New data reveals that prominent centralized exchange (CEX) platforms, including Crypto.com and Bybit, saw their trading volumes surge in December. According to blockchain reporter Colin Wu, in December, the overall spot trading volume of centralized crypto exchanges rose 27.4% month-on-month despite some of them seeing notable dips. “In December, the spot trading volume of major exchanges rose by 27.4% month-on-month. The top three in terms of percentage change were Gate at 65%, Crypto.com at 50%, and Bybit at 44%. The bottom three were BitMart at -24%, Bitget at -12%, and…

Day: January 10, 2024

XRP Whales Make Big Moves Amid Market Volatility

XRP Whales are causing a stir in the XRP community as holders speculate on what could be the reason for their latest moves. On-chain data shows that these whales have moved a significant portion of their holdings in the last 24 hours. Over 63 Million XRP Tokens Moved Data from Whale Alert shows that two significant XRP transactions have occurred recently. The first was a transfer of 26,400,000 XRP from an unknown wallet to the crypto exchange Bitstamp. The second was a transfer of 36,964,930 XRP from the crypto exchange…

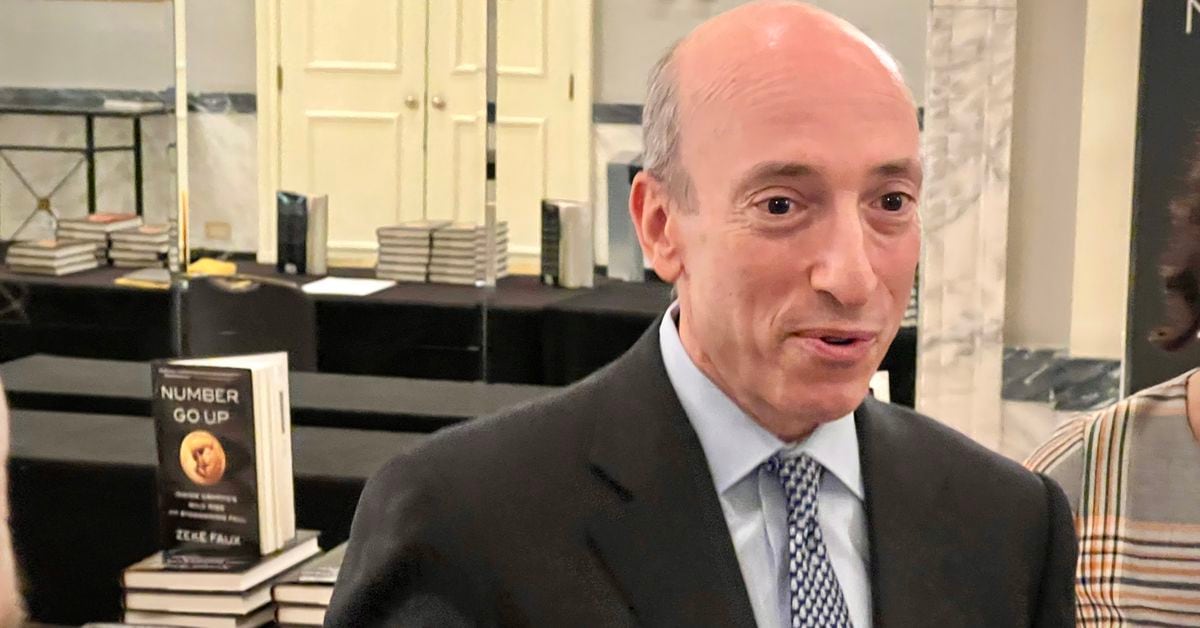

Gary Gensler’s Begrudging Spot Bitcoin ETF Statement

Commissioner Hester Peirce, a steady supporter of the crypto industry over the years, praised the decisions as “the end of an unnecessary, but consequential, saga.” She said that “the only material change since we last denied a similar application was a judicial rebuke,” referring to the SEC’s loss against Grayscale in the U.S. Court of Appeals for the District of Columbia. Original

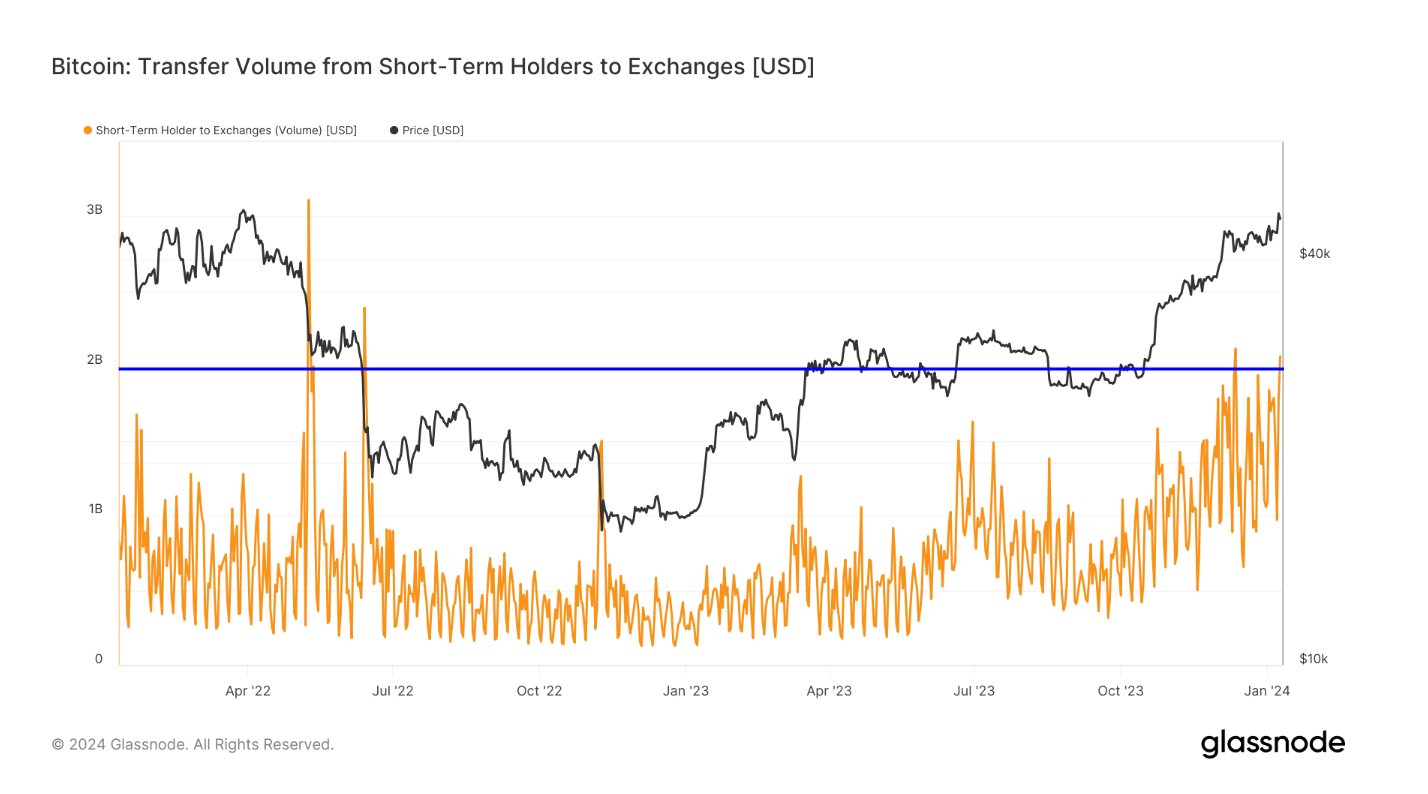

Bitcoin Short-Term Holders Participate In $2 Billion Selloff

On-chain data shows that Bitcoin short-term holders have deposited $2 billion in BTC to exchanges, the fourth largest amount in the last two years. Bitcoin Short-Term Holder Exchange Inflows Have Spiked Up As analyst James V. Straten explained in a new post on X, the BTC short-term holders have potentially participated in a very sizeable selloff recently. The “short-term holders” (STHs) are the Bitcoin investors who bought their coins within the last 155 days. The STHs comprise one of the two main divisions of the BTC market based on holding…

Spot Bitcoin ETFs Approved: The Crypto Industry Reacts

“If the SEC is anti-crypto, they have shot themselves in the head. If they had just quietly approved the Grayscale ETF application all those many years ago, there would be a few crypto ETFs out there without much fanfare. By delaying as long as they have, they are creating a lot more free publicity for crypto. Also, they appear to be consciously setting it up so that multiple ETFs will start trading at the same time. Whatever the reason, they are invoking the marketing might of the biggest behemoths on…

ETF Euphoria Shows Bitcoin Needs Wall Street After All

What the ETF really brings is more credibility. In this case, Wall Street involvement is contingent on government approval. The SEC finally approving an ETF after years of rejections based on fears of “market manipulation” indicates a degree of acceptance, however begrudging, of this asset class by one of its fiercest critics, SEC chair Gary Gensler. In theory, crypto is also independent of governments, and so the SEC shouldn’t matter that much. In reality, crypto Twitter is basically obsessed with most everything Gensler says and does. Source

Bitcoin ETF Approval Effects Won’t Be Seen for Months: 21Shares Co-Founder

Wealth-management firms must adhere to various processes before they can add the ETFs to their list of approved allocations, said Snyder, whose Zug, Switzerland-based firm teamed up with Cathie Wood’s ARK Invest to propose an ETF that was among those winning approval from the Securities and Exchange Commission (SEC) on Wednesday. Original

Why Are Bitcoin (BTC) ETFs Such a Big Deal? Gold Provides a $100 Billion Answer

Given that bitcoin ETFs directly hold the underlying asset, there could also be organic demand for bitcoin itself, said El Isa. “This could potentially drive up its value as more investors, including institutional allocators like BlackRock and Fidelity, seek to hold the asset within the ETF. This, in turn, could have a cascading effect, further solidifying bitcoin’s position in the global financial landscape.” Original

JPMorgan CEO criticizes BTC despite backing BlackRock Bitcoin ETF

JPMorgan Chase CEO Jamie Dimon reiterated his longstanding skepticism about BTC despite his company’s role in the BlackRock Bitcoin ETF. Despite the cryptocurrency’s status as the most valuable in terms of market capitalization, Dimon remained unswayed, questioning its intrinsic worth. Under Dimon’s leadership, JPMorgan Chase has been identified as an authorized participant for BlackRock’s newly approved spot Bitcoin ETF, the iShares Bitcoin Trust. “The actual use cases are sex trafficking, tax avoidance, anti-money laundering, terrorism financing; it’s not just people buying and selling bitcoin. There’s no value if you’re buying…

Gary Gensler’s Statement on Bitcoin ETF Approvals

Investors today can already buy and sell or otherwise gain exposure to bitcoin at a number of brokerage houses, through mutual funds, on national securities exchanges, through peer-to peer payment apps, on non-compliant crypto trading platforms, and, of course, through the Grayscale Bitcoin Trust. Today’s action will include certain protections for investors: Source