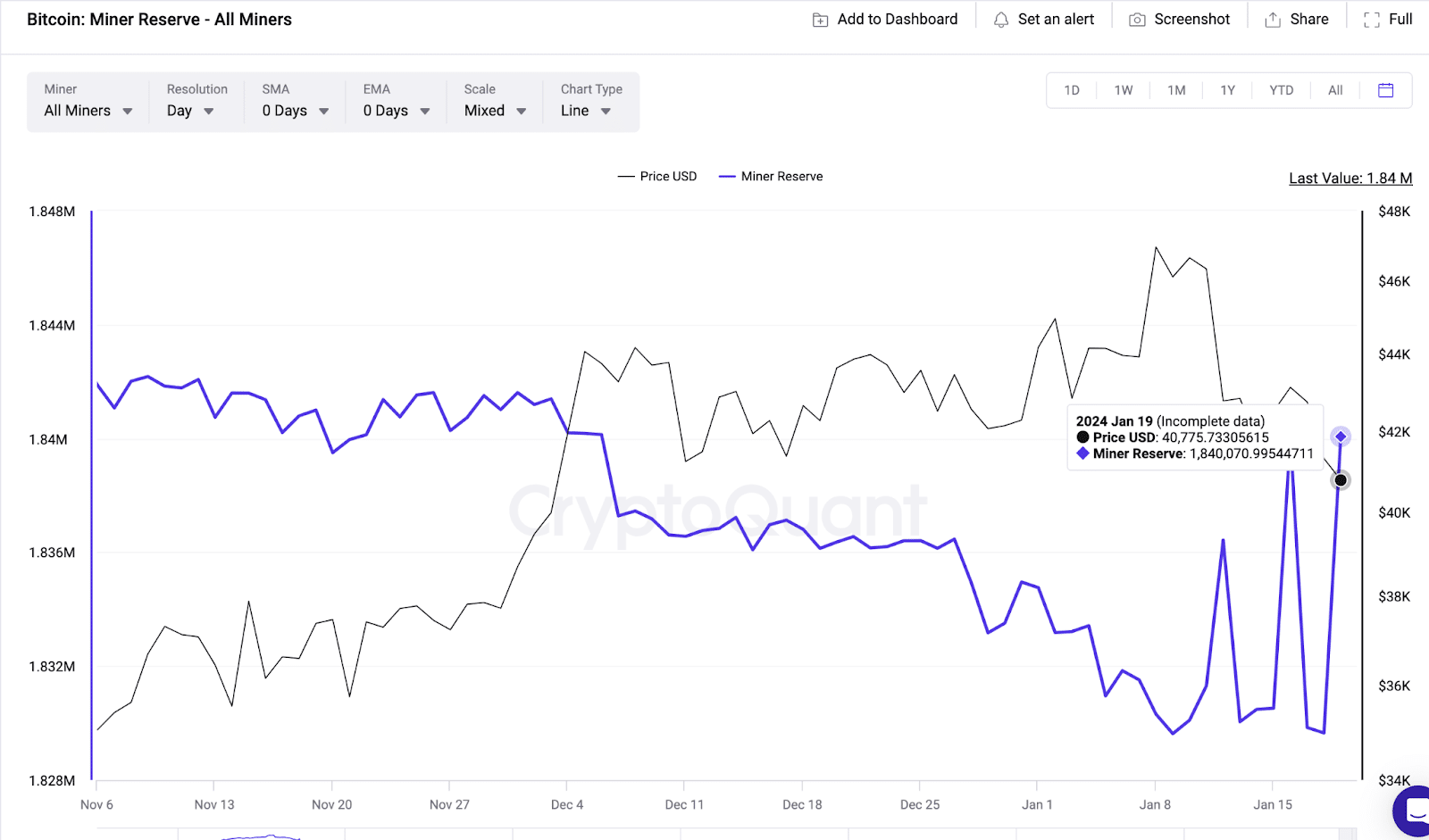

Bitcoin price dipped to a 40-day low of $40,700 on Jan 19, sparking concerns of major liquidations if it loses the $40,000 support. Since the much-anticipated spot ETF approval verdict, Bitcoin (BTC) has delivered sideways price performance. Another sell-off wave on Jan. 19 saw prices tumble toward $40,000 for the first time since mid-December. Miners acquired BTC worth $482 million amid market downturn On Jan. 19, Bitcoin price tumbled below $40,700 for the first time in 40 days, having consolidated within the $42,000 to $43,000 range for the better part…

Day: January 19, 2024

USDT Issuer Tether Goes On Massive 8,888 BTC Buying Spree

In an encouraging development for the crypto space, Tether, the issuer of the world’s largest stablecoin USDT, has doubled down on its Bitcoin investment momentum by acquiring a staggering 8,888 BTC, further diversifying its portfolio. Tether Increases Its Bitcoin Holdings Tether has recently made its third largest Bitcoin purchase, as the stablecoin issuer added a total of 8,888 BTC valued at $380 million at the time of purchase. This brings its total BTC holdings to 66,465 BTC, valued at $2.81 billion with an average buy price of $42,353. This transaction…

Bitcoin And Ethereum Snagged By Savvy Investors Amid Price Fall

Recently, cryptocurrency analytics platform Lookonchain reported activities of Bitcoin (BTC) and Ethereum (ETH) whales amid the ongoing market downturn. These whales appear to have been capitalizing on the recent decline in the crypto prices to bolster their holdings. According to Lookonchain, amid the market dip, a newly established wallet withdrew 700 BTC, valued at roughly $29.36 million, from the Binance exchange. These BTCs were purchased at an average price of $41,948 each.It is worth noting that, according to the analyst, such a move during a market downturn demonstrates a bullish sentiment…

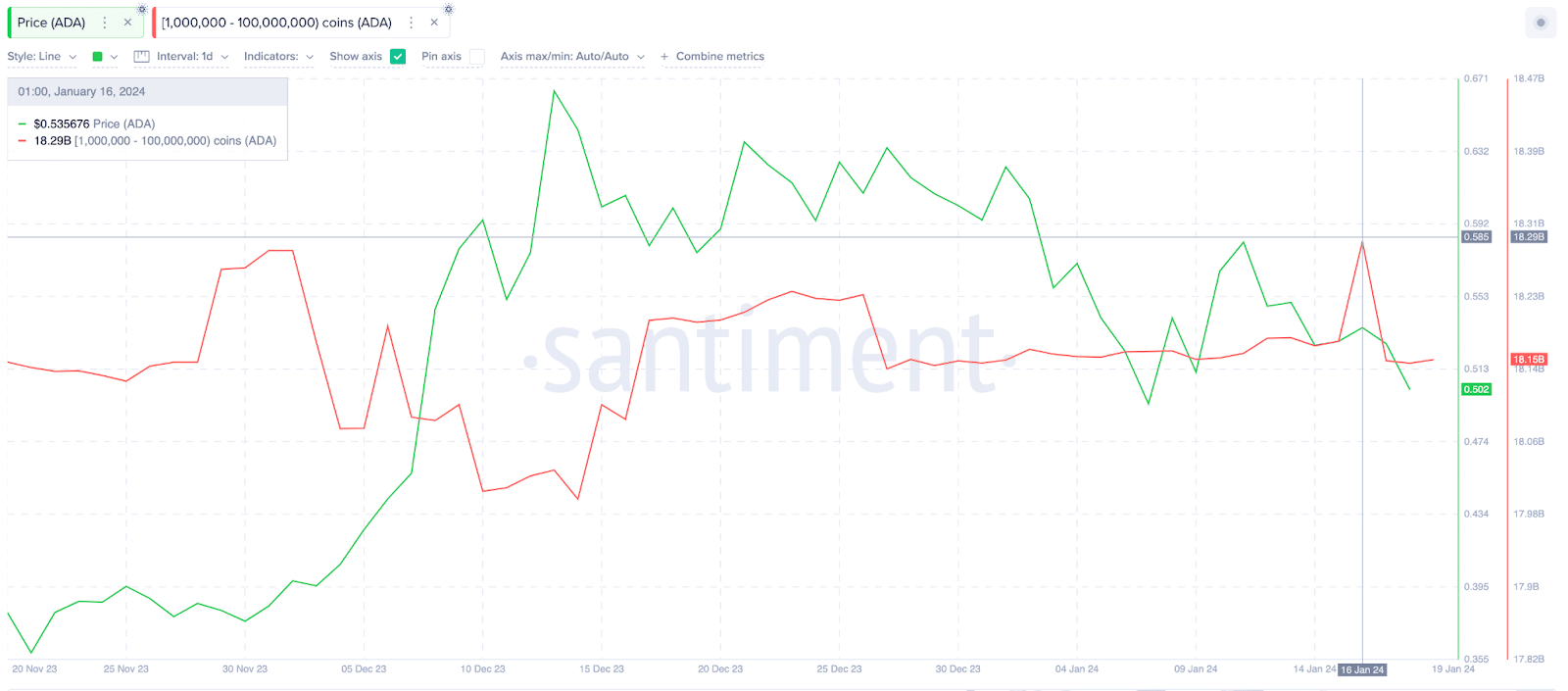

Cardano Price at Risk as Whales Make this $120M Move

Cardano price wobbled below the vital $0.50 level in the early hours of Jan. 19, on-chain data trail reveals key details surrounding the price downtrend. Cardano price entered sizable gains in the first 10 days of January as investors gradually shifted focus from Bitcoin (BTC) to the altcoin markets. However, a wave of bearish headwinds and widespread market liquidations saw ADA prices tumble below $0.50 on Jan. 19. What are the factors behind the current ADA price downtrend, and what can traders anticipate in the coming days? Cardano whales spotted…

Top Crypto Exchange Binance To Roll Out Support for New Altcoin on Launchpool Platform

Top global crypto exchange Binance has announced plans to support another new altcoin via its Launchpool platform. Binance Launchpool, which lets users stake coins to farm new assets, says its 45th project will be AltLayer (ALT), an open and decentralized protocol for Ethereum (ETH) rollups. Rollups are solutions that execute transactions outside of Ethereum’s blockchain but record the transactional data. They’re designed to help with scaling by reducing transaction costs and congestion on the main Ethereum chain. Between January 19th and the 25th, Binance users can stake BNB as well…

The New York Times Still Doesn’t Get Bitcoin

True, bitcoin is not guaranteed to rise in price and could even drop to $0. And true, as Sommer points out, there are other ways to gain exposure to crypto via traditional routes, like buying other indexes that invest in crypto-related stocks, like Coinbase, MicroStrategy or the many publicly listed mining companies. Original

Grayscale’s $529 Million BTC Move To Coinbase Pushes Price Below $41,000

Bitcoin (BTC), the largest cryptocurrency in the market, has experienced a sharp drop below the $41,000 mark as exchange-traded funds (ETFs) for Bitcoin went live on January 12. The subsequent profit-taking, selling pressure, and outflows from Grayscale’s Bitcoin Trust ETF (GBTC) played a significant role in the downward trend. Grayscale’s Bitcoin Transfers To Coinbase Intensify On Tuesday, NewsBTC reported that six days ago, Grayscale initiated the first batch of BTC outflows from their holdings to a Coinbase, totaling 4,000 BTC (approximately $183 million) over six days. However, the asset manager…

Oaktree’s Howard Marks sees minimal difference between Bitcoin and gold

Howard Marks, co-founder of Oaktree Capital Management, questions the intrinsic value of Bitcoin and gold, favoring high-yield bond funds as a more secure investment option. In a recent episode of the Merryn Talks Money podcast, Howard Marks, co-founder of Oaktree Capital Management, expressed his views on Bitcoin and gold, suggesting a lack of intrinsic value. Marks, whose firm specializes in distressed debt and manages about $180 billion, highlighted gold’s historical reliability but questioned its fundamental justification. Discussing the current investment climate, Marks noted a significant shift, indicating that the era…

SEC acknowledges Nasdaq’s spot Bitcoin ETF options request

Options trading for spot Bitcoin ETFs may be up after a Securities and Exchange Commission nod allowed multiple “non-security commodity” funds to list on U.S. exchanges. Nasdaq submitted 19b-4 filings with the SEC to amend listing rules allowing trading derivatives on ETFs underpinned by Bitcoin (BTC). Following the proposed rule changes, the SEC has acknowledged the requests, opening a 21-day window for public comments and feedback. ETF expert James Seyffart opined that the SEC could field a decision on these filings by the end of February; however the verdict may…

Gaming Gift Cards Are Like Crypto – and Not in a Good Way

“So, it would cost him like, $6 to pay a kid for like, $50 worth of income for him. He’d have like 2000 kids a month and he was making $1,000 to $2,000 a day, and that was the most I had ever seen…. He’s my age; he’s like, fourteen, fifteen, and he’s doing this every single day.” Source