Binance, one of the leading cryptocurrency exchanges, has recently decided to refund users $1 million USDT (Tether) following an incident related to the CyberConnect (CYBER) token. The refund aims to compensate users affected by a price discrepancy on listed CYBER tokens due to liquidity constraints on the Korean cryptocurrency exchange Upbit. Binance Addresses CyberConnect Woes As described by Binance, the incident unfolded when a liquidity crunch on CYBER cross-chain bridges hindered transactions on Upbit. This led to a price disparity between Upbit and other exchanges, attracting arbitrageurs who borrowed CYBER from…

Day: September 7, 2023

CFTC commissioner calls for crypto regulatory pilot program

Caroline Pham, a commissioner with the United States Commodity Futures Trading Commission (CFTC), has suggested a limited pilot program in an effort to address crypto regulation. In a pre-recorded message for a Cato Institute event on Sept. 7, Pham said that following public roundtable discussions she planned to propose a pilot program for digital asset markets, claiming the U.S. may soon need to “play catch-up” to crypto-friendly jurisdictions. She suggested that the program would be similar to regulatory sandboxes previously introduced at the state level. “A pilot program can create…

JPMorgan moves into deposit tokens for settlements: Report

Financial giant JPMorgan is making another move into the crypto space with a new blockchain-based solution for cross-border transactions, reveals a report by Bloomberg. The system, however, won’t be available until the bank receives the green light from regulators in the United States. JPMorgan has reportedly developed most of the infrastructure to run the new deposit token, which will be first launched for corporate clients to speed up payments and settlements. Deposit tokens are issued on a blockchain by a depository institution to represent a deposit position. The solution contrasts…

‘Pure’ DeFi has little chance for real-world use because of need for oracles: BIS

The need for an oracle in decentralized finance (DeFi) is a major impediment to adoption in the real world, according to the authors of a Bank for International Settlements (BIS) bulletin. The problems with oracles are both practical and principled, and the study’s authors saw no way around them. An oracle is a third party that provides real-world data flowing to or from a DeFi protocol. An oracle is centralized by nature, and its presence means a protocol is not fully decentralized—if that is tolerated, then trustlessness is lost, the…

North Korea’s ‘Lazarus’ Hackers Stole $41 Million From Crypto Gambling Site, FBI Says

The Lazarus Group, also known as APT38, has been linked to hundreds of millions of dollars in stolen crypto with attacks on companies, exchanges, DeFi protocols and bridges. It’s a massive operation that U.S. authorities and even the United Nations claim funds North Korea’s nuclear weapons program. Source

Tokenization News Roundup: the ‘Next Trillion’

The Takeaway: Banks in particular are increasingly interested in tokenization, and having the interbank communications standard, Swift, already engaged in pilot programs is affirmative. “For tokenization to reach its potential, institutions will need to be able to seamlessly connect with the whole financial ecosystem. Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity, removing a huge hurdle in the development of tokenization and unlocking its potential,” Tom Zschach, chief innovation officer at Swift said in a press statement. Source

Windows tool targeted by hackers deploys crypto mining malware

Hackers have been using a Windows tool to drop cryptocurrency-mining malware since November 2021, according to an analysis from Cisco’s Talos Intelligence. The attacker exploits Windows Advanced Installer — an application that helps developers package other software installers, such as Adobe Illustrator — to execute malicious scripts on infected machines. According to a Sept. 7 blog post, the software installers affected by the attack are mainly used for 3D modeling and graphic design. Additionally, most of the software installers used in the malware campaign are written in French. The findings suggest…

Ethereum holdings declined while Bitcoin and USDT steadied

In Binance’s 10th proof-of-Reserves (POR), Ethereum (ETH) holdings decreased, while Bitcoin (BTC) and Tether (USDT) remained stable or slightly increased. Binance published its 10th POR amid liquidity concerns, offering the public a look into the state of customer assets and holdings. The disclosure reveals mixed trends: Bitcoin and Tether deposits have stayed steady or slightly grown, but Ethereum holdings have dropped by 4.3%. Key figures from Binance’s reserves showed that Bitcoin deposits stood at around 588,000 BTC while there was approximately 3.89 million ETH, down 4.3%. Meanwhile, the exchange held $15.44…

Jay-Z and Jack Dorsey’s firm expands to foster Bitcoin talent in Africa

The Bitcoin non-profit, Btrust, co-founded by rapper Jay-Z and Block CEO Jack Dorsey, has acquired the Bitcoin talent company, Qala. Following this acquisition, Qala, an organization that provides training for African Bitcoin and Lightning engineers, has been rebranded as the Btrust Builders Program. According to reports on Sep. 6, the deal is a synergistic acquisition to advance Bitcoin development in Africa. While Btrust has the financial resources, it didn’t have the structure to develop the African Bitcoin talent pipeline. Today, we are thrilled to share a monumental story in our journey. We…

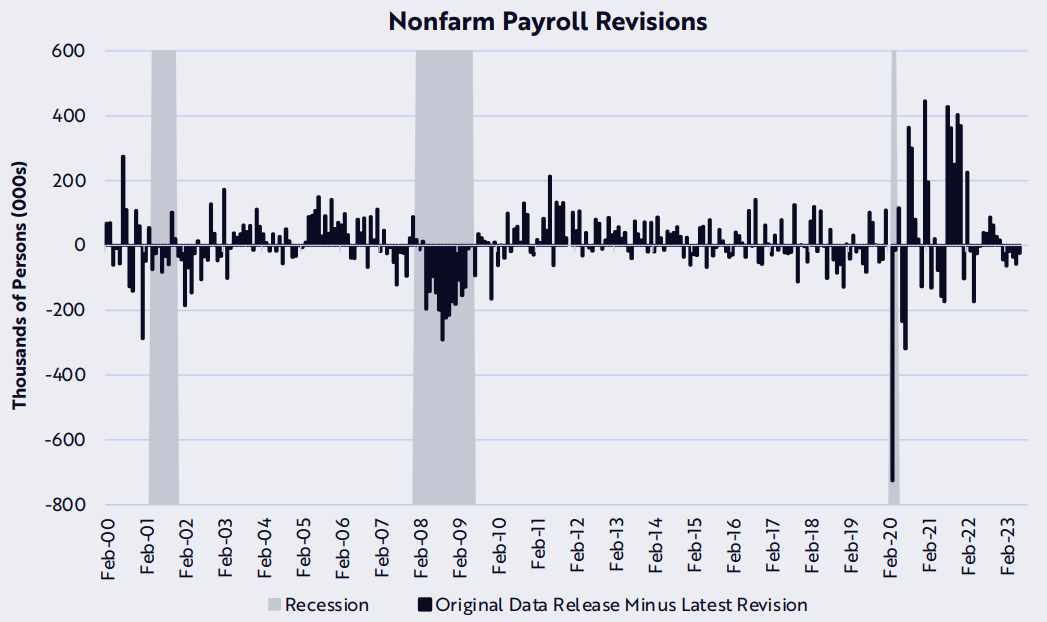

Persistent macro headwinds could delay Bitcoin bull market — ARK Invest

2023 has been a whipsaw year for investor sentiment and even though equities markets have defied expectations, a recent report from ARK Invest highlights reasons why the remainder of 2023 could present several economic challenges. ARK manages $13.9 billion in assets, and its CEO, Cathie Wood, is a strong advocate for cryptocurrencies. In partnership with the European asset manager 21Shares, ARK Investment first applied for a Bitcoin exchange-traded fund (ETF) in June 2021. Their most recent request for a spot BTC ETF, which is currently pending review by the U.S.…