Bitcoin (BTC) has been in a rut, and BTC’s price is likely to stay in its current downtrend. But like I mentioned last week, when nobody is talking about Bitcoin, that’s usually the best time to be buying Bitcoin. In the last week, the price took another tumble, dropping below $19,000 on Sept. 6 and currently, BTC bulls are struggling to flip $19,000–$20,000 back to support. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing literally whatever it takes to combat inflation “until the job…

Day: September 9, 2022

Bitcoin Notches Biggest Gain in 6 Months as Price Soars

BTC’s 10% increase outpaced ETH’s 4.5% climb, which is an aberration, given ETH’s outperformance since July. Most risky assets were higher on the day, as traders appear to be shrugging off Federal Reserve Chairman Jerome Powell’s hawkish comments on inflation. Bitcoin’s outperformance relative to other risky assets on Friday, however, implies that traders see BTC’s recent sell-off as overdone. Source

Bitcoin Price Outlook for September – Market Updates Bitcoin News

Almost ten days into September, market volume in bitcoin has started rising, as traders return to action following the summer break. As volume returns, so does volatility, with this week showing both high levels of bullish and bearish sentiment in the token. Looking forward to the remainder of the month, the main question is undoubtedly whether either of these can prevail, or will price consolidation continue for another month. Current Market Status Last Friday saw the release of August’s non-farm payrolls (NFP). Which showed that 315,000 jobs were added to…

DApp activity rises 3.7% in August for the first time since May: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Decentralized applications, or DApps, finally showed a glimmer of recovery in August as the daily average of unique active wallets rose by 3.7% compared to May. With just under a week left for the Merge, SEBA Bank has opened Ethereum staking services for institutions. On the other side, layer-2 scalability solutions are hopeful of seeing a significant cut in their carbon emissions post Merge.…

Crypto Investor Paradigm Argues Infrastructure Providers Should Not Be Subject to US Treasury Sanctions

Paradigm acknowledged that sanctions can be an important tool to preserve national security, but said it believes base layer participants merely record and order data (which may include sanctioned addresses), but do not actively control sanctioned assets. Paradigm further suggested that stringent regulation would eventually push blockchain innovation offshore, making it more difficult to track crypto transactions for legitimate national security purposes. Source

Blockchain.com abrirá una oficina en Dubai tras obtener aprobación reglamentaria preliminar

El informe señala que el exchange con sede en Londres firmó un contrato con la Autoridad Reguladora de Activos Virtuales (VARA, por sus siglas en inglés) de Dubai, la nueva agencia reguladora de activos digitales de la ciudad, para abrir una oficina en el emirato, aunque todavía no está claro cuándo comenzarán las contrataciones. Source link

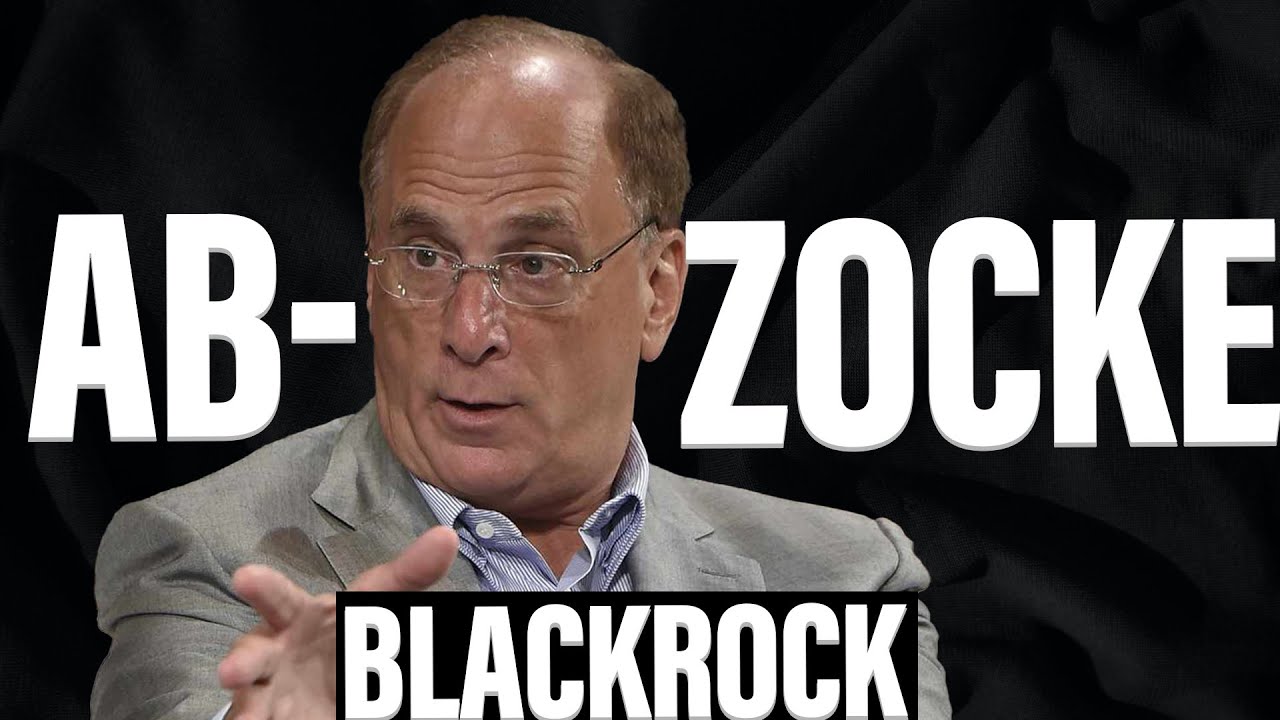

WARNUNG: Blackrocks Plan Mit Bitcoin!!!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io WARNUNG: Blackrocks Plan Mit Bitcoin!!! Mehr zum Thema im Video: ┕ SOCIAL MEDIA ┕ Telegram ▸ ┕ Instagram ▸ KRYPTO KAUFEN ┕ (25 USD geschenkt) ┕ (geringste Gebühren) ┕ (10 USD geschenkt) KRYPTO SICHER LAGERN ┕ BUCHTIPPS: ┕ WERDE KANALMITGLIED: ┕ bitcoin prognose 2022, krypto news heute, bitcoin news, bitcoin news heute, DISCLAIMER: Die Meinung der zitierten Experten stelllen, außer eindeutig hervorgehoben, nicht die Meinung des Kanals dar. Haftungsausschluss: Die Inhalte des Video stellen keine Anlageberatung und keine Kaufempfehlung dar. Das Video…

Why The Ethereum Price Could Rally Above $1,800 Before A Big Crash

The Ethereum price is following Bitcoin as the two largest cryptocurrencies by market capitalization trend to the upside. The market is currently facing low timeframe resisting, but the general sentiment seems to have flipped bullish across the board. At the time of writing, Ethereum price trades at $1,700 with a 5% and 7% profit in the last 24 hours and 7 days, respectively. In the meantime, Bitcoin is outperforming with a 10% profit over the past trading session. ETH’s price with minor gains on the 4-hour chart. Source: ETHUSDT Tradingview…

Senadores presionan a Mark Zuckerberg para combatir las estafas con criptomonedas

“Desde el 1 de enero de 2021 hasta el 31 de marzo de 2022, el 49% de las denuncias por fraude realizadas ante la FTC que están relacionadas con criptomonedas afirman que la estafa comenzó en redes sociales”, escribió el grupo, y destacó que esto les costó a los consumidores un total de US$417 millones. Source

3 Bitcoin price metrics suggest Sept. 9’s 10% pump marked the final cycle bottom

The correlation between Bitcoin (BTC) and stock markets has been unusually high since mid-March, meaning the two asset classes have presented near-identical directional movement. This data might explain why the 10% rally above $21,000 is being dismissed by most traders, especially considering S&P 500 futures gained 4% in two days. However, Bitcoin trading activity and the derivatives market strongly support the recent gains. Curiously, the current Bitcoin rally happened a day after the White House Office of Science and Technology Policy released a report investigating the energy usage associated with…