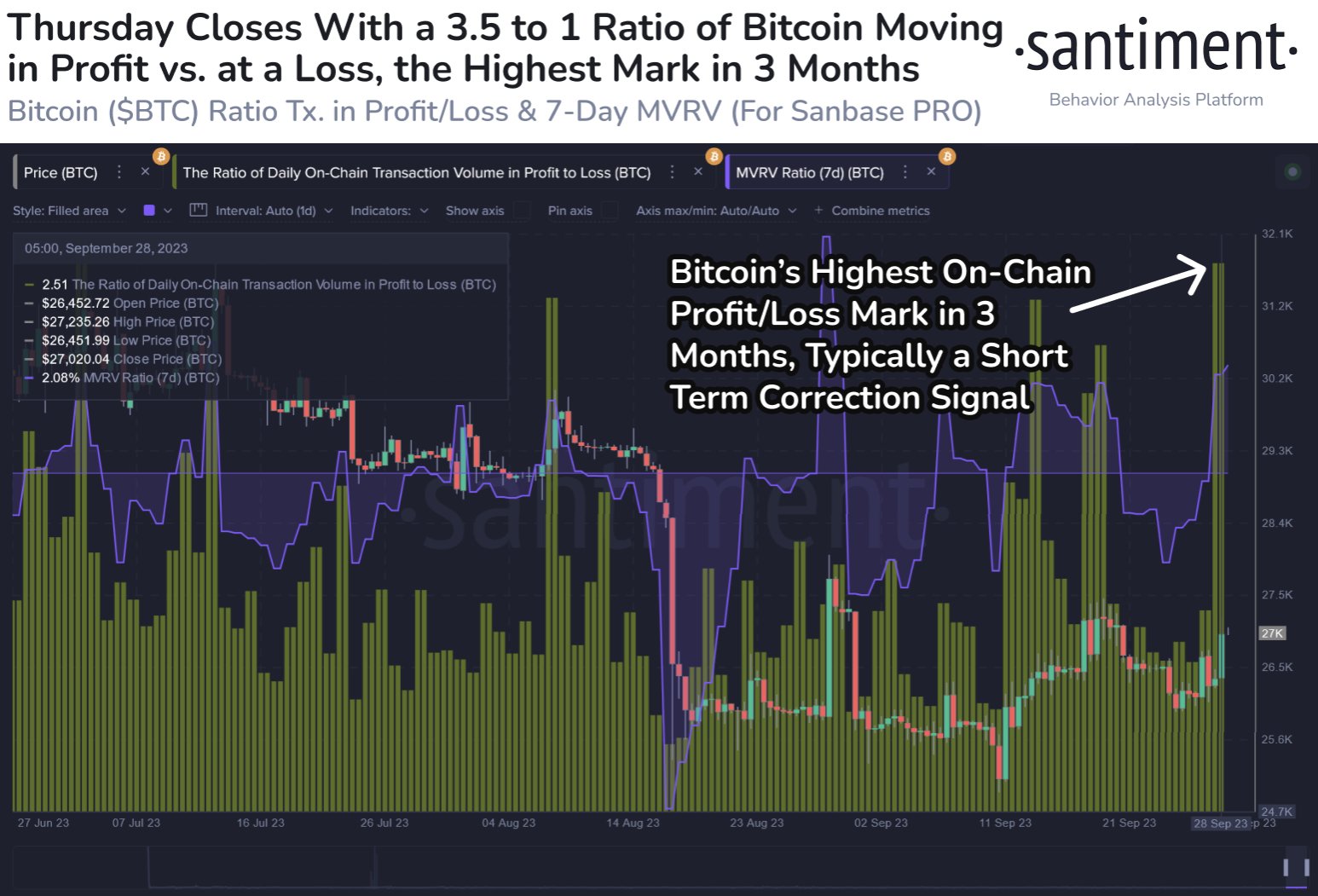

Bitcoin has broken back above the $27,000 level during the past day, but if on-chain data is to go by, this surge may not last for long. Bitcoin Investors Are Taking Profits At Highest Rate In 3 Months According to data from the on-chain analytics firm Santiment, there is a chance that a short-term correction could happen for the cryptocurrency. The relevant metric here is the “ratio of daily on-chain transaction volume in profit to loss,” which, as its name suggests, tells us about how the profit-taking volume compares against…

Day: September 29, 2023

Quarterly Investment Guide 4Q 2023: Bitcoin outlook

Patient bitcoin investors may have to hold their composure for at least another quarter as the Federal Reserve’s outlook on interest rate policy dampens what might have been an even stronger month for the cryptocurrency. Bitcoin has had a difficult but decent year so far. The flagship cryptocurrency is up more than 60% for the year, according to Coin Metrics, thanks to a big run up in the first quarter. Not much has happened since, however. Bitcoin is down about 5% since April 1, and subsequent gains from any of…

10-Year US Treasury Yield Returns to Its Historical 4.5% Mark

Since 2007, the 10-year Treasury Yield has struggled to reach its long-term average of 4.5%. The 10-year US Treasury yield, a critical indicator of economic health, has reached a significant milestone. For the first time since the Global Financial Crisis (GFC) of 2008-09, it has risen back to the 4.5% yield. This development has brought optimism to long-term Treasury investors, offering the prospect of positive annual real yields, especially with inflation moderating. A Return to Historical Norms The 10-year US Treasury yield’s resurgence to 4.5% marks a return to its…

CoinShares says US not lagging in crypto adoption and regulation

European cryptocurrency investment firm CoinShares is optimistic about cryptocurrency regulation in the United States as the firm enters the new market. On Sept. 22, CoinShares officially announced the launch of its new division, CoinShares Hedge Fund Solutions, marking the first time the firm introduce its offerings to qualified U.S. investors. CoinShares’ entrance into the U.S. market comes at a time when many U.S. crypto firms are looking at expanding their businesses outside the country due to regulatory hurdles at home. One such firm, cryptocurrency exchange Coinbase, has been actively pushing expansion…

First Mover Americas: Circle Argues Stablecoins Aren’t Securities in Response to SEC’s Binance Lawsuit

The latest price moves in bitcoin (BTC) and crypto markets in context for Sept. 29, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Source

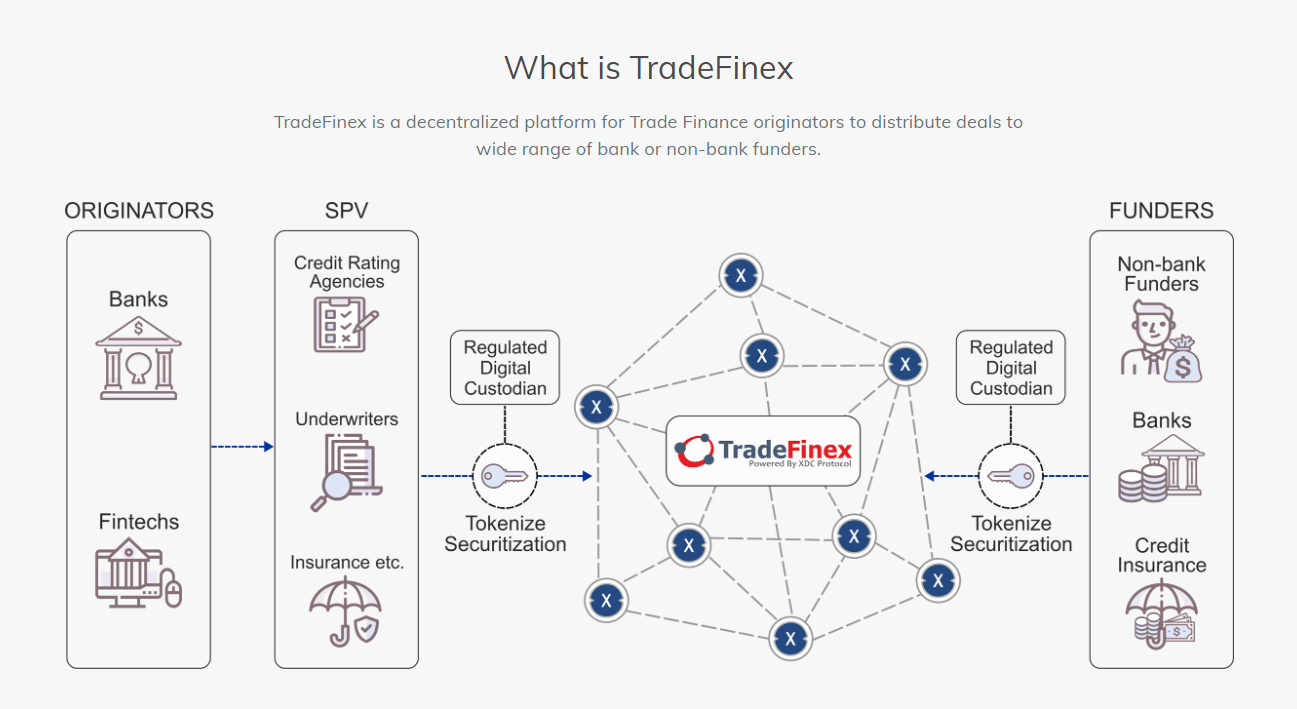

SBI works with UAE’s TradeFinex to set up joint crypto venture in Japan

SBI Holdings and TradeFinex will look to drive trade finance adoption of the Ethereum Virtual Machine-compatible enterprise blockchain XDC Network through a new joint venture in Japan. United Arab Emirates-based firm TradeFinex operates its own decentralized platform on the XDC Network for trade finance originators to connect to a variety of banks and lending institutions. Aimed at enterprise use cases, TradeFinex primarily provides blockchain-based trade finance products, including invoicing, letters of credit, purchase order finance and supply chain finance. A visual representation of TradeFinex’s trade finance stack. Source: TradeFinex. The XDC…

Gemini Bows Out of Netherlands Due to Regulatory Challenges

The Netherlands took the lead among European Union member states by mandating that crypto companies adhere to the 5th Anti-Money Laundering Directive (5AMLD). Leading cryptocurrency exchange Gemini has decided to halt its operations in the Netherlands, citing mounting regulatory hurdles imposed by the Dutch central bank De Nederlandsche Bank (DNB). The move follows the footsteps of Binance, another digital asset trading platform that withdrew from the market earlier this year due to similar regulatory constraints. In an emailed statement addressed to its Dutch users on September 26, Gemini conveyed its…

What it means for crypto markets

The FTX bankruptcy lawsuit reached a key juncture in the second week of September after the United States Bankruptcy Court for the District of Delaware approved the sale of $3.4 billion worth of crypto assets. The court also approved $1.3 billion in brokerage and government-recovered assets as part of the liquidation process, with $2.6 billion in cash bringing the total tally to $7.1 billion in liquid assets. Among the different cryptocurrencies set for liquidation, Solana (SOL) tops the pile with a value of $1.16 billion, and Bitcoin (BTC) is the second-largest…

Important Events That Could Have A Massive Impact On XRP Price

Despite some analysts noting why XRP is unlikely to end on a high, certain macro (and micro) factors could significantly impact the token’s price and possibly see it enjoy the same trajectory it did following Judge Analisa Torres’ ruling in favor of Ripple. SEC-Related Factors Could Impact XRP Price On August 17, the US Securities and Exchange Commission (SEC) was given approval by Judge Analisa Torres to file its motion seeking an interlocutory appeal against her ruling at the Court of Appeals. However, this wasn’t an approval of the SEC’s…

Crypto Payments Firm Circle (USDC) Rolls Out Tokenized Credit Protocol Perimeter, Unveils Circle Research Division

“We’ve seen the great utility stablecoins and USDC have brought to developers, corporations, end-users and more across an array of use cases, including for global lending markets within DeFi,” the company said in a blog post. “However, for new entrants to participate in these markets, the ability to securely unlock credit on-chain through safe standards and underwriting, represents a significant barrier to entry.” Source