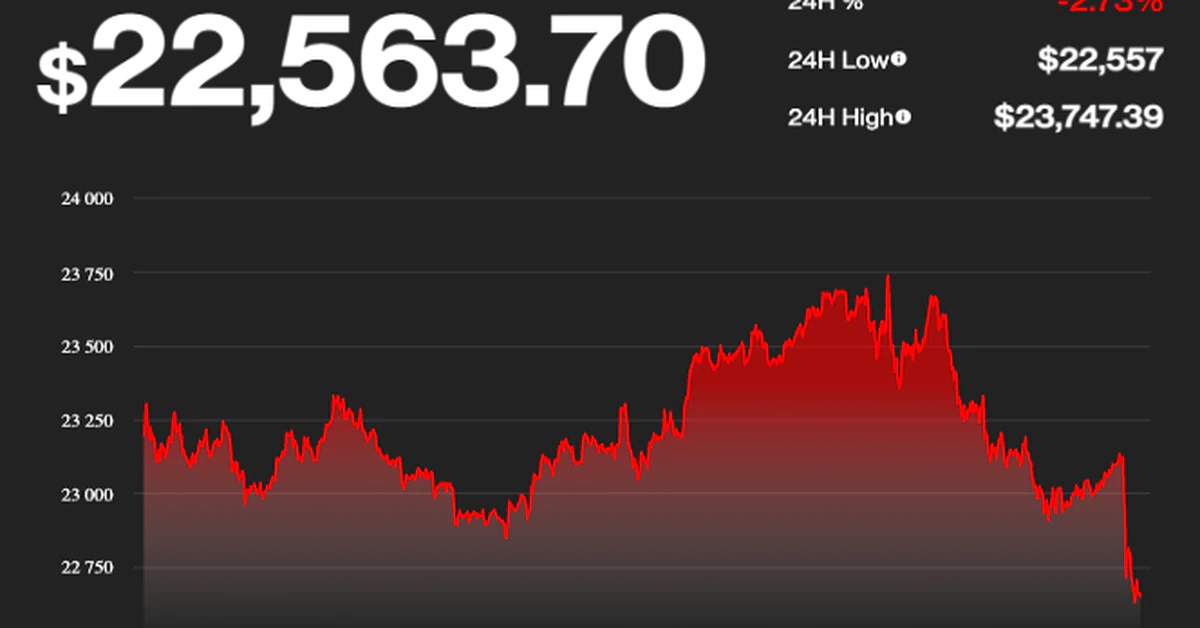

The mood across the cryptocurrency ecosystem is noticeably brighter on July 22 after a week of gains helped traders put the events of the past two months behind them and look toward a positive future. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has been oscillating around support at $23,000 over the past couple of days and continues to hold slightly above its 200-week moving average (MA), which has been a reliable indicator of bear market bottoms in the past. BTC/USDT 1-day chart. Source: TradingView…

Day: July 22, 2022

Bitcoin Finishes the Week in Positive Territory Again

An indicator that we broached earlier this week which bears reexamination is the current level of BTC funding rates. As a reminder, funding rates represent payments to traders that are long or short BTC. They can reflect trader sentiment within futures markets. When funding rates are positive, investors often view this as bullish in nature. Conversely, when funding rates are negative, investors view this as bearish. As it stands, BTC funding rates have been positive every day in July, except July 1, July 10 and July 15. Original

DeFi’s downturn deepens, but protocols with revenue could thrive

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments related to the DeFi lending crisis as Celsius filed for bankruptcy. At a time when bears are more dominant in the current market, DeFi protocols with a revenue system can thrive. Lido Finance has announced plans to offer its Ether (ETH) staking services across the entire L2 system. Aave plans to…

Inflation got you down? 5 ways to accumulate crypto with little to no cost

Experienced crypto traders know that bull markets are for selling and bear markets are for accumulation, but the latter can be difficult amid a backdrop of surging inflation that saps the purchasing power of fiat currencies. As the crypto market heads deeper into crypto winter, with prices in the gutter and developers focused on creating the next popular protocol or breakout token, some crypto fans have begun to explore new ways of increasing their stack in preparation for the next bull market. Here’s a look at the top five ways…

Texas GOP Aims to Enshrine Crypto in State’s Constitution

The Lone Star State is already an important crypto mining hub, and Republican officials would like to build on that momentum. Source

Lohnt sich Bitcoin mining 2022 noch – Hier eine komplette EXCEL Liste mit allen Szenarien!Excel tool

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Lohnt sich Bitcoin mining 2022 noch – Hier eine komplette EXCEL Liste mit allen Szenarien!Excel tool In diesen Video zeig ich euch, meine komplette excel liste ob sich bitcoin mining im jahre 2022 noch lohnt oder ob man sich nach alternative a la helium etc. umsehen sollte! Stromverbrauch difficulty und vieles mehr berücksichtigt! 🔔Hier bei HiveOs registrieren: 🔔Hier bei BITPANDA anmelden(eine Aktie geschenkt!): 🔔Binance registrieren hier und 5% Geschenk!: 🔔Hier bei Bitfinex anmelden: 🔔Hier auf Bittrex anmelden: 🔔Hier auf CoinEx anmelden: 🔔Hier…

Trading Firm Susquehanna Plots Bahamas Crypto Expansion: Sources

Bahamian officials have campaigned for the industry’s business with open arms. The island is ready to be “a home for global leaders” in the crypto space, Prime Minister Philip Davis said at the SALT conference in the Bahamas in May, where Bart Smith, Susquehanna’s crypto lead, also spoke. Source

The 3AC saga takes another bizarre twist

About eight months ago, I vouched pretty strongly for Su Zhu to be included in the prestigious Cointelegraph Top 100. My reasoning was pretty straightforward: Zhu was not only an influential figure on social media, but he ran arguably the most revered hedge fund in crypto — Three Arrows Capital, also known as 3AC. Then, the bear market of 2022 exposed 3AC as a house of cards run by founders who believed their own hype — and made reckless business decisions along the way. With the 3AC saga still unfolding,…

Piden al Banco de Estados de África Central desarrollar una moneda digital común, según informe

El Banco de Estados de África Central funciona como el banco central para los miembros de la Comunidad Económica y Monetaria de África Central (CEMAC), a la que pertenecen Camerún, Gabon, Chad, República del Congo, Guinea Ecuatorial y la República Centroafricana. Source

800k ETH Exits From Gemini

On-chain data shows around 800k ETH has exited wallets of the crypto exchange Gemini, a sign that could prove to be bullish for Ethereum. Crypto Exchange Gemini Observes outflows Of 800k ETH As pointed out by an analyst in a CryptoQuant post, the Ethereum exchange reserve has plunged down to lows not seen since 2018. The “all exchanges reserve” is an indicator that measures the total amount of Ethereum currently stored on wallets of all centralized exchanges. When the value of this metric goes down, it means the number of…