3 Big Drivers Determining the Future of Crypto in the U.S. Source

Day: September 13, 2023

DCG proposes repayment plan for Genesis creditors

Digital Currency Group (DCG), the parent company of the insolvent crypto lending firm Genesis, is pushing for a repayment plan for its creditors, which includes participants in the Gemini Trust Co.’s Earn program. In a filing on Wednesday, Sep. 12, DCG assured Gemini Earn program investors that they could potentially receive complete reimbursement, equal to or even exceeding their initial investment. Partial repayments will be made in Bitcoin (BTC) and Ethereum (ETH). The filing also indicates that other unsecured creditors of Genesis could potentially recover between 70% and 90% of…

What Will Be the Next Target of the SEC's Enforcement Regime?

What Will Be the Next Target of the SEC's Enforcement Regime? Source

Lazarus Group reportedly behind the $54m CoinEx hack

Lazarus Group, the hacker group believed to be sponsored by the North Korean government, is allegedly responsible for attacking CoinEx, a crypto exchange, according to blockchain security experts SlowMist and on-chain sleuth ZachXBT. Wallets involved in draining funds from CoinEx on Sep. 12 also participated in stealing $41 million from Stake.com, the crypto casino. Attackers siphoned millions in digital assets from the operators’ hot wallets in both cases. It appears North Korea is also responsible for the $54M @coinexcom hack from yesterday after they accidentally connected their address to the…

SWIFT enrolls 3 central banks in CBDC interoperability beta test, expands sandbox

Three central banks have joined the beta phase of bank messaging platform SWIFT’s central bank digital currency (CBDC) interoperability project, the company announced Sept. 13. It has also entered a new phase of sandbox testing, it said. The Hong Kong Monetary Authority, the Central Bank of Kazakhstan and an unnamed central bank have integrated their infrastructure with SWIFT’s “CBDC connector solution” for direct testing, the company said. The first phase of sandbox testing began in March with a lineup of over 18 participants, including Royal Bank of Canada, Banque de…

SEC Charges Stoner Cats With Alleged Unregistered $8 Million Securities Sale In NFT Crackdown

In a recent move that intensifies the Securities and Exchange Commission’s (SEC) crackdown on the Non-Fungible Token (NFT) sector, the SEC has charged Stoner Cats 2 (SC2) with conducting an “unregistered offering of crypto asset securities.” The charges specifically target Stoner Cats’ sale of non-fungible tokens, which raised approximately $8 million from investors to finance the production of an animated web series. SEC’s Legal Earthquake Hits NFT Market Once Again The SEC order reveals that on July 27, 2021, SC2 sold over 10,000 NFTs to investors at approximately $800 each,…

Phishing Attack on Cloud Provider With Fortune 500 Clients Led to $15M Crypto Theft From Fortress Trust

A phishing attack on Retool led to the theft, which helped spur Fortress Trust’s agreement to sell itself to Ripple, sources said. Source

Alibaba launches its ChatGPT-like AI model for public use amid loosening restrictions in China

Alibaba announced that its proprietary large language model, an artificial intelligence system called Tongyi Qianwen, will be available for public and enterprise access throughout China starting Sept. 13. Tongyi Qianwen is a ChatGPT-like large language model trained on a corpus of English and Chinese text. While its exact specifications aren’t known — early rumors indicated it would be trained with as many as 10 trillion parameters, 10 times as many as OpenAI’s GPT4, but these remain unsubstantiated — Alibaba previously released two 7 billion-parameter open-source models based on the Tongyi…

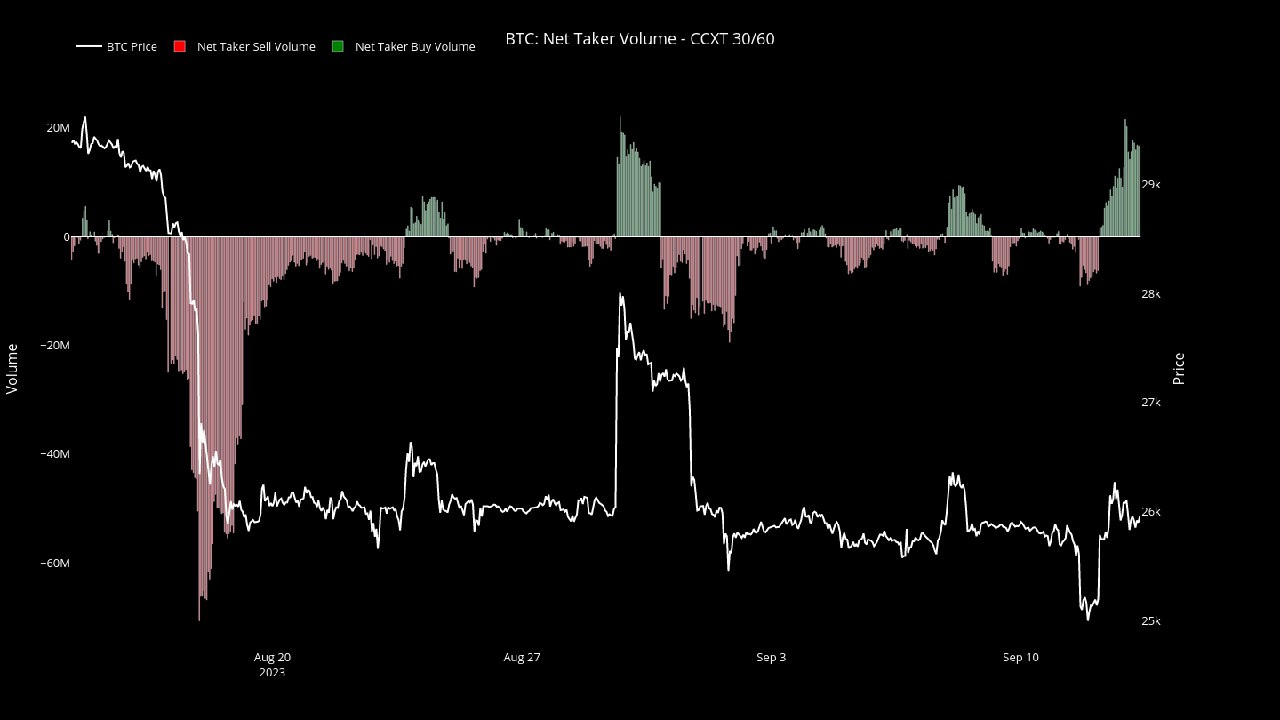

Bitcoin Net Taker Volume Turns Highly Positive, Bullish Sign?

Data shows the Bitcoin Net Taker Volume has turned significantly positive recently, a sign that may be bullish for the asset. Bitcoin Net Taker Volume Has Risen To Positive Values Recently In a new post on X, the CryptoQuant Netherlands Community Manager, Maartunn, pointed out that buying activity appears to be occurring in the market. The relevant indicator here is the “Net Taker Volume,” which measures the difference between the Bitcoin taker buy and taker sell volumes. When this metric has a positive value, the taker’s buy volume is greater…

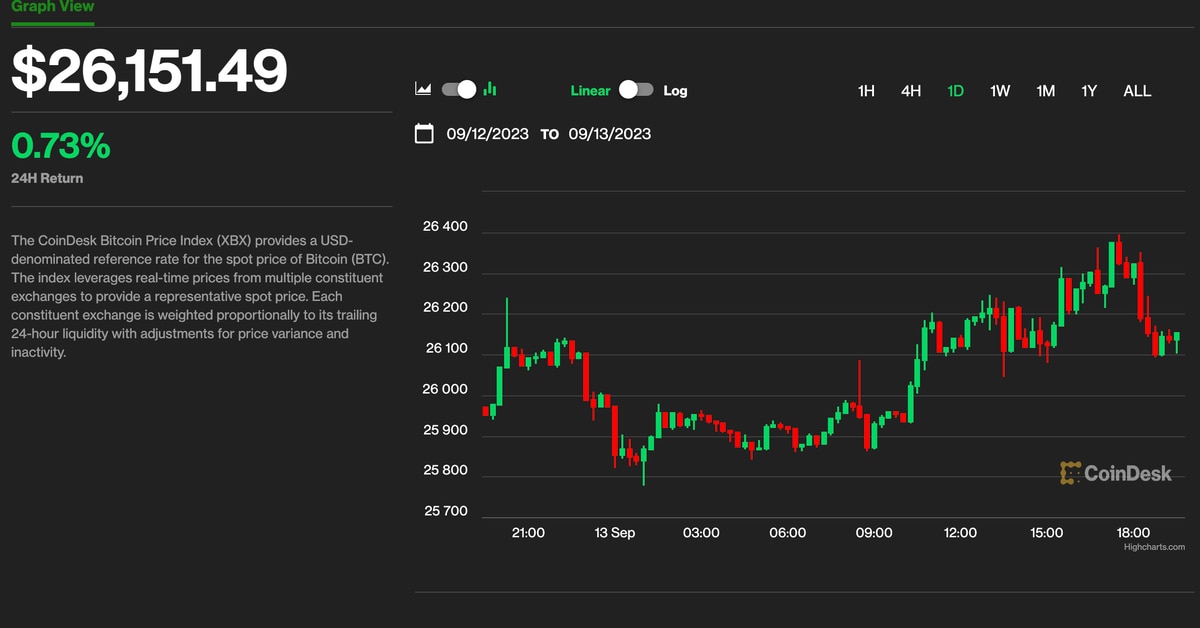

Bitcoin BTC Price Steady at $26K, Solana SOL Price Dips 2% After FTX Asset Sale Approval

Solana’s SOL also advanced earlier today, but then swiftly dipped more than 2% following the court decision. The imploded exchange holds $1.16 billion of the token, stoking fears about dumping, but part of the stash is locked as venture investment and not available for sales. Despite the decline, SOL was still up 1.2% for the day. Source