The notice comes ahead of potential official approval on Wednesday from the U.S. Securities and Exchange Commission. Approval of bitcoin ETFs would broaden bitcoin access to more investors, who wouldn’t have to go to a crypto exchange, potentially providing an easier way to buy the world’s largest digital asset. Original

Day: January 10, 2024

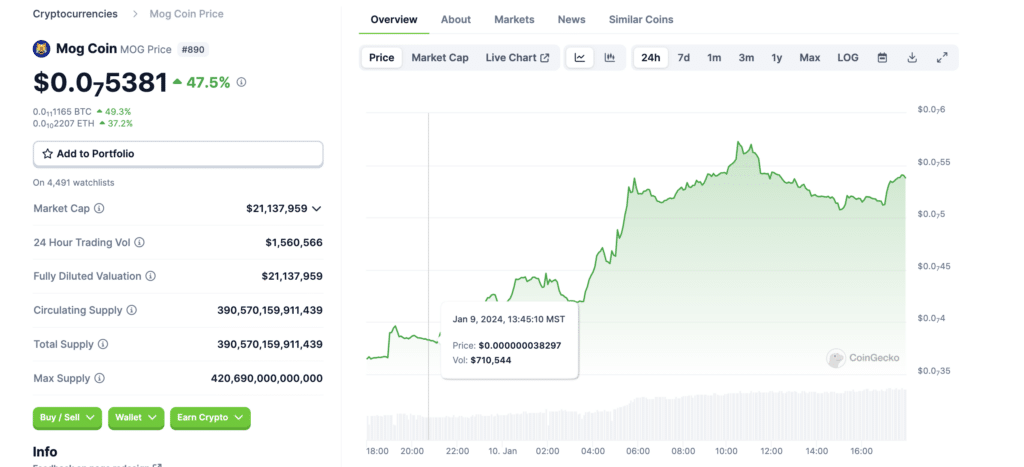

MOG Coin sees 47.5% gain as ETF deadline approaches

MOG Coin, an Ethereum-based coin, takes a spot on CoinGecko’s top trending report following double-digit gains in the last 24 hours. As another Ethereum-based coin, MOG joins the surging token list on pending ETF approval day. MOG tokens are actively traded on decentralized and centralized crypto exchanges, with Uniswap V2 Ethereum emerging as a popular platform for buying and trading Mog Coin. The MOG/WETH trading pair on Uniswap V2 has since recorded a substantial trading volume of over $1 million in the last 24 hours. Mog Coin price chart | Source:…

Bitcoin ETF Confusion Abounds

The crypto industry can breathe a sigh of relief: It looks like a federal U.S. regulator will let the world’s largest traditional finance asset managers and other firms list and trade shares of a vehicle giving retail and institutional investors exposure to the price of a decentralized, trustless, stateless digital asset (if you’re in the U.S.). But of course, the bitcoin exchange-traded fund (ETF) drama wouldn’t be complete without, well, drama. Source

Spotlight on Potential $100 Billion Influx and Bitcoin ETF Approval Amid Governance Debates

GITHUB REJECTION! While crypto traders, tradfi investors, financial institutions and probably lots of normies and newbies were engaging in the gripping speculation over whether U.S. regulators would approve a spot bitcoin ETF, a struggle over the very soul of the Bitcoin blockchain was taking place on the open-source developer platform GitHub. At the core of the matter was whether data-oriented applications like Ordinals inscriptions – often referred to as “NFTs on Bitcoin” – should be allowed on a network that purists argue should be preserved primarily as a settlement layer…

1inch DAO Makes DeFi History, Votes To Onboard Legal Counsel

In a historic move that sets a precedent for decentralized autonomous organizations (DAOs), 1inch DAO, the entity behind the 1inch Network, has voted to secure “legal advisory services” from STORM Partners. Notably, this decision comes amid growing regulatory scrutiny on the crypto and decentralized finance (DeFi) sectors. 1inch DAO Votes To Onboard STORM Partners For Legal Advisory Services Following voting that ended on January 9–overwhelmingly supported by the 1inch community–holders decided to onboard STORM Partners. This marks a significant step forward in the DAO’s efforts to navigate the complex legal landscape and…

Fidelity trading app displays spot Bitcoin ETF tickers

Users reported seeing spot Bitcoin ETF symbols on trading platforms ahead of approval from the SEC. Fidelity’s retail trading app showed spot Bitcoin ETF tickers, including ARK 21Shares Bitcoin ETF (ARKB), although one user confirmed that trading was unavailable for now. Shortly after, Bloomberg notably listed 11 Bitcoin (BTC) ETFs on its terminal under the “pending listing” designation. The Chicago Board Options Exchange also filed a request for acceleration with the U.S. Securities and Exchange Commission (SEC) on behalf of Invesco Galaxy, essentially asking for permission to list and start…

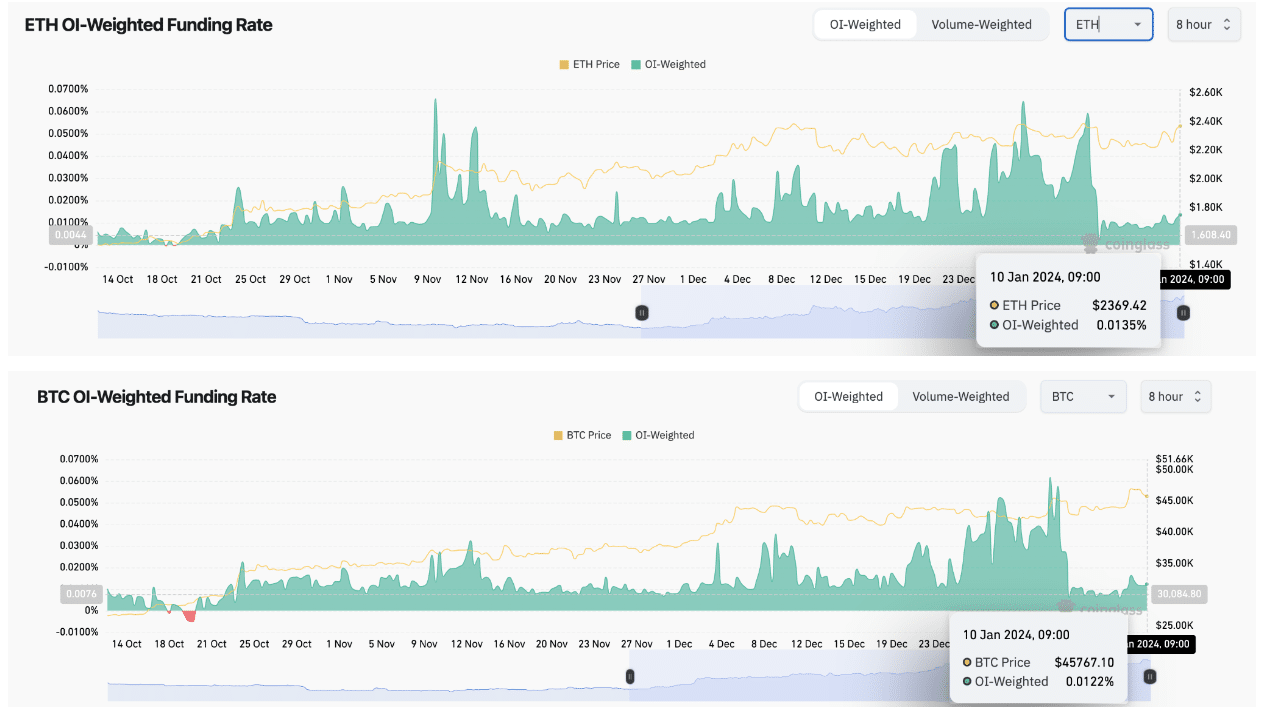

Will ETH Price outperform BTC After ETF Approval?

Ethereum price briefly broke past the $2,400 mark on Jan. 10, up 10% within the weekly time frame, ahead of the much-anticipated Bitcoin ETF Approval. The crypto market experienced widespread volatility on Jan 9 after the U.S. Securities and Exchange Commission (SEC) announced false Bitcoin (BTC) ETF approval in a now-denounced post on X. Despite the raging controversy, Ethereum’s (ETH) price has maintained a steady uptrend, trading as high as $2,440 on Jan. 10. Ethereum vs Bitcoin: Crypto derivatives traders are betting bigger on ETH Between Jan. 7 and Jan.…

Everyone Wants the SEC’s Fake News to Be Real

After all, ETFs are just standard investment products, not manna sent from heaven. Once people realize that, we might see a slow uptick in demand and price action for bitcoin, but not a flood of all-time-high milestones. Gold, if you check, didn’t suddenly become a mainstream investment; it took years. And, it’s likely to be the same with bitcoin. Still, the hype around the ETF announcement shows how many people out there want a positive narrative to move bitcoin higher. That, rather than the actual impact of ETFs, may be…

Tokenized Treasuries’ Surging Demand Prompts Yield-Bearing Offering by Enigma Securities

“As interest rates have steadily risen, we have seen a huge amount of demand from our institutional clients for a product that would allow them to take advantage of these high risk-adjusted returns,” Philippe Kieffer, head of business development at Enigma, said in a statement. Source

The bitcoin chart is showing signs of resuming long-term trend back to $66K as ETF decision looms

Here’s a breakdown of the bitcoin chart and what to watch for to confirm that the cryptocurrency is resuming its long-term trend back to all-time highs. If you haven’t heard, bitcoin was up substantially in 2023, and a full-fledged ETF may finally get approved by the SEC. Some experts claim that could be a clear sell-the-news event if/when it happens, while others believe it will prompt an even bigger rally. Either is possible, but right now it’s important to recognize that BTC’s price action has been working well over the last…