The United States Commodity Futures Trading Commission (CFTC) filed suit against Binance on March 27 for violations of the Commodities Exchange Act and CFTC regulations. Those violations included transactions with Ether (ETH), according to the suit. This claim, at first glance, touched on a notable point of contention between the CFTC and the Securities and Exchange Commission (SEC). The CFTC claimed in its suit that Binance engaged in transactions with “digital assets that are commodities including Bitcoin (BTC), Ether (ETH), and Litecoin (LTC) for persons in the United States.” That…

Day: March 27, 2023

A Privacy-Protecting U.S. CBDC Could ‘Take Over the World’

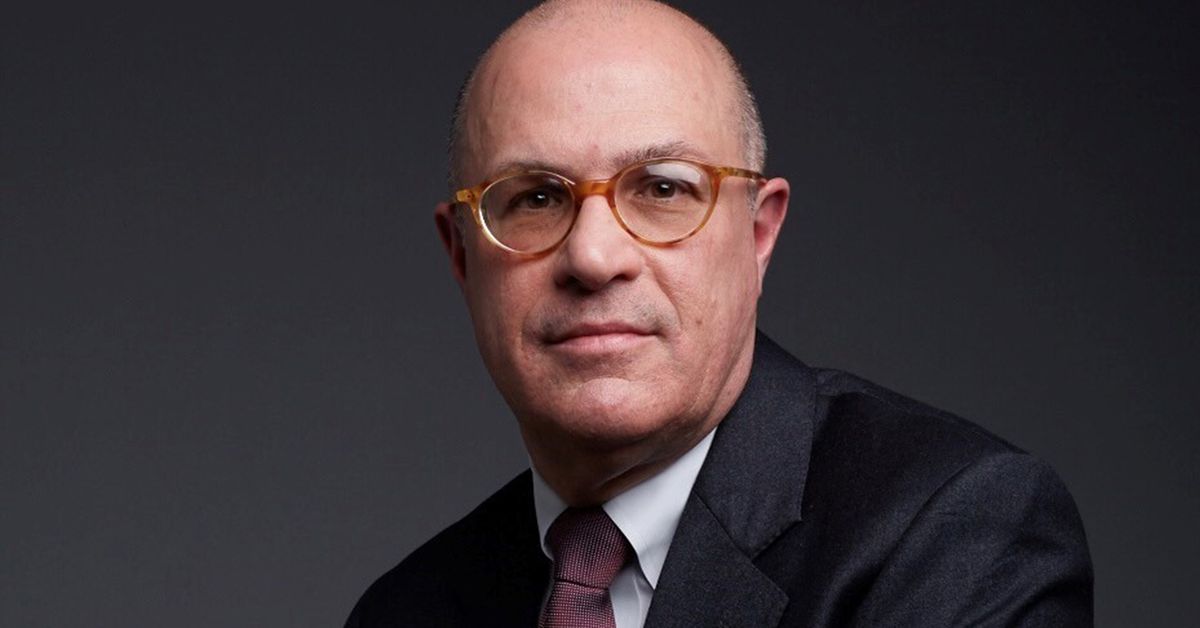

“Where I differ with them is the assumption that we in America, the world’s most ingenuitive nation history’s ever known, could not design a very different central bank digital currency,” Giancarlo said. He added that if the digital dollar is created using open architecture, it could potentially satisfy users’ surveillance concerns. Source

Twitter Suspends Official Arbitrum Account

The co-founder of Offchain Labs, the company behind Arbitrum, Harry Kalodner confirmed the suspension in a text message to CoinDesk, though he said he was unsure of Twitter’s rationale. “The Arbitrum Foundation which now controls that account is investigating,” said Kalodner. Source

Binance Depositors Flee Following CFTC Charges, On-Chain Data Shows

In the last 24 hours, Binance has seen a net outflow of $400 million on Ethereum, according to blockchain analytics firm Nansen. This compares to a net flow of $2 billion over the past seven days. Savvy traders who Nansen considers “smart money” operators have also removed $9 million over the last 24 hours from Binance as of presstime. Source

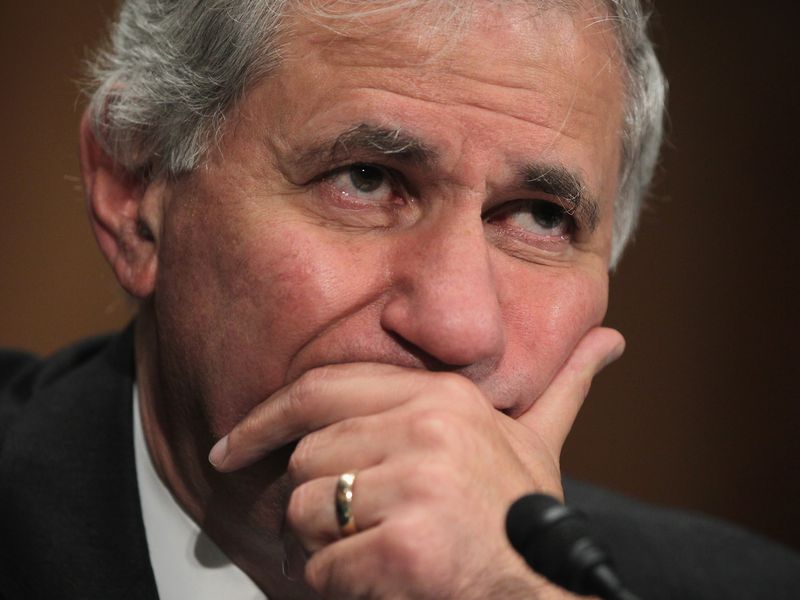

U.S. Bank Regulators Investigating Leaders of the Failed Tech Banks

Barr said the bank was a “textbook case of mismanagement.” And its government minders were well aware it had serious problems. In 2021, the supervisors found issues with its liquidity management, and in 2022, they determined an array of problems with board oversight, risk management and internal auditing, Barr said. That summer, they dropped the bank’s management and governance ratings to alarm-bell levels, subjecting it to growth restrictions. Original Source BankBanksfailedInvestigatingLeadersRegulatorsTechU.S CryptoX Portal

Experts Predict More Bank Failures in the US Following Interest Rate Hike and Unsettled Banking Crisis – Economics Bitcoin News

After the recent bank collapses in the U.S., a number of people believe that more failures are coming following the Federal Reserve’s increase of the benchmark interest rate by 25 basis points (bps). American journalist Charles Gasparino insists that Wall Street’s “low-rate” junkies are ignoring the U.S. banking crisis. Quill Intelligence CEO Danielle DiMartino Booth asserts that the banking industry is facing problems that “nobody wants to call a banking crisis.” Ignoring the U.S. Bank Crisis There have been numerous opinions and statements from financial experts and officials following the…

Ted Cruz and Ron DeSantis take on the ‘digital dollar’: Law Decoded, March 20–27

Two lawmakers in one week weighed in against the possibility of a United States central bank digital currency (CBDC). Florida Governor Ron DeSantis — expected by many to throw his hat into the ring for the 2024 U.S. presidential race — has called for a ban on a digital dollar in the state. DeSantis spoke out against the Federal Reserve issuing and controlling a CBDC, claiming the initiative would grant “more power” to the government. Texas Senator Ted Cruz went even further, introducing a bill to block the Fed from…

An overview of fake product detection using blockchain technology

Digital identities can help in fake product detection by providing a unique and verifiable identity to each product, making it easier to track its movements through the supply chain and verify its authenticity, thereby preventing the circulation of fake products. In the modern era of e-commerce, the problem of fake products is prevalent, and it poses significant risks to both consumers and manufacturers. However, digital identities can play a crucial role in detecting and preventing fake products from entering the market. Digital identities provide a secure and reliable means to…

US Crypto Firms Eye Overseas Move Amid Regulatory Uncertainty

Most stayed put, however. It’s easy to joke about moving to Montreal but harder to actually do it, which is something many crypto companies are discovering. “The United States, overall, has the best infrastructure and support for small businesses in general,” says Kuveke, who has found it easier to do banking in the U.S. than Portugal, where he says the banks are “mind-bogglingly terrible.” And moving to another country is “not a casual process,” says Kuveke, because it involves a gauntlet of paperwork and approvals and is “many months of…

Crypto market rally stalls at the $1.2T level, but bulls are getting positioned

After gaining 11% between March 16 and March 18, the total crypto market capitalization has been battling resistance at the $1.2 trillion level. This same level was reached on August 14, 2022 and was followed by a 19.7% decline to $960 billion over the next two weeks. During the lateralization period between March 20 and March 27, Bitcoin (BTC) gained 0.3%, while Ether (ETH) posted modest gains of 1.6%. Total crypto market cap in USD, 12-hour. Source: TradingView One source of favorable short-term momentum is a change in the Federal…