An alternative investment company, Valkyrie, has added $73.6 million in capital into two crypto-focused trust funds. Valkyrie initially had $1.2 billion in assets under management at the end of the second quarter. This information is in amended filings with the United States Securities and Exchange Commission (SEC). Over the years, crypto investments and Decentralized finance have proven to be a great alternative to the traditional finance system. It could be because DeFi has a way to boycott the bureaucracy in the financial system. Decentralized Finance (DeFi) allows the use of…

Day: September 16, 2022

US Treasury publishes laundry lists of crypto risks for consumers, national security

The United States Treasury Department released three publications related to digital assets Friday, in response to U.S. President Joe Biden’s Executive rder “Ensuring Responsible Development of Digital Assets.” One of them focuses specifically on crypto assets, and a shorter action plan looks at countering illicit finance risks. The discussion of crypto assets in “Crypto-Assets: Implications for Consumers, Investors, and Businesses” takes a cynical tone from the beginning, with the introductory paragraphs of the report stating: “The potential for blockchain technology to transform the provision of financial services, as espoused by…

Proof-of-Work Proponents Question Validator Censorship as 59% of Staked Ethereum Is Held by 4 Companies – Bitcoin News

Prior to The Merge, Ethereum used to have dozens upon dozens of mining pools dedicating hashrate toward the blockchain network. That has all changed and most of the miners transitioned or plan on transitioning to other Ethash compatible coins like ethereum classic, ERGO, and the new fork ETHW. Now Ethereum blocks are verified by validators and at the time of writing, there are 429,278 validators. However, a great deal of the 13.7 million staked ethereum is held by four known providers. 4 Known Providers Hold 59% of the Staked Ethereum…

Coinbase podría registrar ingresos de US$1200M el próximo año por la suba de las tasas de interés, según JPMorgan

Solo la alianza entre Coinbase y Circle, el emisor de USDC, podría contribuir con alrededor de US$700 de ingresos adicionales, estimó JPMorgan. Las dos compañías se unieron en 2018 para formar una empresa conjunta llamada CENTRE Consortium, la cual incluía una participación en los ingresos generados por los intereses de las reservas de USDC. Source

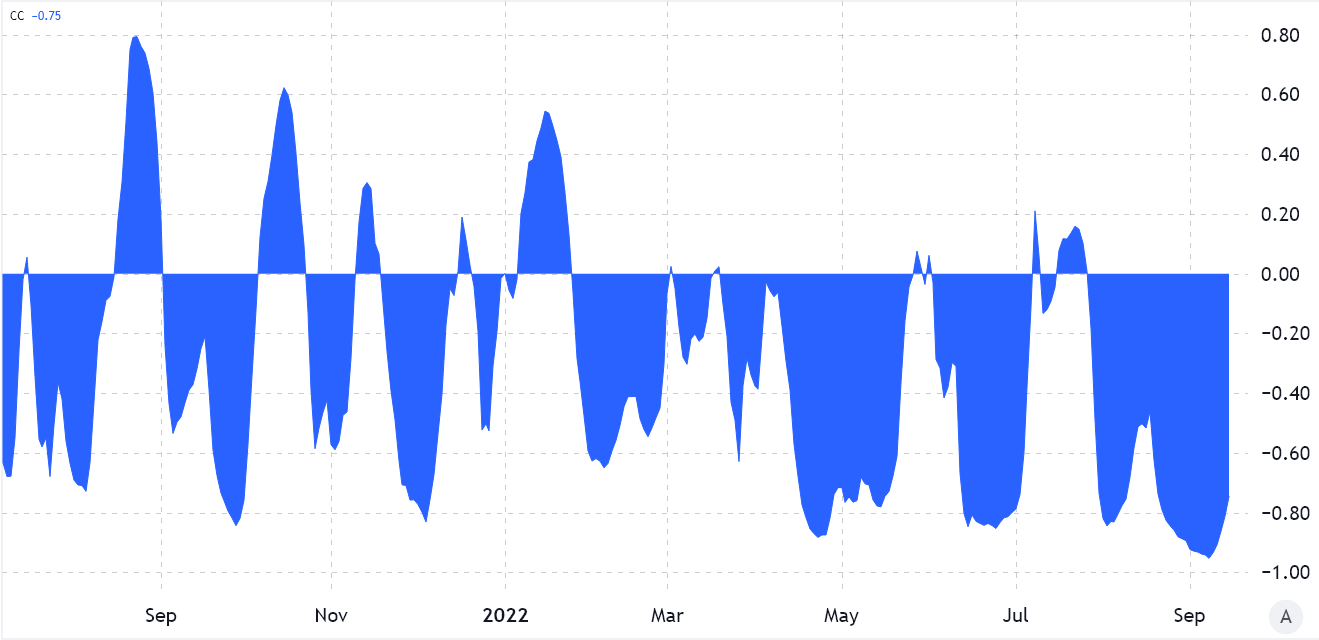

Data challenges the DXY correlation to Bitcoin rallies and corrections ‘thesis’

Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative. Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher. Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index. This is…

Bitcoin and Ether Close the Week Lower

● Bitcoin (BTC): $19,621 −0.9% ● Ether (ETH): $1,434 −4.4% ● CoinDesk Market Index (CMI): $974 −1.4% ● S&P 500 daily close: 3,873.24 −0.7% ● Gold: $1,684 per troy ounce +1.1% ● Ten-year Treasury yield daily close: 3.45% −0.01 Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices. Original

The Latest Innovations in Bitcoin Mining – Bitcoin 2022 Conference

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin 2022 Conference – Innovations in the Mine Powered by Bitdeer: #bitcoin2022 #bitcoinmagazine #Renewables Austin Storms VP Bitcoin Mining Operations, Galaxy Digital Jonathan Yuan Owner, Coin Heated – @coinheated ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Two Sigma Ventures Raises $400M for Two Funds, Plans Crypto Investments

The early-stage focused Two Sigma Ventures IV fund and growth-stage Opportunity Fund will invest across a number of industries, including enterprise software, financial technology and consumer technology. The company doesn’t have a dedicated crypto fund, but about 15% of its capital will go toward crypto and Web3 projects, Two Sigma partner Dan Abelon told CoinDesk during an interview. Source

Binance Bungles Accounting for Helium Tokens, Overpays Clients Millions

The Helium network has two tokens, HNT and MOBILE. Binance counted them as one, HNT, resulting in a windfall for customers who deposited the MOBILE. Source

The floppening? Ethereum price weakens post-Merge, risking 55% drop against Bitcoin

Ethereum’s native token Ether (ETH) has been forming an inverse-cup-and-handle pattern since May 2021 on the weekly chart, which hints at a potential decline against Bitcoin (BTC). ETH/BTC weekly price chart featuring inverse cup-and-handle breakdown setup. Source: TradingView An inverse cup-and-handle is a bearish reversal pattern, accompanied by lower trading volume. It typically resolves after the price breaks below its support level, followed by a fall toward the level at a length equal to the maximum height between the cup’s peak and the support line. Applying the theoretical definition on ETH/BTC’s…