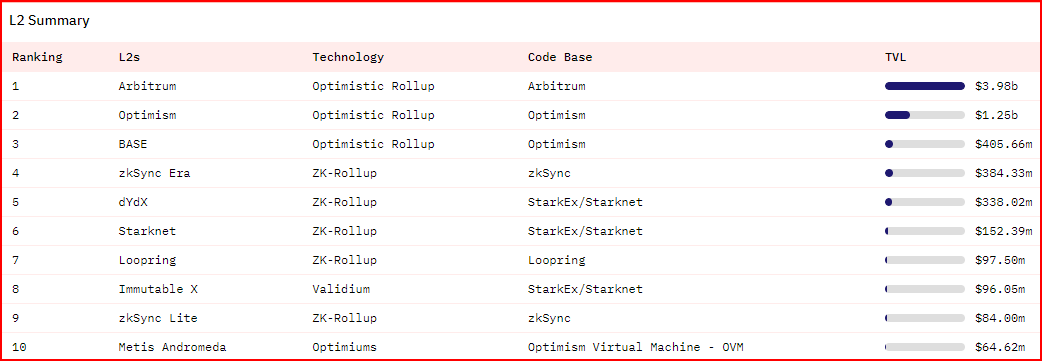

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied The total value locked (TVL) on the Base layer-2 network spiked to more than $400 million since the launch of the Aerodrome decentralized exchange. The most recent information from DefiLlama shows that the TVL of Base, a layer 2 Ethereum (ETH) network developed at Coinbase, increased by more than 56% to reach $405.66 million in the past week. With the launch of Aerodrome on the Base chain, the TVL on the Base chain has exceeded 400…

Day: September 2, 2023

UK lawmakers call for global alliance to tackle misuse of AI

UK lawmakers wish to unite global efforts to safeguard the masses against bad actors who misuse artificial intelligence, or AI. The UK’s House of Commons issued a report acknowledging the potential benefits of AI, such as enhanced productivity and innovative consumer products. However, regulators also highlight the challenges associated with the burgeoning tech, including privacy issues. The AI industry is evolving rapidly, particularly with the emergence of large language models like ChatGPT. These models have transformed AI into a versatile and ubiquitous technology. The report notes that the rapid development…

U.S. SEC Punts on Bitcoin (BTC) Spot Exchange-Traded Fund Approvals, Delays Decisions Until October

The U.S. Securities and Exchange Commission (SEC) is delaying its decision on the approval of spot-based Bitcoin (BTC) exchange-traded funds (ETFs) until October. In new filings, the regulatory agency announces that it will be pushing back its decision to approve or deny numerous bids to create BTC ETFs, including those of financial firms Invesco, WisdomTree and Valkyrie, from August to October. A Bitcoin ETF would give investors exposure to the crypto asset through brokerages, much like precious metals such as gold and silver. The move comes as no surprise to…

FTX brass spent more than $2.5m in customer funds on a luxury yacht

Customer funds from Sam Bankman-Fried’s FTX were allegedly spent on a $2.5-million yacht, which was believed to be a gift for Sam Trabucco, the former co-CEO of Alameda Research. Two filings — one from July 31 and another from Aug. 31 — show a long list of statements, fund transfers and payments made prior to FTX’s bankruptcy. Among the items listed is a cash payment of more than $2.5 million to the American Yacht Group “for the benefit of Sam Trabucco.” Trabucco was one of the first hires at Alameda,…

Crypto rule confusion is an investor’s worst nightmare, Criptonite CEO says

Florian Rais, CEO of Geneva-based Criptonite Asset Management, isn’t happy with the lack of crypto clarity in the U.S. The U.S. Securities and Exchange Commission’s (SEC) ongoing delay regarding spot Bitcoin ETF applications, and its “misalignment” with the U.S. courts, is a nightmare for investors, Rais tells crypto.news. Read on for Rais’ take on how regulatory confusion in the U.S. has ramifications abroad, and whether the current bear market will inspire M&A activity. Why is clarity in the U.S. so important for a cryptocurrency-focused asset manager like Criptonite? Rais: It…

Ripple counters SEC, says XRP has intrinsic value

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Ripple, in a Sept. 1 court filing, rebuts a regulatory assertion that XRP lacks intrinsic value, emphasizing its role as a bridge virtual asset. In the ongoing legal showdown with the U.S. Securities and Exchange Commission (SEC), Ripple has challenged the agency’s claim that XRP is nothing more than a piece of computer code. Contrary to the interpretation by the regulatory watchdog, Ripple affirms that the court did not make such a ruling. This clarification sheds…

New SEC hedge fund rules not expected to trouble crypto firms

New rules instituted by the U.S. Securities and Exchange Commission (SEC) to regulate the private funds industry are not expected to affect crypto companies. The new rules, voted 3-2 on Aug. 30 by SEC commissioners along party lines, will impact hedge funds, private equity, and certain venture capital funds. However, they seem to have piqued the interest of asset managers overseeing crypto versions of private equity funds as they navigate the possible implications. Adam Guren, a co-founder of crypto-focused alternative asset manager Hunting Hill Digital, said the new requirements shouldn’t…

Examining growth potential for PepeCoin, Conflux, and Injective in 2023

In 2023, PepeCoin (PEPE), Conflux (CFX), and Injective (INJ) continue to attract investor attention. Their rapid growth is why investors are increasingly considering them for diversification. Amid this, there is a new entrant in Borroe Finance. This article explores what lies ahead and how they can impact crypto. PEPE: navigating the intersection of meme culture and finance PepeCoin merges the fun of internet memes with the potential of blockchain technology, using its popularity to bridge the gap between mainstream and crypto audiences. It ensures security and transparency through blockchain and can…

XRP Whales On The Move Again, As The Altcoin Records Significant Utility Spikes

In the last 48 hours, the XRP market has witnessed a significant amount of large-scale transactions, drawing much attention from the general crypto space. According to data from blockchain tracker Whale Alert, XRP whales conducted transactions involving over a billion XRP on Friday, September 1. Ripple Transfers 75 Million XRP To Unknown Wallet In Whale Buying Spree Through a series of posts by Whale Alert on social media platform X (formerly Twitter), it can be inferred that the XRP market witnessed four major whale transactions. The biggest of these transactions…

Analyst Issues A Bitcoin Warning, Calls September A Red Month

In a recent video by renowned cryptocurrency analyst Benjamin Cowen, ominous predictions for Bitcoin performance in September have emerged. Cowen, known for his data-driven approach to cryptocurrency analysis, shared his insights regarding Bitcoin’s historical performance in September and its potential trajectory for the current year. Cowen acknowledged that September has traditionally been a challenging month for BTC, often characterized by negative price movements. He emphasized that while historical trends suggest a red month for Bitcoin in September, there are no guarantees, and occasional green September does occur. The analyst highlighted…