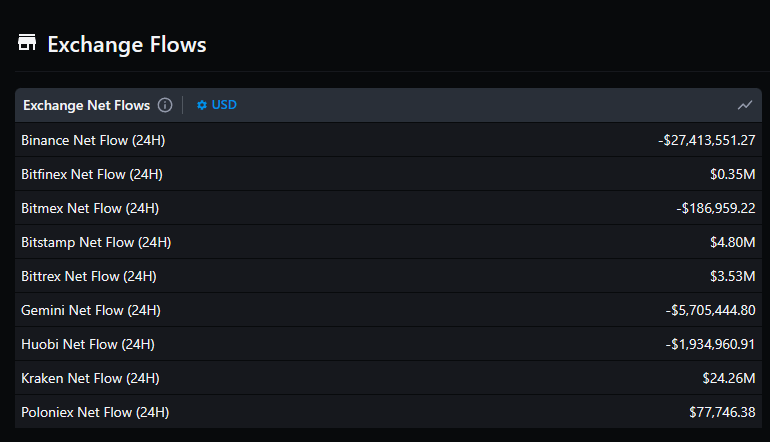

Amid executive departures and trading suspensions, Binance faces liquidity concerns as whale activity reveals a complex pattern. Binance, the world’s leading crypto exchange, remains under scrutiny while the community maintains a cautious stance concerning its general liquidity. In the past week, several high-level executives from the exchange’s APAC and Eastern Europe divisions have resigned. Moreover, Binance has temporarily suspended trading of multiple altcoins, including the BUSD stablecoin, in response to mounting regulatory pressure. As these issues converge, whales appear to be changing tact, shuffling coins around. Data from crypto analysis…

Day: September 6, 2023

Change to US accounting rules will be a boon to companies holding crypto in 2025

The Financial Accounting Standards Board (FASB) has unanimously approved rules for accounting for the fair value of companies’ cryptocurrency holdings, according to media reports. The rules will go into effect in 2025. The FASB is the United States organization that sets accounting and reporting standards for organizations that follow U.S. Generally Accepted Accounting Principles (GAAP). It issued a call for comments on proposed changes to the FASB Accounting Standards Codification in March. The proposal was discussed and put to a vote on Sept. 6. Fair value is the estimated price…

Ark 21Shares, VanEck Start Bids for First Ether ETF in the U.S.

The exchange filed 19b-4 documents on Wednesday, formally kicking off a review process. Once the U.S. Securities and Exchange Commission (SEC) acknowledges the filings, it will start a 240-day clock for a final decision. The SEC will have a number of intermediary deadlines to make a decision, but has traditionally taken the maximum number of days possible to review applications. Source

Following SEC delays, Ark Invest and 21Shares file for spot Ether ETF

Amid the United States Securities and Exchange Commission (SEC) delaying a decision on Ark Investment Management’s spot Bitcoin (BTC) exchange-traded fund, the firm has proposed an investment vehicle with exposure to Ether (ETH). In a Sept. 6 filing, Ark Invest and 21Shares requested the SEC approve the listing of shares of a spot ETH ETF on the Cboe BZX Exchange. The investment vehicle, called the ARK 21Shares Ethereum ETF, will have crypto exchange Coinbase act as a custodian and measure the performance of Ether based on the Chicago Mercantile Exchange…

Bitcoin Price (BTC) Little-Changed at $25.7K After FASB and Ether ETF News

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity…

Genesis sues parent company DCG, other affiliate for $600M loans, then stays action

Bankrupt cryptocurrency lender Genesis Global Capital (GGC) filed two suits on Sept. 6 seeking the repayment of overdue loans from affiliated companies. The loans are worth over $600 million in total. GGC filed the complaints against Digital Currency Group (DCG) and DCG International Investments (DCIG) in the Southern District of New York Bankruptcy Court. GGC and DCGI are both owned by DCG. According to the complaint against DCGI, GGC loaned it 18,697.7 Bitcoin (BTC) in June 2022 under an open loan agreement reached in 2019. The outstanding balance of the…

Bankrupt Crypto Lender Celsius Network Files to Recover Assets From EquitiesFirst

EquitiesFirst is a private lending platform that owed Celsius some $439 million worth of cash and bitcoin (BTC) as of July 2022. Celsius first took collateralized loans from the lender in 2019, but failed to return collateral in 2021, CoinDesk reported earlier. Wednesday’s filing named both the company and its CEO, Alexander Christy, as defendants. Source

Enterprise blockchain, Bitcoin staking and Web3 pique investors’ interest

The sharp increase in global interest rates may have limited investors’ appetite for crypto ventures, but new projects are still flourishing and attracting capital to speed up growth. Data from the Cointelegraph Research Venture Capital Database shows June closed out with a 29.73% decrease in venture capital investments, with just $779.32 million secured in 62 deals, compared to June 2022. However, the overall trend for the year shows a rise in venture capital deals. Cointelegraph’s VC roundup highlights the latest projects striving in this complex and competitive environment. Orbital raises…

Sam Bankman-Fried’s Motion for Pretrial Release Goes Before 3-Judge Panel

Bankman-Fried’s lawyers and the government have fought for weeks now over what the defense claims are subpar conditions in the Metropolitan Detention Center. They claim their client can’t properly prepare for his October trial from jailhouse bars, and therefore needed to be released. That motion is separate from their appeal of Judge Lewis Kaplan’s revocation of Bankman-Fried’s bail. Source

Grayscale Bitcoin Trust’s alleged wallet addresses released by Arkham

Blockchain analytics platform Arkham Intelligence claims to have identified the addresses of the Grayscale Bitcoin Trust. The trust consists of more than 1,750 addresses holding a total of over $16 billion worth of Bitcoin (BTC), according to a Sept. 6 thread on X (formerly Twitter). Arkham claimed that Grayscale is “the 2nd largest BTC entity globally.” Breaking: Arkham has identified the Grayscale Bitcoin Trust’s holdings on chain. It is the 2nd largest BTC entity globally, holding >$16B of BTC. Though Grayscale publicly reports balances, they have refused to identify the…