BTC first rallied 2.5% to a fresh 19-month high of $47,900 immediately following the official SEC account’s shared on X (formerly Twitter) about the bitcoin ETF approval, attracting massive attention with crypto observers prematurely celebrating the landmark decision. Source

Day: January 9, 2024

Coinbase Expects A Repeat Of 2018-2022 Bitcoin Cycle, What This Means For Crypto

Crypto exchange Coinbase, one of the largest exchanges in the world, has released its latest report on Bitcoin and the crypto market, highlighting its expectations for the Industry. The 44-page report launched by Coinbase Institutional in conjunction with Glassnode predicts a repeat of one of the most explosive bull markets in recorded crypto history; the 2018-2022 market cycle. Coinbase Says Bitcoin Will Repeat 2018-2022 Cycle In the report, Coinbase and Glassnode analysts take into account a number of indicators and metrics, such as total supply in profit, among others, to…

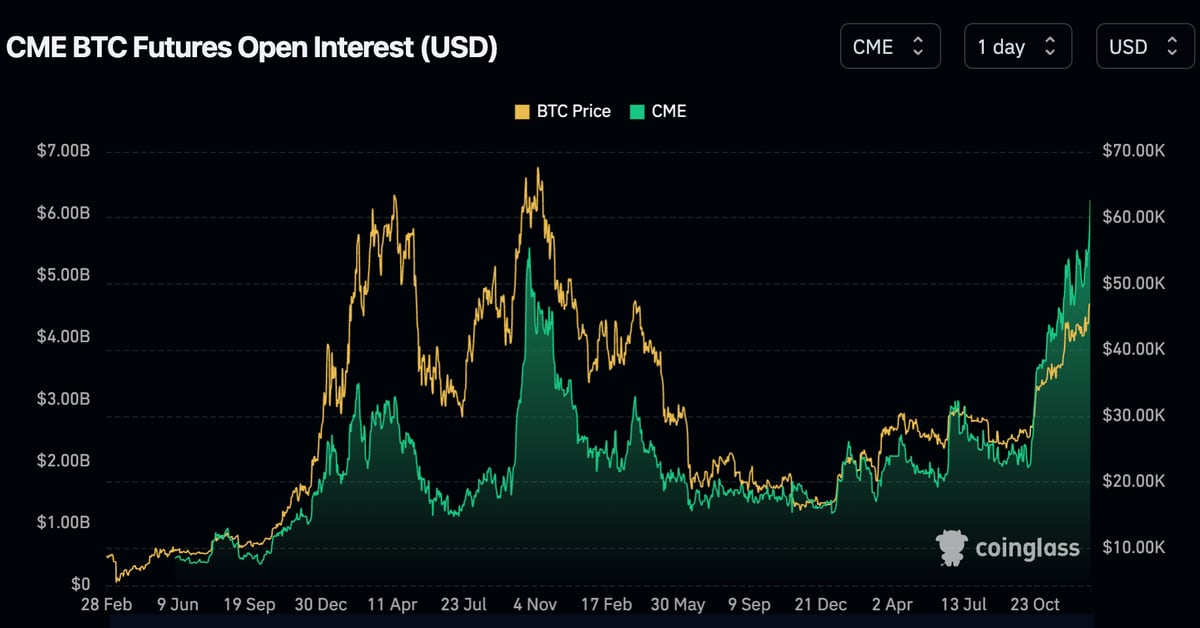

Bitcoin (BTC) Futures on CME Will Face Sell Pressure If Spot Bitcoin ETF Gets Approved: K33

The other 57% of the contracts are held by active market participants, the report follows, whose exposure increased by 128% – to around 75,000 BTC from 33,000 – over the past three months. Holding these positions open is very expensive at the current premium, K33 noted, forecasting that some investors will seek to realize profits after the bitcoin ETF approval. Source

Bitcoin dips 3% on false SEC spot Bitcoin ETF approval

Unknown hackers hijacked the X account of the United States Securities and Exchange Commission (SEC), posting a fake spot Bitcoin ETF approval message. On Jan. 9, the SEC chair Gary Gensler debunked an announcement claiming spot Bitcoin ETFs were approved. The SEC’s official X account published the notice. However, Gensler warned that the page had been compromised and clarified that no spot Bitcoin ETF had been approved yet. The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of…

VanEck Announces Massive $72 Million Bitcoin ETF Seeding As Two Tickers Appear On DTCC Website

As the US SEC prepares to make its final decision regarding Spot Bitcoin ETF approvals, the Depository Trust and Clearing Corporation (DTCC) has officially listed the Spot ETFs tickers from investment management firm, VanEck. VanEck’s Spot ETF Ticker Listed on DTCC American investment management firm VanEck’s Spot Bitcoin ETF has recently appeared on the active and pre-launch list of the DTCC. VanEck’s ETF can be identified by the ticker ‘HODL’ on the DTCC’s official platform. This move positions VanEck as a key player in the evolving landscape of Spot ETF…

SEC Twitter ‘Compromised,’ Bitcoin ETFs Not Approved Chair Gensler Says After Account Said Products Greenlit

The U.S. Securities and Exchange Commission (SEC) has not approved any spot bitcoin ETF applications as of Tuesday afternoon, despite a tweet from the regulator’s X (formerly Twitter) account saying they had been, the agency’s chair, Gary Gensler, said. Source

No, a Trump Victory Might Be Bad for Crypto

And, truth be told, crypto seems to have blown its greatest chance yet to develop serious, widely-available protocols that can withstand threats from malicious actors and nationstates. Instead, these past four years, under pressure from antagonistic authorities across the globe, but especially in the U.S., this decade-and-a-half old industry whiffed on its opportunity to prove exactly how resilient, open and utilitarian blockchain-based technologies can be. Source

Bitcoin Social Dominance Soars As Spot ETF Approval Nears: Santiment

The crypto community is buzzing about the US Securities and Exchange Commission (SEC) approving spot Bitcoin Exchange-Traded Funds (ETFs). This anticipation has permeated market discussions and significantly influenced social media metrics around Bitcoin. According to Santiment, a leading on-chain analytics platform, there has been a notable increase in Bitcoin’s social dominance in recent times, particularly in short-term periods. Bitcoin Social Dominance Surge And Market Response Santiment’s data reveals a spike in Bitcoin ETF-related conversations since mid-October, marking the highest level of social interest since the bullish rally. The top eight…

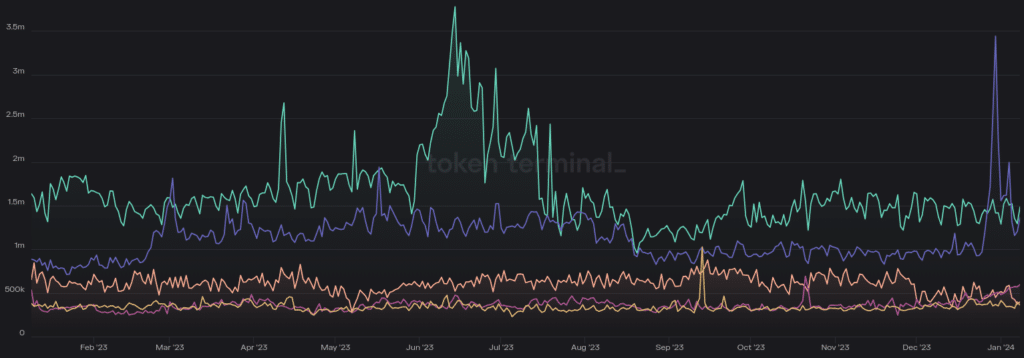

Tron takes throne in daily active addresses

Tron just took the throne, beating Ethereum and Bitcoin with the most daily active addresses, with 1.4 million addresses active on Jan. 8. According to Token Terminal data, Tron (TRX) is followed by BNB Chain (BNB) with its 1.36 million, Polygon (MATIC) with under 600,000 Bitcoin (BTC) with just under 400,000 and Ethereum (ETH) with 362,000. Tron, Polygon, Bitcoin, and Ethereum daily active addresses chart | Source: Token Terminal The significance of daily active addresses (DAAs) as a metric extends beyond mere numbers; it offers a multifaceted insight into the…

Valkyrie CIO Anticipates XRP And Ethereum Spot ETFs Following Bitcoin’s Approval

While Bitcoin exchange-traded fund (ETF) applications are still awaiting approval from the US Securities and Exchange Commission (SEC), executives from asset management firms are already speculating about the potential launch of spot ETFs for other major cryptocurrencies, including XRP and Ethereum (ETH). Valkyrie Invest’s Chief Investment Officer, Steven McClurg, expressed his belief that the SEC’s potential approval of a Bitcoin ETF could pave the way for similar offerings in the XRP and Ethereum markets. However, regulatory challenges and classifying XRP and Ethereum as securities may present hurdles toward these index funds.…