The recent flash crash of Bitcoin from over $45,500 to as low as $41,100 has sent shockwaves throughout the crypto community, sparking debate over the underlying causes. While some have attributed the crash to unconfirmed rumors that the US Securities and Exchange Commission (SEC) might, after all, not approve Bitcoin ETFs in January, The Wolf Of All Streets on X suggests a different explanation. Blame The High Funding Rate For The BTC Crash The analyst points to the ultra-high positive funding rate on perpetual futures contracts as the primary culprit. In…

Day: January 3, 2024

Stablecoins Can Help Fix the Current Lending Market

The Global Financial Crisis reduced the depth of capital markets. Blockchain-based stablecoins can help fill the gap, say Christine Cai and Sefton Kincaid, of Cicada Partners. Source

Imminent Approval of U.S. Bitcoin ETF Boosts Crypto Market Optimism

The SEC has requested that issuers have their authorized participant agreement – describing who will play the key role of creating and redeeming ETF shares – available in the coming days. Authorized participants are a central part of the ETF business, but this job will be a particularly tough one, with bitcoin ETF APs needing basic knowledge of digital assets and the ability to provide safekeeping and custody, conduct due diligence for anti-money-laundering and know-your-customer purposes, ensure compliance with sanctions regulations, deal and place crypto asset orders on behalf of…

Bitget stacks workforce amid growing interest in Bitcoin, BRC-20 tokens

Bitget increased its headcount ahead of anticipated developments in crypto’s two largest decentralized networks and the intersection between AI and digital assets. The crypto exchange added some 400 staffers to its workforce during 2023 in preparation for major industry trends involving Artificial Intelligence (AI), Bitcoin (BTC), and Ethereum (ETH). According to a letter from managing director Gracy Chen, Bitget’s hiring spree increased its employee number from 1,100 to 1,500. Chen said the extra hands were needed to leverage technological upgrades that have galvanized Bitcoin fervor and gradually displayed its value…

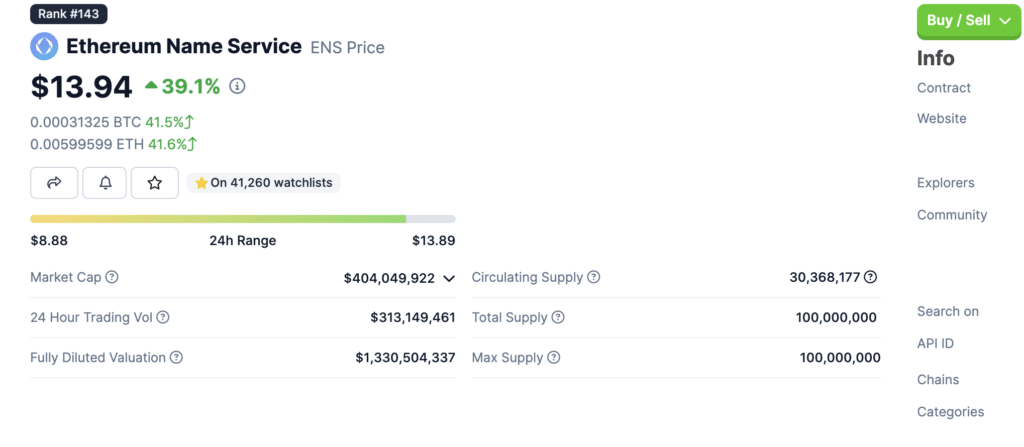

ENS rises nearly 40% following Vitalik Buterin endorsement

Following a Jan. 3 post on X from Vitalik Buterin mentioning Ethereum Name Service, the token saw a 39.1% increase on an otherwise down day for the market. In the post on X, Buterin emphasizes the importance of trustless, Merkle-proof-based CCIP resolvers for Layer 2 (L2) solutions. He stressed the need for ENS subdomains to be registrable, updateable, and readable directly on L2s, emphasizing the significance of keeping ENS affordable. All L2s should be working on (trustless, merkle-proof-based) CCIP resolvers, so that we can have ENS subdomains registerable, updateable and…

Crypto Users Lose $300 Million To Phishing Scams In 2023

In a startling revelation by Scam Sniffer, the cryptocurrency world has been hit hard by a series of sophisticated phishing scams in 2023. The team behind the crypto security tool has reported that Wallet Drainers, a type of malware, have successfully siphoned off nearly $295 million from approximately 324,000 unsuspecting victims in the space. These malicious software programs, predominantly found on phishing websites, trick users into authorizing harmful transactions, leading to significant asset theft from their crypto wallets. ETH’s price trends to the upside on the daily chart but with…

SIX Swiss Exchange Records 13% Drop in Turnover

The trading turnover for SIX Swiss Exchange recorded a notable decrease to CHF 1,046.3 billion from the previous year’s CHF 1,208.1 billion in 2023. This reflects fluctuations, expansions, and new market entries, shaping the trajectory of both exchanges’ activities throughout the year According to a statement released by the company today (Wednesday), the exchange witnessed a surge in transaction volumes, reaching 46,094,349 from the previous 60,810,665, showcasing increased market activity despite lower turnover. Ten companies chose SIX Swiss Exchange for equity listings, aggregating approximately CHF 2.2 billion in transaction volume.…

USDC Stablecoin Momentarily Loses $1-Peg on Binance, Slides to $0.74 Before Rebounding

The 2% market depth on Binance for the USDC/USDT pair is skewed to the upside, with $26 million in orders stacked up to $1.02 and $6.1 million in orders stacked down to $0.98, according to CoinMarketCap. This means that when a trader makes a sell order larger than $6.1 million, the price would fall below $0.98. There was $6.2 million worth of volume at 12:10 UTC followed by $4.3 million at 12:21 UTC. Source

Spot Bitcoin ETF approval unlikely until 2nd week of January

Options trading analysts pointed to Jan. 10 and beyond as the timeline for an SEC decision on spot Bitcoin ETFs amid bearish speculation that all applications may be rejected. Greekslive noted that a U.S. Securities and Exchange Commission (SEC) stand on spot Bitcoin (BTC) ETFs was unlikely to arrive before Jan. 7, citing stock price actions from crypto mining operations and digital asset-related companies in America. Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors…

Bitcoin falls 10% in three hours following Matrixport proclamation

Bitcoin fell about 10% three hours earlier today, but market data sheds some light on this unexpected change of direction. Bitcoin (BTC) is trading at just over $42,300 after seeing a price decrease of about 7.4% over the last 24 hours. Earlier today, the price quickly fell from about $45,500 to $40,800 — a loss of over 10% in under three hours. CoinGlass data shows that Bitcoin has seen $2.7 million of one-hour-long liquidations, $116 million of 4-hour-long liquidations, and $129 million of 24-hour-long liquidations. Crypto investor Scott Melker suggested…