Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Meme coins have struggled over the last 24 hours with PEPE and BONK sliding by 2.51% and 5.2%, respectively. However, traders are backing Sponge V2 to rally as its buy-and-stake campaign rises to $1.9 million. Pepe and Bonk dropping A flash crash in the market caused crypto prices across the board to plunge. However, leading meme coins were among the worst affected, with PEPE and Bonk dropping by double…

Day: January 5, 2024

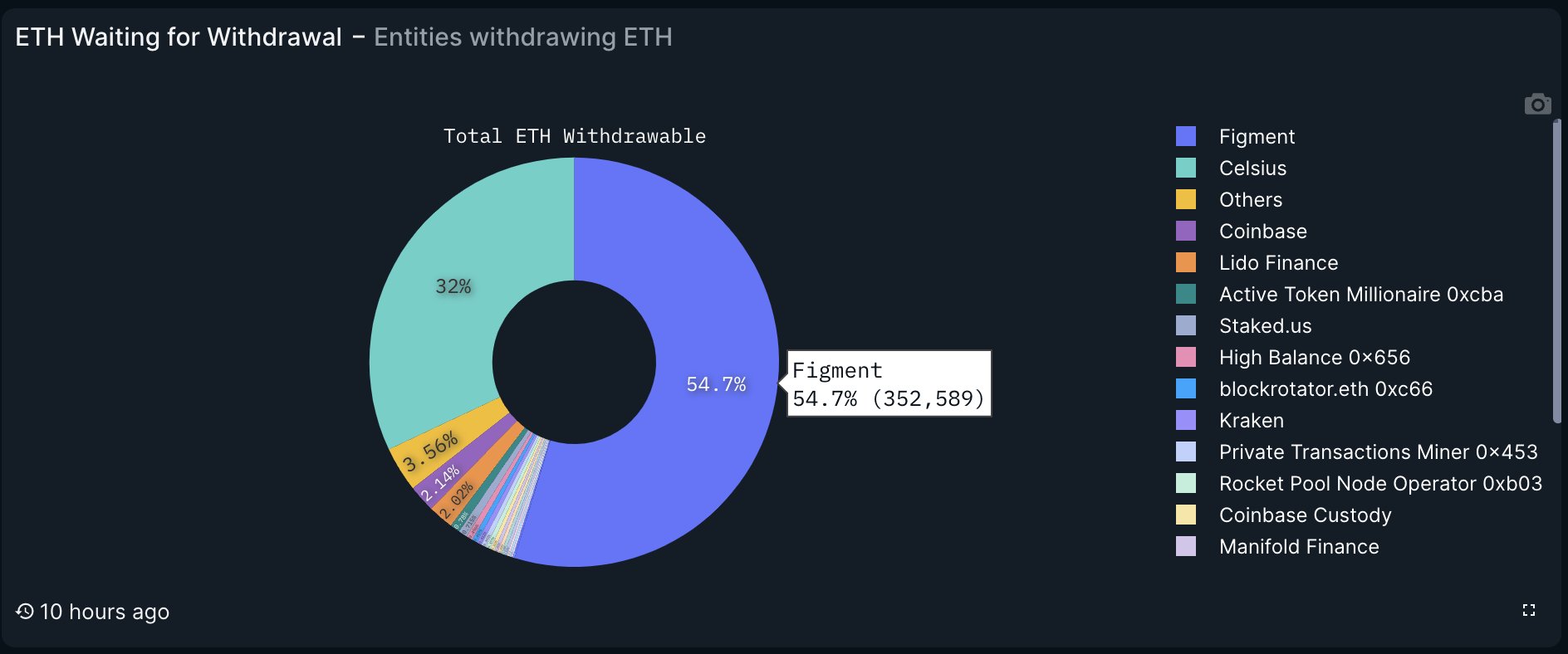

Ethereum Price Crash Looming? Celsius To Unstake $465 Million

Celsius Network, the bankrupt cryptocurrency lending company, is gearing up to unstake approximately $465 million worth of Ethereum (ETH) as part of its efforts to compensate creditors. This development follows the company’s bankruptcy filing in July 2022, leaving creditors in a prolonged 18-month wait for financial recompense. Celsius’s decision to unstake a substantial amount of ETH is seen as a necessary step to ensure liquidity for creditor compensation. The company’s official announcement, made via X (formerly Twitter), highlights the strategic nature of this move: “In preparation of any asset distributions,…

Brink to Receive 5% of VanEck Bitcoin (BTC) ETF Profits

While this is largely welcomed from the incumbent crypto community, there will also be friction in some quarters. Therefore providers like VanEck will be keen to demonstrate some commitment to the core Bitcoin industry by giving back to developers and others. Original

Why This Analyst Thinks It’s Impossible For The Bitcoin ETF To Be Priced In

On a high note, the crypto market starts in 2024, with BTC’s price rising steadily from $41,000 to around $46,000 as the Bitcoin ETF decision looms. The upcoming decisions by the U.S. Securities and Exchange Commission (SEC) on the BTC spot Exchange Traded Funds (ETFs) could lead to significant market fluctuations. These decisions, expected between January 5th and 10th, have kept Bitcoin (BTC) and Ethereum (ETH), along with altcoins, on a tightrope with high funding rates indicating a preference for leveraged trades. BTC’s price trends to the upside on the…

Cryptocurrency investors eagerly await SEC ruling on bitcoin ETFs

Omar Marques | Lightrocket | Getty Images Crypto investors are eagerly awaiting an imminent ruling from the SEC that will likely approve the trading of a spot bitcoin ETF, more than a decade after initial attempts were rejected. 13 companies have filed for a spot bitcoin ETF: Grayscale Bitcoin Trust Ark/21 Shares Bitcoin Trust Bitwise Bitcoin ETF Trust BlackRock Bitcoin ETF Trust VanEck Bitcoin Trust WisdomTree Bitcoin Trust Valkyrie Bitcoin Fund Invesco Galaxy Bitcoin ETF Fidelity Wise Origin Bitcoin Trust Global X Bitcoin Trust Hashdex Bitcoin ETF Franklin Templeton Digital…

Ethereum Validators Forced to Wait Days to Unstake Amid Celsius Withdraws

The exit queue for Ethereum validators spiked to over 16,000 on Friday, while it was just at 26 the previous day, according to blockchain data from validatorqueue.com. The queue represents more than $1 billion worth of staked ETH at current prices, but the large backlog means it could take up to 5.6 days for that ETH to get back into the hands of its depositors. Source

Shiba Inu to make wild price swing

Crypto analyst LuckSide Crypto predicts Shiba Inu will make a major price move within days based on incoming spot Bitcoin ETF news. The analyst suggests Shiba Inu (SHIB) could be triggered today. LuckSide Crypto points out that although the market has been experiencing significant volatility, the surge the community is waiting for to break past the resistance line could be triggered by new around spot Bitcoin ETFs. LuckSide Crypto attributes this prediction to speculation being what got these markets here in the first place, fuelling gains for Bitcoin (BTC) and…

Ethereum Layer 2 Networks Just Set A New Record

The total value locked (TVL) on Ethereum layer-2 networks recently hit a new all-time high in January, a testament to the continued adoption of Ethereum. Layer 2 networks sit on top of the Ethereum blockchain and help scale it by processing transactions off-chain before sending data back to the main blockchain. According to data from L2BEAT, a layer-2 analytics platform, the TVL on these scaling solutions recently reached an all-time high of $21.16 billion, representing a 340% growth from the same day last year. Ethereum Layer-2 Networks Hit New Milestone…

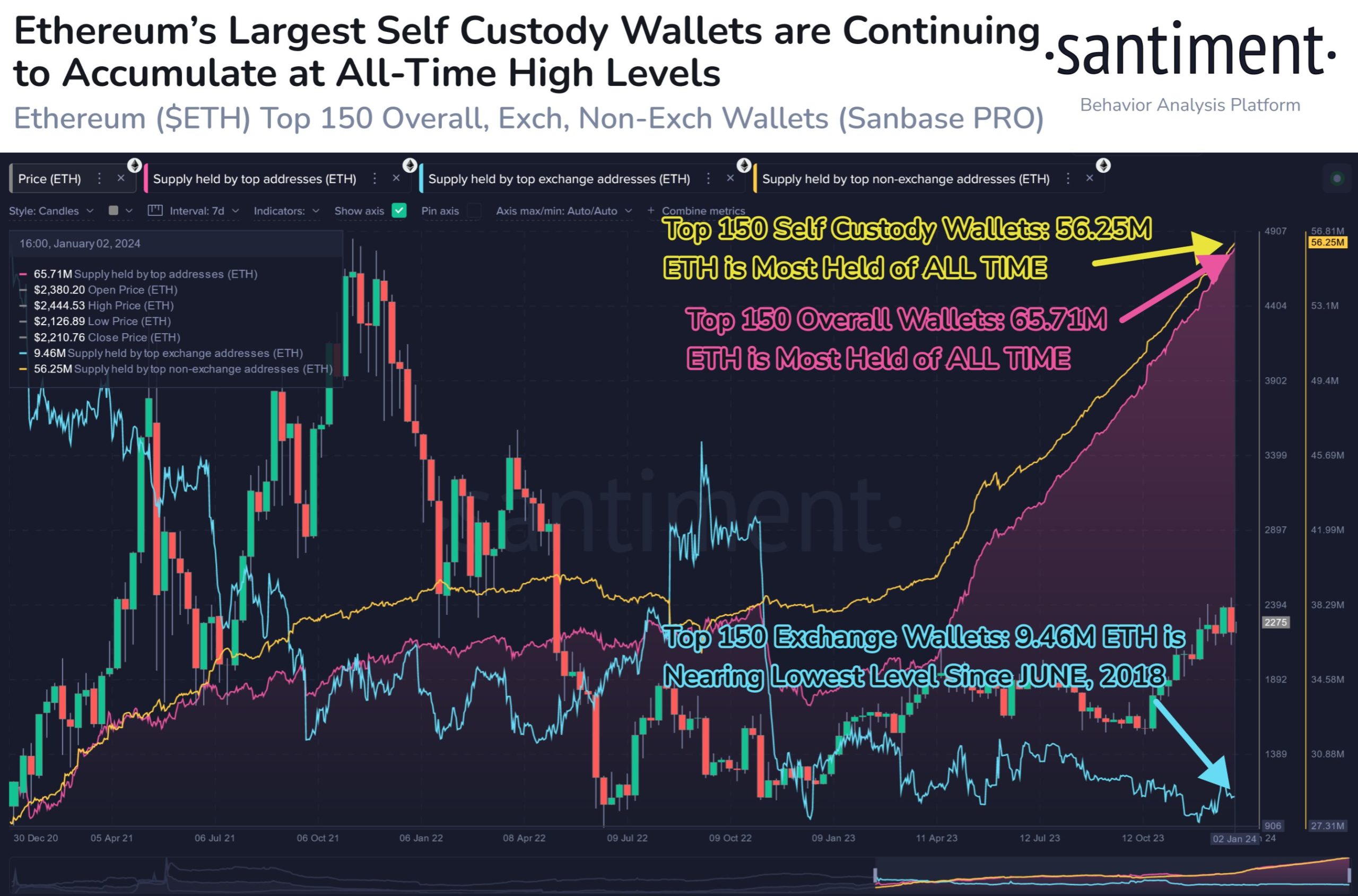

Do They Know Something You Don’t?

On-chain data shows the largest of the Ethereum whales have continued to buy more recently as their supply sets another new all-time high. Largest Ethereum Wallets Have Been Rapidly Accumulating According to data from the on-chain analytics firm Santiment, the largest non-exchange Ethereum wallets have continued to show some rapid accumulation recently. The relevant indicator here is the “supply held by top non-exchange addresses,” which keeps track of the total amount of Ethereum that the 150 largest self-custodial wallets are carrying in their combined balance right now. Naturally, the 150…

Mango Markets (MNGO) Faces Regulatory ‘Inquiry’ Ahead of Eisenberg Crypto Fraud Trial

The decentralized crypto exchange (DEX) is facing “inquiries” in the United States stemming from that October 2022 heist, according to posts in the project’s Discord server. Now the DEX’s governing body, called MangoDAO, is voting on whether to appoint a representative who can triage “U.S. regulatory matters” on its behalf. Source