The race to list the first spot-traded Bitcoin (BTC) exchange-traded fund (ETF) in the United States has seen the entrance of major financial institutions like BlackRock, Fidelity and VanEck. While the U.S. Securities and Exchange Commission (SEC) first approved a Bitcoin-linked Futures ETF in October 2021, the current filings are for spot Bitcoin ETFs. Following Grayscale’s recent legal victory against the SEC’s review of its spot Bitcoin ETF proposal, many now believe approval of the investment funds is more likely. The interest of BlackRock — the world’s largest asset manager…

Day: September 4, 2023

Bernstein Says Crypto ETFs Could Extend beyond Bitcoin and Ethereum

Bernstein analysts believe that diversification presents a significant commercial opportunity for asset managers. It allows them to enter the rapidly growing digital asset market and benefit from increased demand and market growth. In the world of finance, few innovations have garnered as much attention and excitement as the potential launch of crypto exchange-traded funds (ETFs). Bitcoin (BTC) has been the center of attention in finance for years, but the advent of crypto ETFs is poised to introduce a new era of diversified digital asset investments. Analysts at Bernstein believe that…

Expert Market Analysts Agree A Spot Bitcoin ETF Is A Matter Of When, Not If

The crypto community has been kept at the edge of its seat as the SEC decided to postpone a decision on the 7 Spot Bitcoin ETFs filed over the last few months. During such a pensive time, market analysts have predicted the SEC authorizing a Spot Bitcoin ETF while the former SEC Chairman foresees a losing battle for the regulator. JP Morgan Analysts Foresee ETFs Approval The United States Securities and Exchange Commission (SEC) and Grayscale, an American digital currency investing and crypto asset management company have been embroiled in…

SEC Likely to Approve Bitcoin ETFs after Grayscale’s Win

The analysts noted that the SEC may have to approve Grayscale’s ETF proposal and potentially other spot-based Bitcoin ETFs in order to maintain regulatory consistency. JPMorgan Chase & Co (NYSE: JPM) has predicted that the United States Securities and Exchange Commission (SEC) will be compelled to approve spot Bitcoin (BTC) Exchange-Traded-fund (ETF) applications from various asset managers following Grayscale’s favorable court ruling. Grayscale Investments, a prominent player in the crypto space, had been seeking SEC approval to convert its Grayscale Bitcoin Trust (GBTC) into an ETF for some time. However,…

Tharman Shanmugaratnam, Singapore’s New President, Says Crypto Is ‘Slightly Crazy’

That was a role he held between 2011 and 2023, overlapping his time as finance minister between 2007 and 2015. He began his career as an economist at the MAS in 1982 after a receiving a Bachelor of Science in Economics from the London School of Economics, a Master of Philosophy in Economics from the University of Cambridge and a Master in Public Administration from Harvard University’s Kennedy School of Government. He was also short-listed for the top job at the International Monetary Fund (IMF). Shanmugaratnam spent 22 years as…

Australia Senate Committee Rejects Crypto Bill Proposed by Opposition Senator

“The Senate Committee was expected to report on this Bill over a month ago and the industry has been eagerly awaiting Treasury consultation on crypto-custody and licensing,” said Blockchain Australia Chair and Digital Assets Lawyer Michael Bacina. “That consultation should be able to build on the industry submissions published as part of the Senate Committee’s review of this Bill.” Source

London Stock Exchange will develop a blockchain-based project

According to an executive, the London Stock Exchange Group is moving forward with the development of a blockchain-powered trading venue. Murray Roos, head of capital markets at the LSE Group, explained to a Financial Times that Julia Hoggett, director of the London Stock Exchange, will lead the next blockchain project. Roos added that the institution has been researching the potential benefits of using blockchain for its new project, but it won’t be crypto-related. The executive stated that the idea would be to use blockchain technology to make the new project…

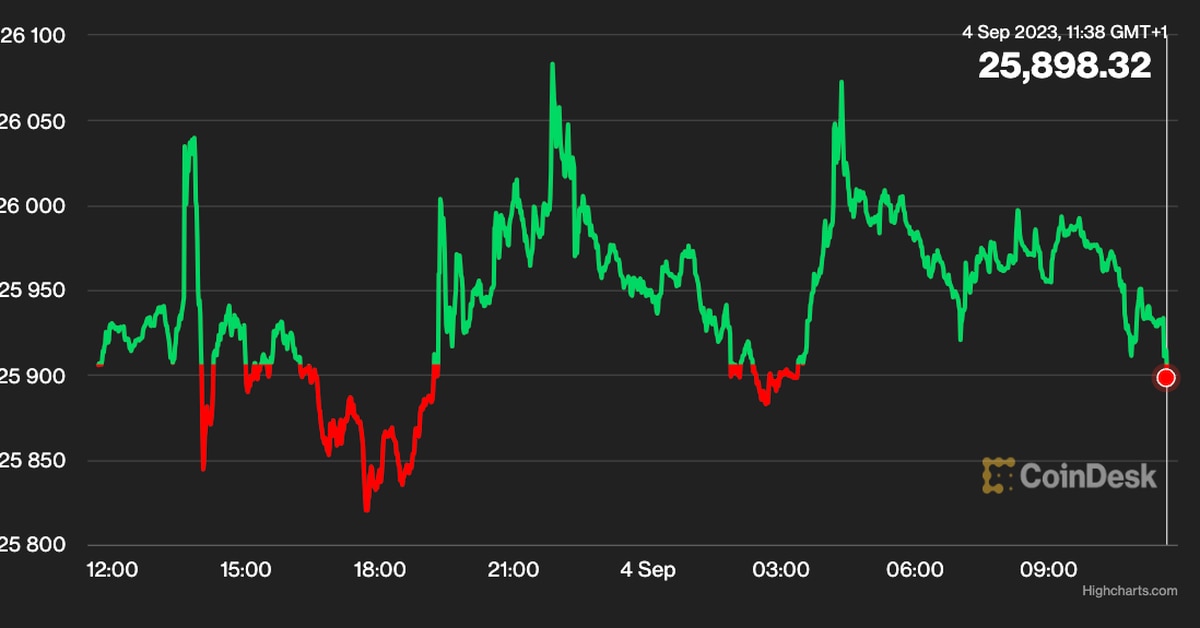

Bitcoin (BTC) Hovers Below $26K; Stellar’s XLM Rallies

Bitcoin traded in a tight range in the past 24 hours, staying between $25,800 and $26,000 after a price spike last week when the cryptocurrency topped $28,000 after a federal appeals court ruled the SEC must review its rejection of Grayscale Investments’ attempt to convert its GBTC into an ETF. Bitcoin retreated as the SEC delayed key ETF decisions that were expected on Friday, damping traders’ hopes of a long-term recovery. “As we enter September, the cryptoasset market remains on the edge of its seat as various macroeconomic and regulatory…

Ronaldo teases NFT plans while on a lie detector test

Soccer legend Cristiano Ronaldo went through a lie detector test to answer various questions about soccer and teased his plans to release more nonfungible token (NFT) collections in the future. The lie detector test video was done as the soccer star released his second NFT collection in partnership with crypto exchange Binance. The collection was released in July to celebrate the athlete’s reign as the highest goal scorer in the sport. Soccer star Cristiano Ronaldo was put under a lie detector test. Source: Binance The video allowed soccer fans to…

US DoJ Says FTX Advertisement Blur Lines between FTX.US and International Business

The DoJ has said that advertisements for FTX did not differentiate between the US arm and the global business. According to the Department of Justice (DoJ), the FTX ads featuring American footballer Tom Brady and comedian Larry David show little distinction between the exchange’s US arm and its international business. According to a Friday filing, the DoJ said the celebrities in the ads describe FTX as an easy and safe way to use crypto, using a device showing the FTX logo and not FTX.US. The DoJ also said that several internal…