The collapses of Signature Bank and Silicon Valley Bank have left many people in disbelief, with skeptics questioning the stability of the traditional financial system. Cryptocurrency, sadly, did not do much to capitalize on that skepticism, considering Bitcoin (BTC) tanked at the first sign of trouble for USD Coin (USDC), which briefly lost its peg to the dollar. Still, the crisis also provided a golden opportunity for the crypto industry to demonstrate its resilience and offer viable alternatives. As faith in the traditional banking system wanes due to SVB causing…

Day: March 20, 2023

Lido’s Staked Ethereum Token STETH Reaches $10.3B Market Capitalization, Ranks Ninth by Market Valuation – Defi Bitcoin News

With the crypto economy experiencing significant gains over the past week and the price of ethereum rising 11.9%, the market capitalization of Lido’s staked ether has increased to $10.3 billion. This recent increase has propelled the token’s overall market valuation to the ninth-largest position, according to the crypto market capitalization aggregation website coingecko.com. Lido Finance’s TVL Dominates Defi with a 21.59% Share The value of liquid staking tokens associated with ethereum (ETH) has increased significantly over the last week following ether’s 11.9% gains against the U.S. dollar. In particular, Lido’s…

Investors shelter in short-term Treasuries, reducing Bitcoin’s chance of rallying to $30K

The price of Bitcoin (BTC) surpassed $28,000 on March 21, but according to two derivatives metrics, traders aren’t very ecstatic after a 36% gain in eight days. Looking beyond Bitcoin’s stellar performance, there are reasons why investors are not fully confident in further price upside The recent rescue of Credit Suisse, a 167-year-old leading Swiss financial institution, is proof that the current global banking crisis might not be over. On March 19, Swiss authorities announced that UBS had agreed to acquire rival Credit Suisse in an “emergency rescue” merger in…

Belgian FSMA surveys crypto investors before taking on new ad regulation authority

The Belgian Financial Services and Markets Authority (FSMA) will have new powers to supervise virtual currency advertising when a new regulation comes into force on May 17. In preparation for its new role, the agency commissioned a survey of investors. The new regulation will have three aspects. First, it will require accuracy and clear language, with no statements on future returns of value. Second, there will be a mandatory warning on all advertising: “Virtual currencies, real risks. The only guarantee in crypto is risk.” In addition, a “broader warning should…

Ethereum Virtual Machine l EVM Explained in Hindi

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Myself Shridhar Mankar a Engineer l YouTuber l Educational Blogger l Educator l Podcaster. My Aim- To Make Engineering … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Scott Melker tells the story of how he became The Wolf of All Streets

Scott Melker, commonly known in the crypto space as “The Wolf of All Streets,” tells the story of how he went from performing very poorly trading stocks and mutual funds to becoming one of the most-followed crypto analysts in the industry. In the latest episode of Cointelegraph’s Crypto Stories, Melker narrates the tale of how the name The Wolf of All Streets came about. According to Melker, it all started as a joke, as he was also known for being a disc jockey. He explains: “Somebody jokingly told me that…

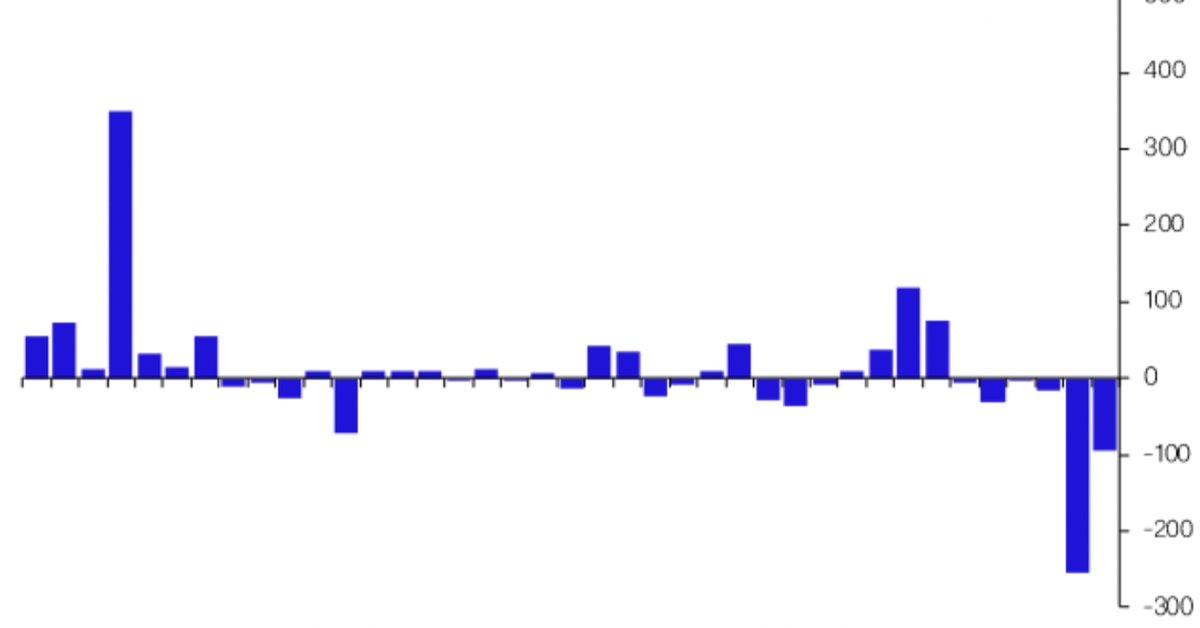

Digital Asset Outflows Continue for 6th Week Despite Bitcoin Price Surge

Overall, the data may reflect a need for liquidity among investors, according to CoinShares. Meanwhile, the largest cryptocurrency by market value’s price has surged from a low of about $19,400 in early March to its current level near $28,000. Over the past week, bitcoin has risen almost 15%. Original

Polygon, Immutable zkEVM to tackle ‘huge incumbents exploiting players’

Gaming developers are getting a new platform on which to build Web3 games, with a tie-up between Polygon Labs and Immutable set to launch a new zero-knowledge Ethereum Virtual Machine (zkEVM). The partnership sees the two Ethereum layer-2 firms create an “Immutable zkEVM” — a Polygon (MATIC)-powered zkEVM fully supported on Immutable’s Web3 game development platform. Scheduled for a March 27 mainnet beta launch, Polygon’s zkEVM enables the validation of mass amounts of transaction data by bundling them up into one transaction that’s then confirmed on the Ethereum network. The…

Price analysis 3/20: SPX, DXY, BTC, ETH, BNB, XRP, ADA, MATIC, DOGE, SOL

Bitcoin continues to trade near $28,000, signaling a strong demand from investors even as the legacy banking system struggles with unprecedented volatility. The takeover of the ailing Credit Suisse bank by UBS boosted European equity markets on March 20, but not everyone is happy with the deal. According to the Swiss Financial Market Supervisory Authority, the value of additional tier-one (AT1) bonds will be written to zero, which will wipe out $17 billion worth of investments for AT1 bond investors. Among the turmoil in the global banking sector, Bitcoin (BTC) has shone…

Credit Suisse’s Buyout Shows Banks Still Have a Banking Problem

CryptoX is a multi-platform publisher of news and information. CryptoXtrade has earned a reputation as the leading provider of cryptocurrency news and cryptomarket analysis, bitcoin and other cryptocurrencies, blockchain technology, finance and investments. CryptoXtrade have become a known leader in the cryptocurrency information market. We work only with trusted information sources providing latest financial and technological innovations that improves the quality of life of CryptoX readers by focusing on Cryptocurrency and Blockchain. CryptoX Portal