In the financial landscape, both liquid staking tokens and government bonds in traditional finance bear the similarity in that they serve as investment vehicles that offer a form of yield or interest over time. In the case of liquid staking tokens, users earn staking rewards, while government bonds offer periodic interest payments. Furthermore, both liquid staking tokens and certain types of government bonds can be readily traded in secondary markets, providing liquidity to investors. Source

Month: September 2023

3AC’s Su Zhu arrested in Singapore

The co-founder of Three Arrows Capital (3AC), Su Zhu, was arrested in Singapore when attempting to leave the country, Cointelegraph has learned from Teneo, the joint liquidator of the bankrupt hedge fund. In a statement, Teneo announced that Zhu “was apprehended at Changi Airport whilst attempting to travel out of Singapore following a committal order granted by the Singapore Courts against him.“ A committal order is used to send someone to prison for contempt of court. On Sept. 25, Teneo was granted its committal request in Singapore, claiming Zhu failed…

Opposing Centralization in Ethereum Staking

Opposing Centralization in Ethereum Staking Source

Bankrupt Crypto Hedge Fund 3AC's Su Zhu Apprehended in Singapore, Liquidator Says

Co-founder of the Three Arrows Capital hedge fund was seized at Changi airport, Teneo said Source

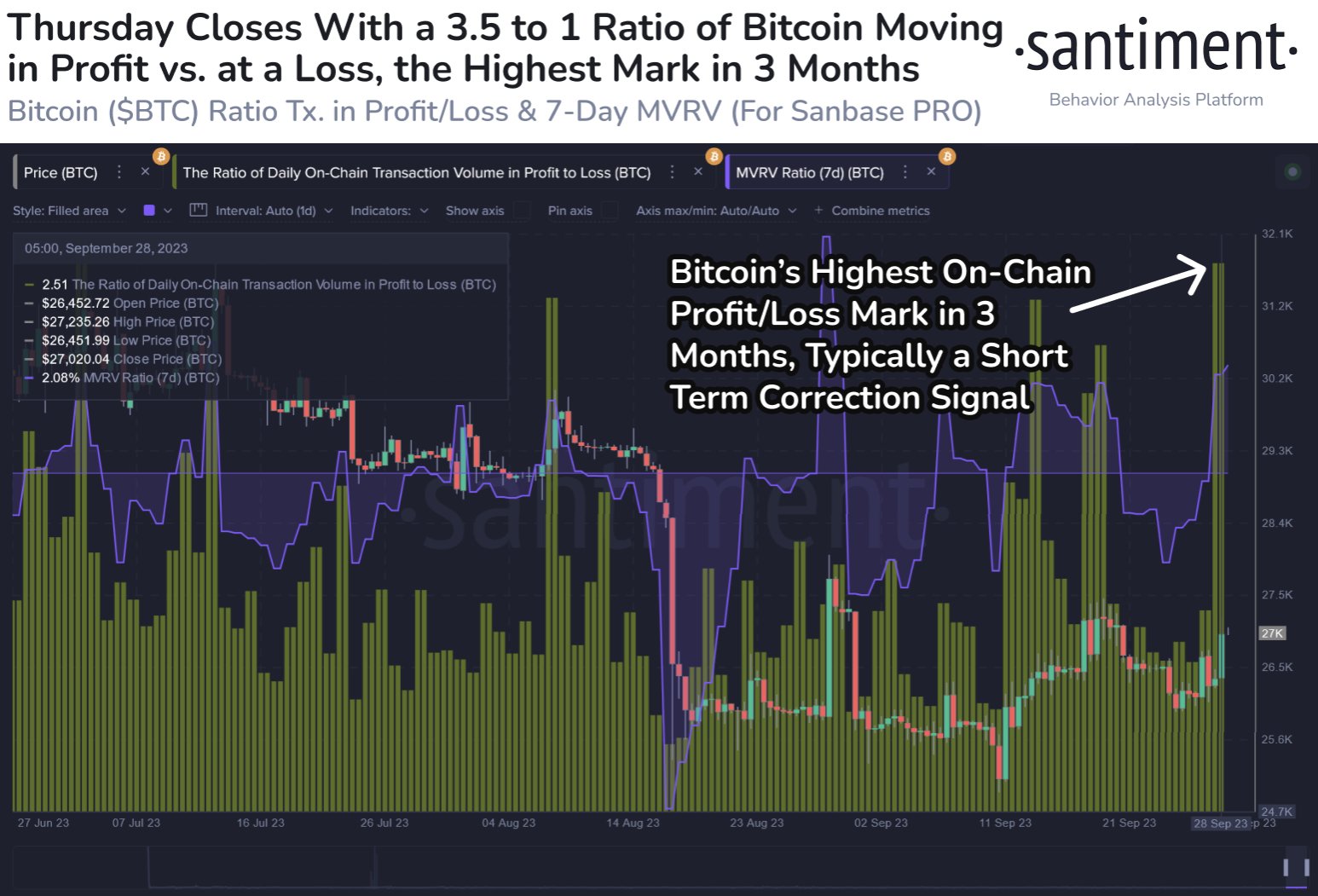

Bitcoin Surge Above $27,000 May Not Last, Here’s Why

Bitcoin has broken back above the $27,000 level during the past day, but if on-chain data is to go by, this surge may not last for long. Bitcoin Investors Are Taking Profits At Highest Rate In 3 Months According to data from the on-chain analytics firm Santiment, there is a chance that a short-term correction could happen for the cryptocurrency. The relevant metric here is the “ratio of daily on-chain transaction volume in profit to loss,” which, as its name suggests, tells us about how the profit-taking volume compares against…

Quarterly Investment Guide 4Q 2023: Bitcoin outlook

Patient bitcoin investors may have to hold their composure for at least another quarter as the Federal Reserve’s outlook on interest rate policy dampens what might have been an even stronger month for the cryptocurrency. Bitcoin has had a difficult but decent year so far. The flagship cryptocurrency is up more than 60% for the year, according to Coin Metrics, thanks to a big run up in the first quarter. Not much has happened since, however. Bitcoin is down about 5% since April 1, and subsequent gains from any of…

10-Year US Treasury Yield Returns to Its Historical 4.5% Mark

Since 2007, the 10-year Treasury Yield has struggled to reach its long-term average of 4.5%. The 10-year US Treasury yield, a critical indicator of economic health, has reached a significant milestone. For the first time since the Global Financial Crisis (GFC) of 2008-09, it has risen back to the 4.5% yield. This development has brought optimism to long-term Treasury investors, offering the prospect of positive annual real yields, especially with inflation moderating. A Return to Historical Norms The 10-year US Treasury yield’s resurgence to 4.5% marks a return to its…

CoinShares says US not lagging in crypto adoption and regulation

European cryptocurrency investment firm CoinShares is optimistic about cryptocurrency regulation in the United States as the firm enters the new market. On Sept. 22, CoinShares officially announced the launch of its new division, CoinShares Hedge Fund Solutions, marking the first time the firm introduce its offerings to qualified U.S. investors. CoinShares’ entrance into the U.S. market comes at a time when many U.S. crypto firms are looking at expanding their businesses outside the country due to regulatory hurdles at home. One such firm, cryptocurrency exchange Coinbase, has been actively pushing expansion…

First Mover Americas: Circle Argues Stablecoins Aren’t Securities in Response to SEC’s Binance Lawsuit

The latest price moves in bitcoin (BTC) and crypto markets in context for Sept. 29, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Source

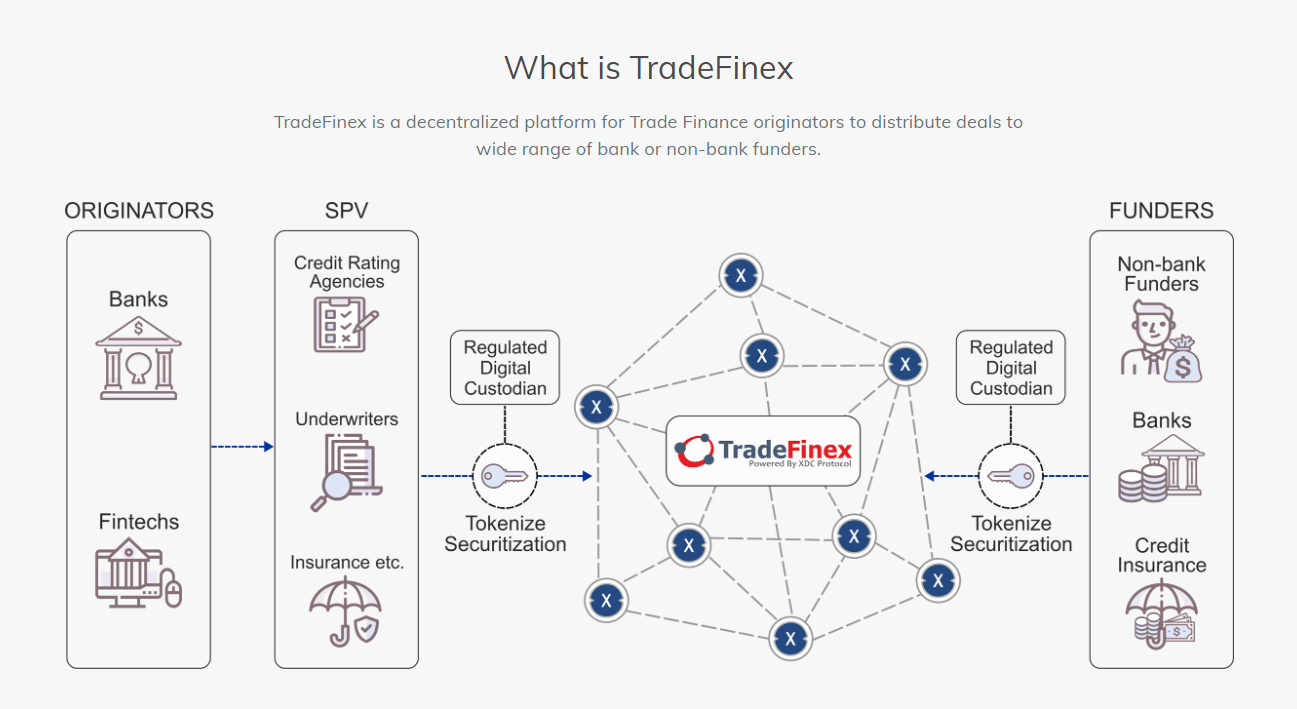

SBI works with UAE’s TradeFinex to set up joint crypto venture in Japan

SBI Holdings and TradeFinex will look to drive trade finance adoption of the Ethereum Virtual Machine-compatible enterprise blockchain XDC Network through a new joint venture in Japan. United Arab Emirates-based firm TradeFinex operates its own decentralized platform on the XDC Network for trade finance originators to connect to a variety of banks and lending institutions. Aimed at enterprise use cases, TradeFinex primarily provides blockchain-based trade finance products, including invoicing, letters of credit, purchase order finance and supply chain finance. A visual representation of TradeFinex’s trade finance stack. Source: TradeFinex. The XDC…