Three crypto venture capital firms, Paradigm, Pantera Capital, and Andreessen Horowitz (a16z), may have over $5b tied up in Silicon Valley Bank (SVB). Crypto venture funds used Silicon Valley Bank Funds were reportedly held in custody by SVB, which was shut down and the Federal Deposit Insurance Corporation (FDIC) assigned as a receiver by the California Department of Financial Protection and Innovation on Mar. 10. Unconfirmed data, scrapped from the United States Securities and Exchange Commission (SEC) ADV file data over five years, shows that as of May 6, 2022, a16z related…

Day: March 12, 2023

Silicon Valley Bank collapse: Everything that’s happened until now

Events surrounding Silicon Valley Bank are moving fast. Here is a breakdown of the major developments over the course of three days. The sudden collapse of Silicon Valley Bank (SBV) has quickly unfolded over the course of three days, depegging stablecoins, leading regulators in the United States and United Kingdom to prepare emergency plans and raising fears among small businesses, venture capitalists and other depositors with funds stuck at the California tech bank. Cointelegraph’s team compiled a roundup of the latest and major developments surrounding the troubled bank: March 10:…

Bitcoin Rises on Report Government Weighing Plan to Protect All Silicon Valley Bank Depositors

Bitcoin Rises on Report Government Weighing Plan to Protect All Silicon Valley Bank Depositors Original

Silicon Valley Bank Failure Highlights Dangers of Fractional-Reserve Banking – Economics Bitcoin News

After the failure of Silicon Valley Bank (SVB), a great deal of Americans are starting to realize the dangers of fractional-reserve banking. Reports show that SVB suffered a significant bank run after customers attempted to withdraw $42 billion from the bank on Thursday. The following is a look at what fractional-reserve banking is and why the practice can lead to economic instability. The History and Dangers of Fractional-Reserve Banking in the United States For decades, people have warned about the dangers of fractional-reserve banking, and the recent ordeal of Silicon…

Earn Daily from Crypto Trading | 100% Proven Strategy to Make Money from Cryptocurrency | Bitcoin

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io अस्वीकरण: क्रिप्टो (crypto) उत्पाद और एनएफटी (NFTs)अनियमित हैं और अत्यधिक … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Investors confident in avalanche, DigiToads, and cardano in 2023 despite recent losses

The cryptocurrency industry is no stranger to the bull market, which describes the upswing in crypto asset prices. With the potential for gains, many investors are constantly looking for the next initiators of a bull run. DigiToads (TOADS), avalanche (AVAX), and cardano (ADA) are three cryptocurrencies that have the potential to rejuvenate the crypto market this year despite losses in early March. Recently we have seen a surge in interest in these projects, setting investors’ and analysts’ hopes high. DigiToads (TOADS) DigiToads is a play-to-earn cryptocurrency that enables users to…

Bank of London bids to acquire Silicon Valley Bank’s UK arm

Global clearing institution Bank of London has submitted a formal proposal to acquire the Silicon Valley Bank’s subsidiary in the United Kingdom, according to a statement disclosed by Reuters on March 12. As per the statement, the purchase is an effort from a consortium of private equity firms: “A consortium of leading private equity firms, led by The Bank of London, confirms it has submitted formal proposals to His Majesty’s Treasury, The Prudential Regulation Authority at The Bank of England and the Board of Silicon Valley Bank UK.” Reuters earlier…

The US government will only help Silicon Valley Bank depositors

On Mar. 12, United States Treasury Secretary Janet Yellen assured Silicon Valley Bank (SVB) depositors that policies were being discussed to recover lost funds. Bail Out or Not Speaking during CBS’s Face the Nation, Yellen reassured SVB depositors and dismissed the idea of a bailout, stating that “the reforms that have been put in place means we are not going to do that again.” She added that the United States banking system is “safe and well-capitalized” and “resilient.” Speaking with CBS on Sunday, Yellen dismisses idea of a bailout for SVB but sought to…

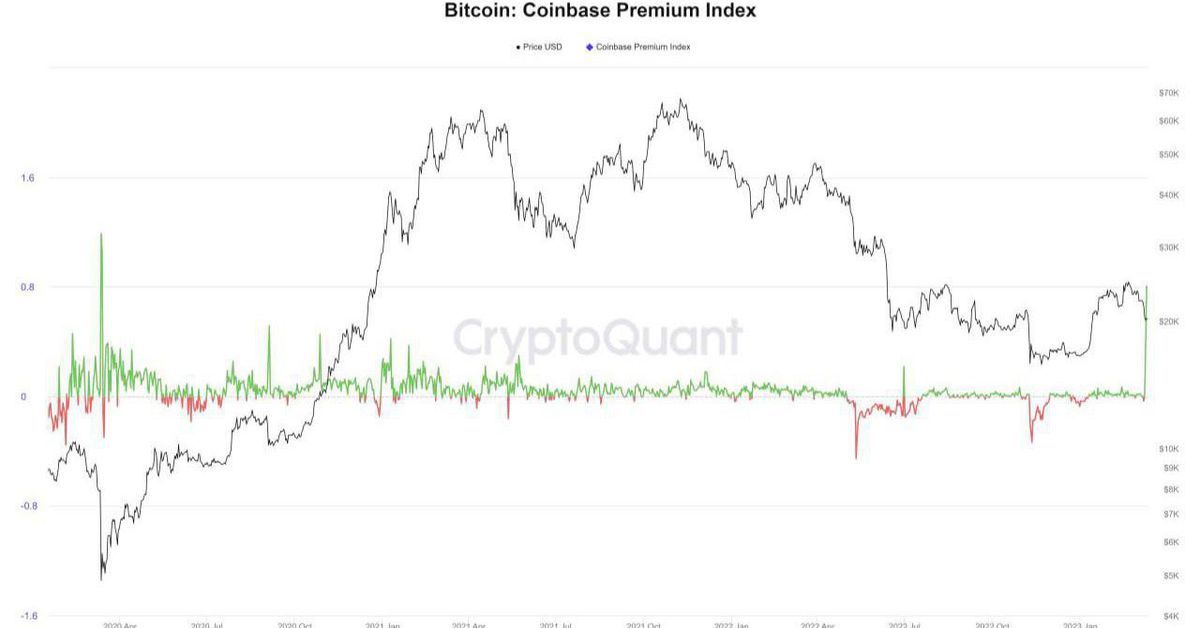

USDC Volatility Lifts Bitcoin’s Coinbase Premium to 3-Year High

“When news broke that Circle’s funds were stuck in Silicon Valley Bank, users rushed to redeem their USDC for USD,” Ignas said. “On Coinbase, users could redeem 1 USDC for $1.00, but Coinbase suspended conversions over the weekend when banks are closed, which worsened the situation, leaving traders with no option but to liquidate holdings in the spot market.” Source

Silicon Valley Bank Under FDIC Auction as Calls for Bailout Grow – Bitcoin News

The U.S. Federal Deposit Insurance Corporation (FDIC) began an auction process for Silicon Valley Bank (SVB) late Saturday night, according to reports. Final bids are due by Sunday afternoon. Unnamed sources indicate that the FDIC is seeking to close the deal promptly after California regulators closed the bank and placed it into FDIC receivership on Friday. Sources Say FDIC Is Working Swiftly to Sell Off SVB Assets as Final Bids Due by Sunday Afternoon The collapse of Silicon Valley Bank (SVB) has caused a significant stir in the United States,…