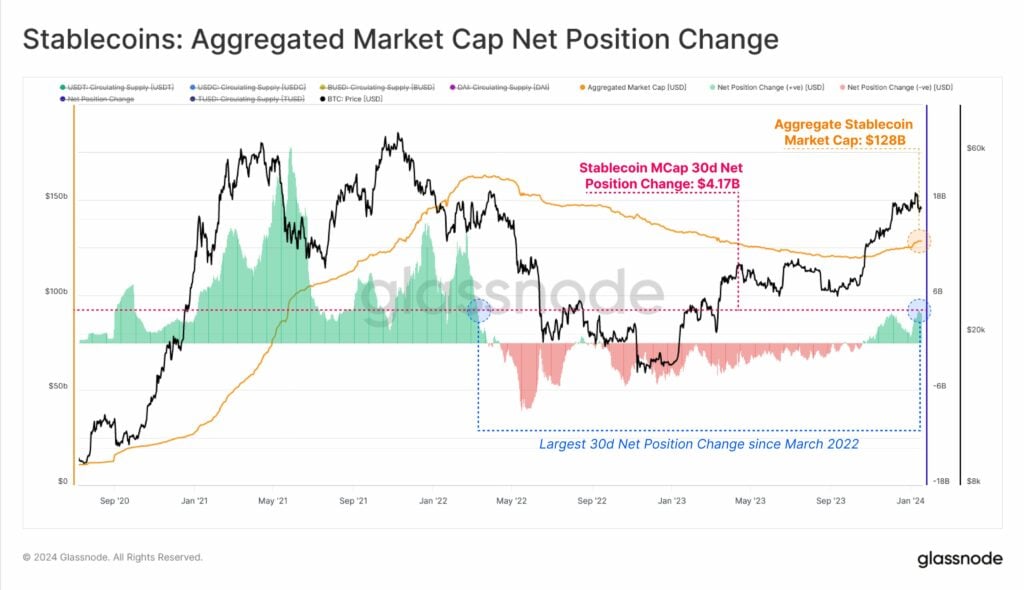

Glassnode data recorded a $4.1 billion monthly increase in the aggregate stablecoin supply, a 21-month high for fiat-pegged cryptocurrencies following bullish momentum. Since October last year, stablecoin supply has shot up steadily with Bitcoin’s price uptick. This ascent has impacted the aggregated stablecoin market cap, which stood above $128 billion as of Jan. 18. The increase marks the largest inflow since March 2022. Tether’s USDT dominated the scene with nearly 73% in market share. The market’s second-largest stablecoin, Circle USD Coin (USDC), followed with a 19% share. Binance USD (BUSD)…

Day: January 18, 2024

Is MATIC Facing A Trust Crisis?

Recently, the blockchain intelligence firm ChainArgos brought to light some unsettling findings about the Polygon network. According to ChainArgos, suspicious transaction patterns have emerged, raising questions about Polygon’s adherence to its initial token allocation plan. ChainArgos’ investigation revealed multiple transactions from Polygon’s network to various exchanges seemed “questionable.” Particularly, the firm pointed out “anomalies” in the flow of tokens from Polygon’s vesting contract, which is responsible for the systematic release of tokens. This contract, distinct from the foundation contract that governs overall allocations, displayed inconsistencies in outflow patterns. The firm’s…

Bitcoin ETF (BTC) AUM Tops Silver, Trails Only Gold Among Commodities

“This was way beyond my short term expectation but is a fantastic validation of bitcoin’s role as a reserve product and of the demand for bitcoin exposure in financial markets,” 21Shares co-founder Ophelia Snyder, who launched one of the ETFs in partnership with Ark Invest, wrote on X (formerly Twitter). Original

Analysts predict a major Bitcoin supply shock before the halving

Analysts anticipate a major Bitcoin supply shock heading into April’s halving as BTC is down by nearly 10% since ETF approval. Bitcoin’s supply dynamics have significantly changed since the SEC approved spot Bitcoin ETFs earlier this month. The leading token has been largely volatile in the past few weeks, but this volatility has remained within a very narrow price range. BTC’s price has fluctuated between $41,000 and $44,000, dropping below $41,500 today, the lowest price in 30 days. Analysts attribute these short price movements to supply dynamics driven by the…

Bitcoin decreases 12% to below $42k following spot ETF hype

Following the anticipated launch of spot Bitcoin ETFs and the expectation of a price surge, Bitcoin has seen a pullback to $41,825, according to a Jan. 18 post on CoinGecko. Bitcoin (BTC) had initially made headlines for hitting $49,000 for the first time since December 2021, as trading opened for spot BTC ETFs across major U.S. exchanges. However, the price of the world’s largest cryptocurrency has since decreased in what some predict might be the start of a larger pullback. The approval of spot Bitcoin ETFs on Jan. 10 was recognized…

Bitcoin (BTC) Price Plunges Below $41K as Bitcoin ETF Fever Breaks

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

Bitcoin Price In Danger? This Terrible Story Could Happen Again

The Bitcoin price has been moving steadily at its current but failed to meet general expectations. Following the approval of the spot Bitcoin Exchange Traded Funds (ETFs), market participants were expecting potential scenarios. In these potential scenarios, Bitcoin pushed through critical resistance at $48,000 and continued making new highs, or the cryptocurrency retraced to $30,000. As usual, the market has avoided pleasing the crowd as BTC trades at $42,000. BTC’s price trends to the upside on the daily chart. Source: BTCUSDT on Tradingview Bitcoin Price Ready To Dip? The spot…

Donald Trump’s NFTs Have Limits Normal Ones Don’t

But buyer beware: the ordinals, as well as the 100 NFTs that one must buy to get it, cannot be traded by their owners until December 2024. The thread said this limitation is meant to restrict their appeal as “investment vehicles,” but in so doing, it also severely denigrates their appeal as NFTs. Source

$245 Million Whale Wakes Up To Threaten XRP Price Recovery

A recent transaction by an XRP whale is currently threatening XRP’s price recovery. This particular address is known to have moved all their XRP holdings worth millions of dollars, a move that the XRP community fears could cause a downturn in the token’s price. Whale Moves Over 443 Million XRP Data from blockchain tracker Whale Alert shows that an unknown address linked to crypto Bitvavo sent 443,112,410 XRP to another unknown address that is linked to Bitvavo. Interestingly, data from the XRP Scan shows that the receiving address was just…

Should Tokenization Follow the ‘Same Activity, Same Rules’ Approach?

The discussion was about use cases, regulation, jurisdictional differences – the usual stuff but eloquently said. At the very end, however, just as I was concluding “nice, but nothing new,” an audience-member asked for the panel’s opinion on the regulatory approach of “same activity, same risk, same regulation.” Source