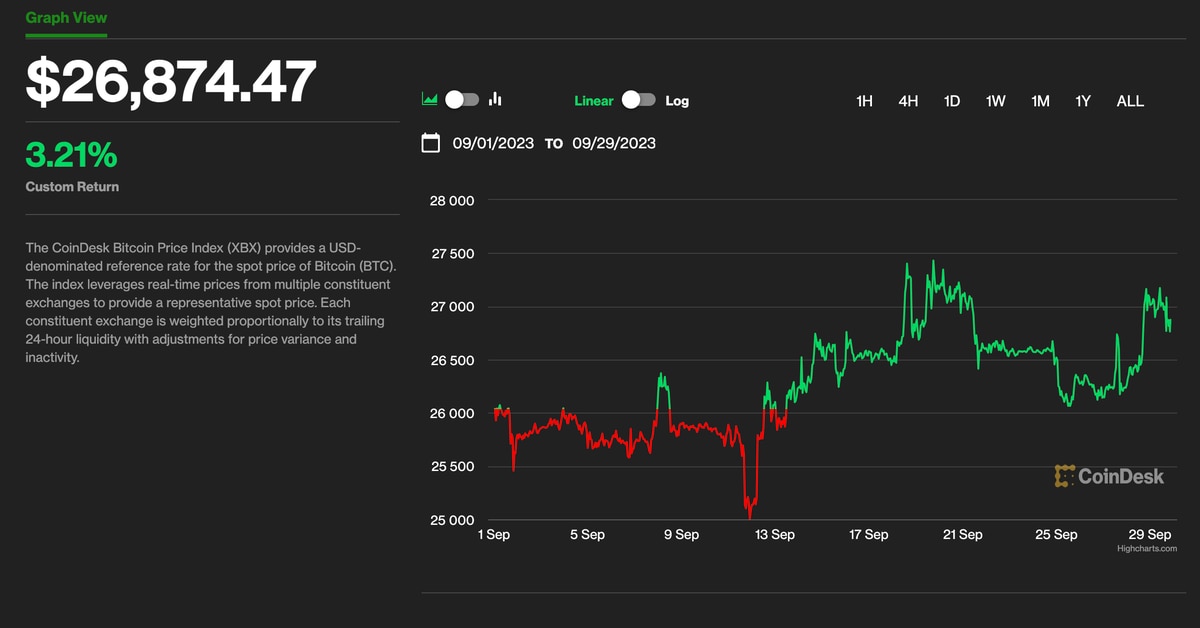

Bitcoin’s Slips Below $27K, But What Might Government Shutdown Mean for Prices Source

Day: September 29, 2023

Chainlink quietly changes multisig rules, Mixin offers $20M bounty: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. The past week in DeFi was dominated by developments in some of the OG DeFi protocols, with Uniswap Foundation announcing plans to raise $62 million in new funding and decentralized oracle service provider Chainlink brushing aside concerns about changes it made to multisignature wallets. Mixin Network, which was hacked for nearly $200 million in crypto assets on Sept. 23, has now offered…

Georgia preparing limited live CBDC pilot, considering Ripple among tech providers

The National Bank of Georgia (NBG) has announced that it will advance its research on a digital lari central bank digital currency (CBDC) in a limited-access live pilot environment. Nine companies, including Ripple Labs, will take part in the project, and one of them will be selected to move forward to the next stage of testing. In a paper released in February, the NBG stated that it was considering a two-tier design for its CBDC, with wallets provided by a third party. It would be programmable and support asset tokenization.…

CommEX dismisses rumors, denies connection with Binance

Despite rumors, CommEX, the company that acquired Binance’s Russian business, has denied any connection with Binance. In a statement, CommEX acknowledges that they have former Binance employees on their team but emphasizes that Binance does not own their company. CommEX did not disclose the identities of their leaders as they prefer to remain private. The company also revealed that it took six months to develop the platform, with former Binance employees contributing their experience in product creation and internal processes. The similarity of cultures and values between the two companies played…

Could A New All-Time High Be On The Horizon? Analyst Predicts

Crypto Rover, a seasoned cryptocurrency trader and analyst, has recently shared insights suggesting that Bitcoin’s current trajectory may change. Based on the latest technical analysis, Bitcoin might soon paint a brighter, bullish picture. Bitcoin Break From The Bearish Shackles In his recent analysis, Crypto Rover explained Bitcoin’s price action shift. It’s been noted that the leading crypto is making headway in breaking a longstanding negative trend that has persisted for 77 days. This shift marks a monumental moment for Bitcoin, which had been entrapped in bearish confines for a considerable duration.…

Invesco Galaxy applies for Ether spot ETF

Asset managers keep pursuing digital asset products, as Invesco and Galaxy Digital allegedly filed for a spot Ethereum (ETH) exchange-traded fund (ETF) on Sept. 29. Bloomberg ETF analyst James Seyffart disclosed the filing on X (formerly Twitter), even though the application hasn’t been uploaded to the SEC’s public database at the time of writing. Invesco Galaxy just filed for a spot Ether ETF, I think this is the 3rd of 4th one of these, have to check tho.. pic.twitter.com/SIJVu8VzFk — Eric Balchunas (@EricBalchunas) September 29, 2023 A spokesperson for Invesco…

Costo sells out of gold bars, but is it a better investment than Bitcoin?

Costco has made headlines this week after it rapidly sold out of gold bars. In times of economic uncertainty and rising inflation, it’s no surprise that investors are turning to traditional safe-haven assets like gold. The question is whether gold’s performance will eventually catapult its price above $2,050, a level last seen in early May. In the past 12 months, the price of gold has surged by an impressive 12%. This rally has been partially fueled by the Federal Reserve’s efforts to combat inflation by maintaining higher interest rates, a…

A $600B tipping point for crypto

A United States appellate court directed the Securities and Exchange Commission in August to reassess its denial of Grayscale’s application for a Bitcoin exchange-traded fund (ETF). A little-noted consequence of that decision is that it could open the floodgates for $600 billion in new cash to enter the cryptocurrency market. ETFs provide investors with a regulated way to gain exposure to different asset classes, including Bitcoin (BTC). The approval of a Bitcoin ETF could democratize investment in the cryptocurrency sector, drawing parallels to how the iShares MSCI Brazil ETF and the VanEck…

Google Cloud is now a validator on the Polygon network

Polygon Labs announced on Sept. 29 that Google Cloud has joined the Polygon proof-of-stake network as a validator. Google Cloud joins over 100 other validators verifying transactions on its layer-2 Ethereum network. This month, @GoogleCloud became part of the decentralized validator set for Polygon PoS. The same infrastructure used to power @YouTube and @gmail is now helping to secure the fast, low-cost, Ethereum-for-all Polygon protocol. With 100+ validators securing the Polygon PoS… — Polygon (Labs) (@0xPolygonLabs) September 29, 2023 Per a post from Polygon Labs on the X platform (formerlly…

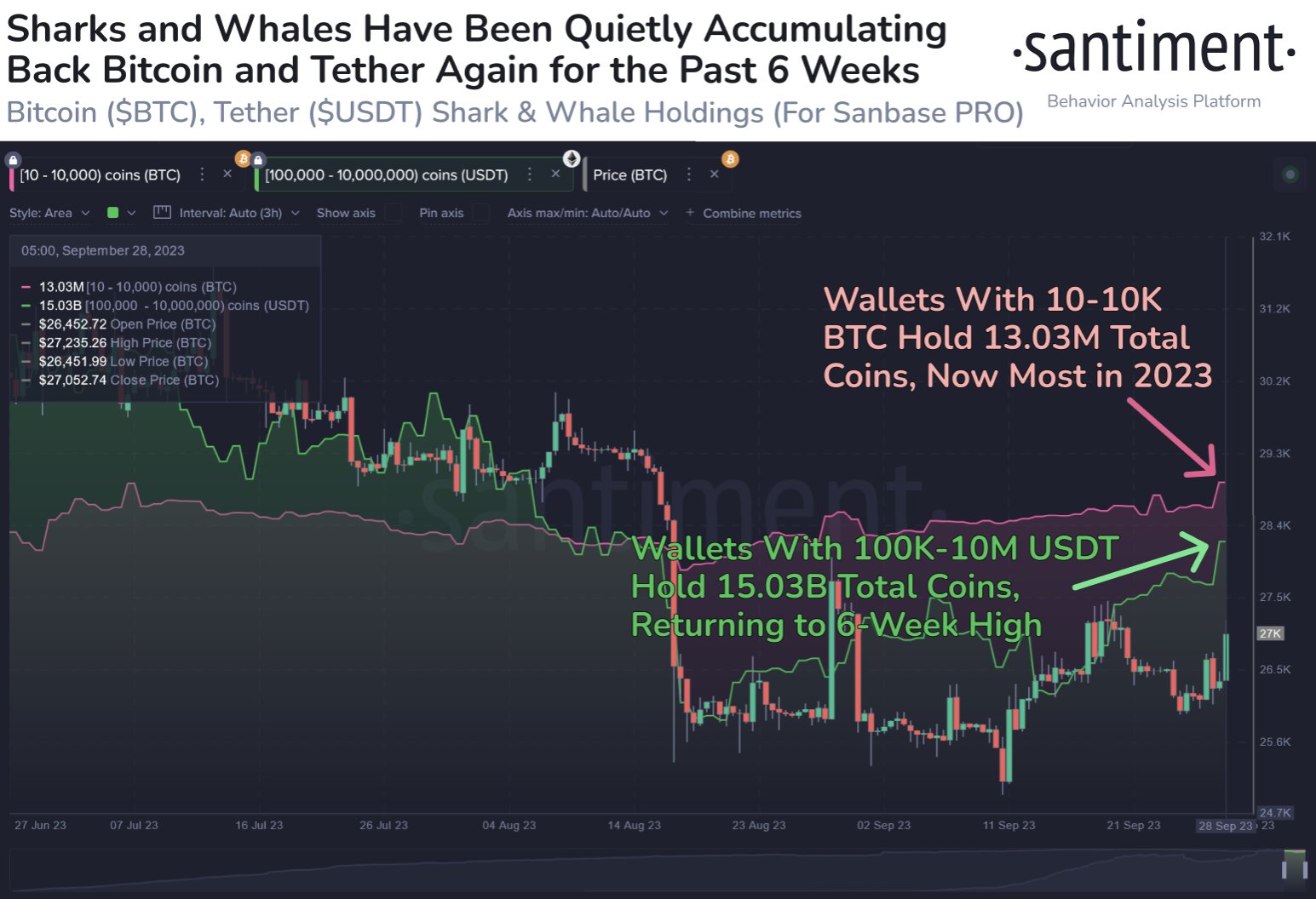

This Bullish Combination Has Finally Formed For Bitcoin, Rally Ahead?

On-chain data shows that a bullish combination has just formed for Bitcoin, which may signal that a rally could be ahead for the asset. Sharks & Whales Are Accumulating Both Bitcoin, Tether Right Now According to data from the on-chain analytics firm Santiment, both the sharks and whales of BTC and USDT have been accumulating recently. The metric of interest here is the “Supply Distribution,” which keeps track of the total amount of a given asset that the different holder groups carry. In the current topic, sharks and whales are…